Global search interest in Bitcoin jumped to its highest level in a year after a sharp price drop drew investors back into the market.

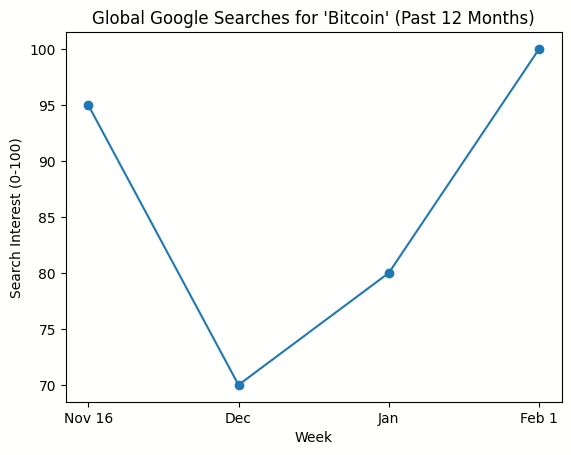

Google Trends data shows worldwide searches for Bitcoin reached a score of 100 during the week starting February 1st, indicating that the reading marks the peak level of interest over the past 12 months.

Notably, the previous high came in mid-November, when searches reached a score of 95. At the time, Bitcoin slipped below the psychological $100,000 level for the first time in nearly six months.

In both cases, sudden price moves triggered a clear rise in public attention, showing how closely search activity tracks market volatility.

Price Swings Drive Renewed Interest

Bitcoin’s latest search spike followed a rapid sell-off, interestingly, on February 1st, Bitcoin traded near $81,500 however, within five days, the price fell to around $60,000, shaking market confidence.

According to CoinGecko data, prices later rebounded, with the apex coin climbing back to about $69,058 at the time of writing.

Analysts often use search data as a simple way to gauge retail interest. Search activity usually rises during sharp rallies or sudden declines, as investors look for news, explanations, or entry points.

According to Bitwise Europe head André Dragosch, the latest surge in Bitcoin searches suggests retail investors are paying attention again after weeks of weaker activity.

Data from CryptoQuant also points to buying during the dip. Julio Moreno, the firm’s head of research, said US investors stepped in once Bitcoin reached $60,000. He noted that the Coinbase premium turned positive for the first time since mid-January, a sign of stronger buying pressure from US-based traders.

Fear Remains High Despite Buying

Even with renewed interest, overall market sentiment stayed weak. The Crypto Fear & Greed Index from Alternative.me fell further on Saturday to an “Extreme Fear” reading of 6. That level is close to lows last seen in June 2022, a period linked to heavy losses across the crypto market.

However, the combination of extreme fear and rising search interest highlights a familiar pattern in crypto markets.

Nonetheless, large price drops often attract both cautious observers and investors looking to buy at lower prices. As Bitcoin stabilizes above recent lows, search trends suggest that many retail participants are once again watching closely.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now