Bitcoin had a good start to the week on Monday, surging from $86k to $88,772. The hike sparked hopes of a climb above $90k.

However, trading action on Tuesday softened the stance and speculation of the asset climbing higher. The apex coin may end the session with a doji as it trades at its opening price.

The uptrend, which started on Sunday with an almost 3% increase, is ending as selling pressure increases. At the time of writing, BTC is grappling with notable selling congestion.

Nonetheless, data from CryptoQuant shows significant buying actions unfolding. The exchange reserves have significantly reduced over the last 24 hours. Dropping almost 1%, the decline in reserve is buoyed by the massive outflows from these trading platforms. Investors moved 7000% more assets than in the previous session.

Long-term holders are seeing less pressure, resulting in less movement from them. However, the aSOPR shows growing selling pressure. More traders are taking profit, explaining the ongoing price trend. It is worth noting that the net unrealized profit and loss is dropping.

Nonetheless, Bitcoin is seeing significant network activity. Transfer volume surged 268% in the last 24 hours, while active addresses plummeted 11%. Transactions on the increased by over 200%.

US traders show increased buying pressure during this period. The Coinbase premium is positive, indicating a significant bullish stance on Tuesday compared to Monday. The Korea Premium indicates lesser selling pressure in the last 24 hours from the Asian market.

Trump Proposes Further Tariffs

It is worth noting that the fundamentals are negative. On Monday, the US President hinted at further tariffs on some products and countries. According to Reuters, he said that extra levies on automobiles, pharmaceuticals, and semiconductor chips are coming. However, there is no information about when they will take effect.

POTUS started tariffs on countries buying Venezuelan oil, promising a 25% tax. Trump announced that further duties would occur on April 2, reiterating that several countries would get them.

Bitcoin Sees Notable Orders at $86k

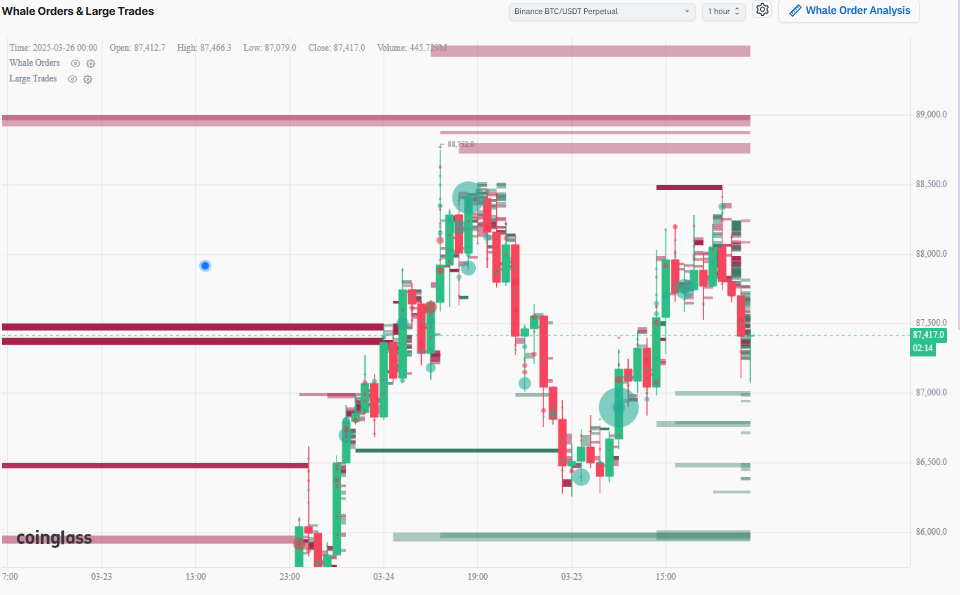

Data from Coinglass shows tremendous whale activity. The chart below shows several enormous green and red bubbles, indicating massive buys and sells.

Traders bought a significant number of BTC in the last 24 hours. Paying close attention to the chart above suggests that the green bubbles are always present at the start of a small hike. However, none are present at the time of writing, explaining why prices are stagnant.

It is worth noting that the red and green lines indicate levels with notable orders. The $88,500 mark is one tough resistance as sell orders mount. Other smaller lines show that more whales are becoming bearish.

Nonetheless, orders on the derivatives market indicate growing demand concentration at $87k. Currently trading at $87,350, the bulls are gearing up to defend the support. However, the defense may not hold long, as most buy orders are around $86,800.

The one-day chart paints a more bearish picture. Bitcoin edges closer to Bollinger’s upper band. The price trend may indicate an impending trend reversal following its gradual price climb over the last two weeks.

Readings from the relative strength index show that the apex coin is seeing almost equal selling and buying pressure. A shift in the trend may determine the following price action.