The Bitcoin halving is arguably the most widely anticipated event in the cryptocurrency industry. It occurs once every four years. In accordance with the pre-programmed code, the 2024 halving saw Bitcoin’s new issuance per block drop from 6.25 BTC to 3.125 BTC per block.

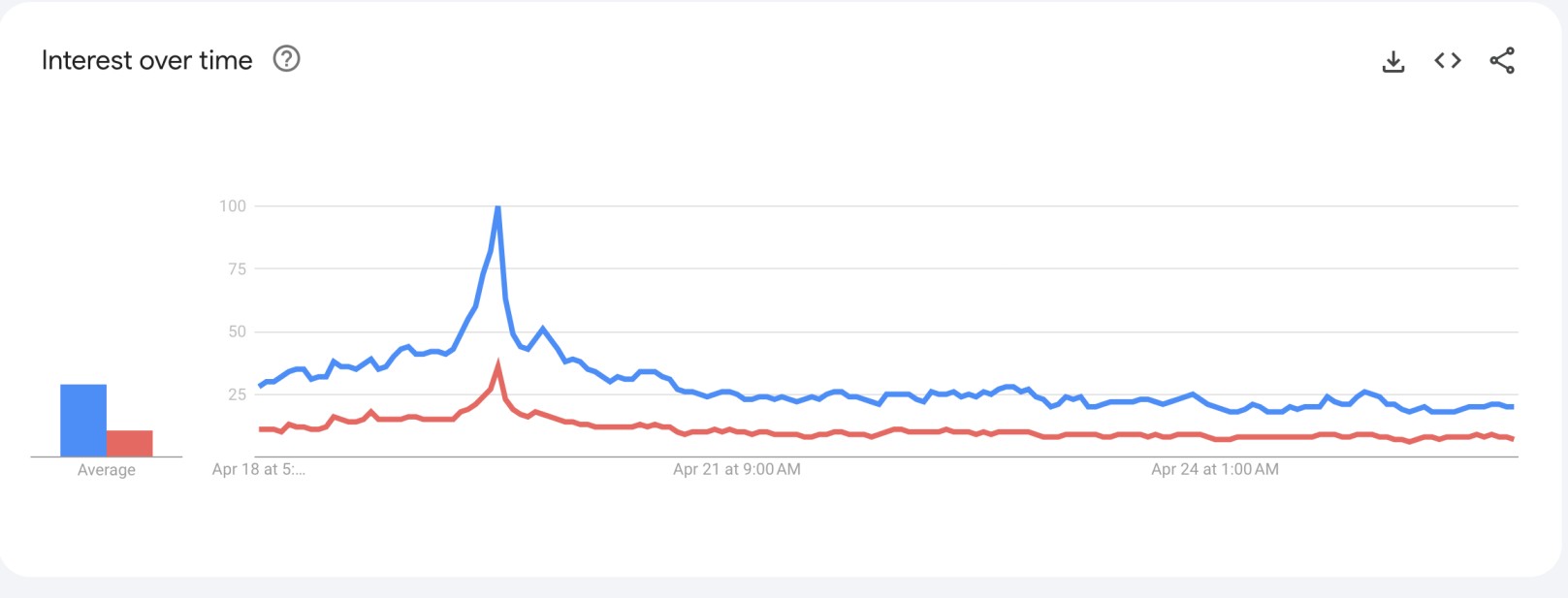

However, interest in the cryptocurrency has significantly reduced in the days following the halving. Google Trends data shows that interest in popular Bitcoin keywords such as “Bitcoin” and “BTC” has dropped by roughly 80% since the halving on April 20, 2024.

As the below data shows, search interest peaked at 100 on the said date as the crypto community tracked the event. However, after the halving, that number has dropped to as low as 20 for “Bitcoin” and a mere 7 for “BTC.”

The lower search volume may suggest that new investors have already accepted the reality that a successful halving does not necessarily translate to a surge in the BTC price, especially in the short term.

Bitcoin Prices Catching Up With Decline Interest

Despite lagging for a while, this decline in global search interest has now been reflected in Bitcoin’s price, with the cryptocurrency and, indeed, the broader market dropping significantly in the past 24 hours. Bitcoin briefly slipped below $63,000 in the hours leading up to press time, its lowest price since the halving.

As CoinTab uncovered, there are several reasons why crypto is down today. Prime among them include growing tensions in the Middle East and less favorable macroeconomic conditions. While the market largely expected the U.S. Federal Reserve to cut interest rates in 2024, such an outcome has become increasingly less likely, with the central bank still warring against inflation.

Meanwhile, the slow price action may not necessarily reflect Bitcoin’s long-term prospects. While the cryptocurrency has historically struggled in the immediate aftermath of a halving, it typically makes a new all-time high within twelve months of the event. Therefore, if history is anything to by, Bitcoin’s price is projected to rise as high as $180,000.