Pepe recently surged to an all-time high on May 13. The milestone came amidst Ethereum’s low volatility performance. Nonetheless, many traders took profit after the ATH. As a result, Pepe lost more than half its accumulated gains. The asset is on the rise, up by over 5%.

However, the global cryptocurrency market cap is on the decline. It is dropped by over 2% in the last 24 hours.

The decline comes amid several bullish reports. One such is the latest appeal by two United States Senators to endorse Bitcoin and the technology backing it. Another is the city of Wisconsin’s announcement that it added over $100 million in cryptocurrencies/ETFs to its portfolio.

The current price of various crypto assets suggests that this fundamental failed to have a positive impact on prices. Will the trend change?

Top Five Cryptocurrencies to Watch

BTC/USD

Bitcoin ended the previous week with gains of less than 2%. It marked the first green after four weeks of consistent small decline. The current seven-day period is starting off like the continuation of the trend.

Currently printing a doji on the weekly scale, the top asset erased its previous gains during the previous intraday session. Despite strong bullish fundamentals, it is struggling at $61,500. Nonetheless, the charts are hinting at the continuation of the previous week’s trend, with the apex coin holding on to key support.

The $60,500 has held out over the last seven days and continues to hold. There is a strong demand concentration present there. Nonetheless, the mark is also a critical level on the Fibonacci retracement levels. It is currently at the 61% Fib level, which many expect a rebound if prices drop to the mark.

The moving average convergence divergence is printing a mixed signal. It also illustrates the huge uncertainty among traders as the 12-day EMA halted its uptrend and is trending sideways. This pattern raises questions about whether the asset will retrace or continue its uptrend.

Many analysts believe that $65k is BTC’s make-or-break level. For it to attain this mark, it must decisively flip the pivot point to $64k.

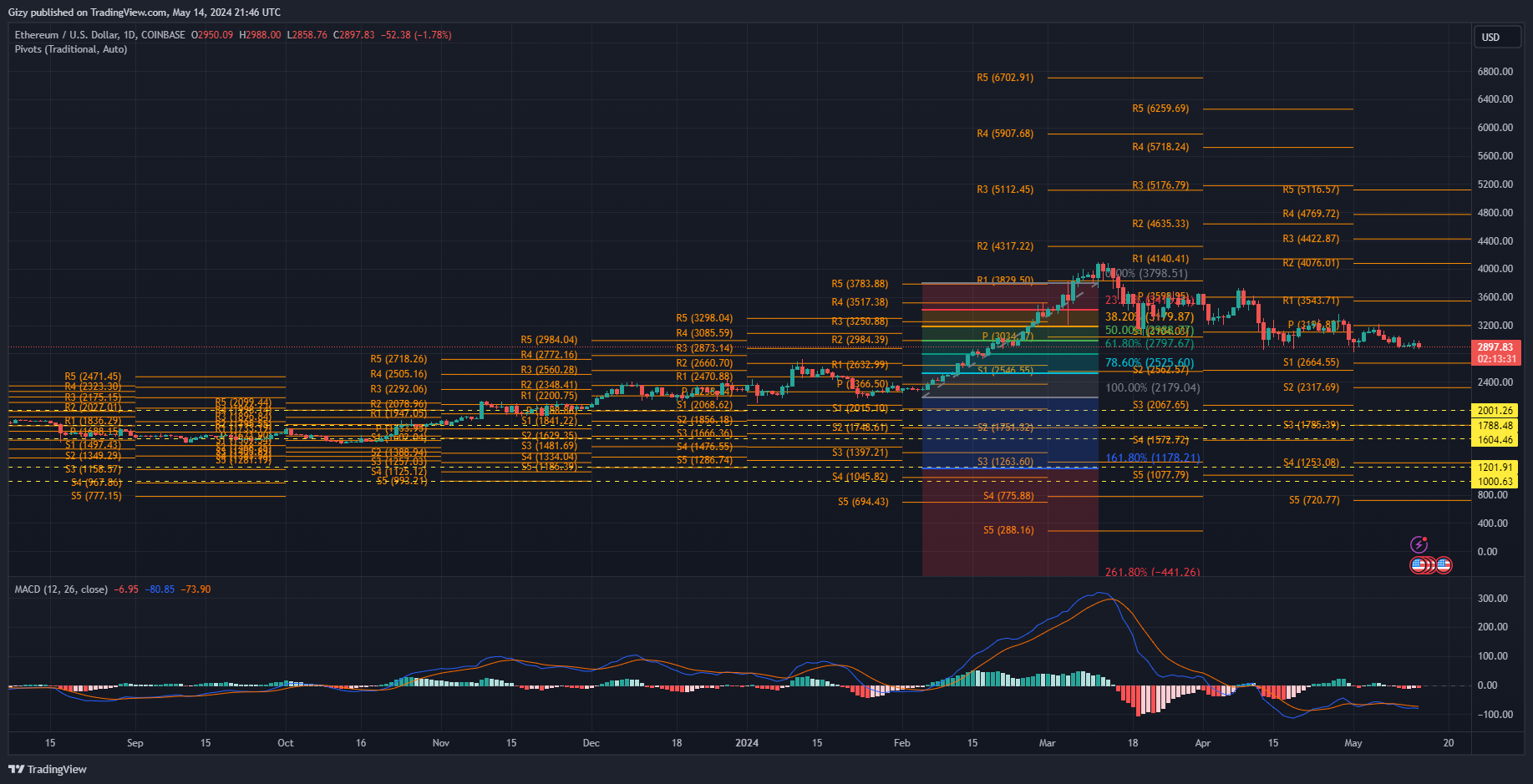

ETH/USD

Ethereum has been less volatile over the last four days, moving by less than 1%. Amidst the notable bullish sentiment of the crypto market during the previous intraday session, the asset only printed a doji following its price actions.

On the weekly scale, the altcoin is printing its third red candle in a row which signifies a pattern. Based on previous price movement, the coin closes lower with each passing week. The same may play out this week.

The bulls try to prevent such from taking place as they will the long-standing mark support at $2,800. The likelihood of the asset failed to flip the mark increases as this is also close to the 61% fib level.

However, indicators do not suggest any impending bullish surges. MACD’s 12-day EMA continues its downward trend as ETH loses both volatility and buying volume. Nonetheless, the 26-day EMA is also on this trend, giving the bears an advantage.

Having lost the pivot point at $$3,100, the cryptocurrency will look to regain stability above it. To do this it must its streak below $3k. Falure to do so will result in it testing the first pivot support. This will mean a drop to $2,660. Nonetheless, the bull will continue to defend $2,800.

PEPE/USD

Following several bullish whale moves on the Ethereum token, the buying volume surged to new levels it has yet to attain. During the previous intraday session, the bulls celebrated the new ATH at $0.0000111. Following the massive selloff afterward, many expected further corrections.

This never happened, as it is up to a new all-time high, gaining less than 3% over the previous one. The cryptocurrency surged above its second pivot resistance at $0.0000113. As with the previous day, it is experiencing another large selloff as traders take profit.

Following its failure to decisively flip the second PR, the token will look to attempt it again. MACD suggests that the trend is right for such trial as the 12-day EMA is still on the ascent with no fresh sell signals.

However, due to the most recent surge, the relative strength index is above 70. This means the cryptocurrency is overbought. following this reading, the bears will capitulate while the bulls will attempt to consolidate their gains.

One of the key critical marks the bulls will look to defend is the first pivot resistance at $0.0000089. It worth noting that the token failed to flip this mark as resistance. It remains to be seen how strong the demand concentration will be.

FLOKI/USD

Floki is another Ethereum token seeing significant surges this week. It tested its seven-day high and register new highs following the flip. It reclaim stability above its pivot point and peaked at $0.00019 during the previous intraday session.

Afterwards, several traders took profit causing notable price decline. The same trend is playing out during the present session. It peaked at $0.00020 but it experienced massive corrections. As a result, it is down by more than half the total accumulated gains.

Nonetheless, current price suggests growing distance from the pivot point. This will mean the asset is edging to the first pivot resistance at $0.00023. Currently up by 3%, the bulls will continue to push price throughout the week to attain this level. Additionally, RSI is at 56, suggesting more room for further climb.

The moving average convergence divergence continues printing the buy signal. Following last week’s price movements, the 12-day EMA resumed its uptrend after a near bearish divergence. The 26-day EMA is also seeing a similar trajectory.

On the other hand, fundamentals could cause severe corrections. This may send the token as low as it pivot point at $0.00017.

WLD/USD

Worldcoin is facing massive correction. It dropped to a low of $4.59 after it started the day at $5.63. Currently down by over 15%, the coin is set for buyback. Nonetheless, the latest downtrend was due to a negative fundamental is experienced. A analyst raised the alarm of some insiders planning on dumping the asset.

In response, retailers started a selloff to avoid losing their unrealized profits. This comes amidst other price declines across other cryptocurrencies. The latest decline also continues the previous day’s trend, which saw it lose over 5%.

Due to the fundamentals, there is huge uncertainty about the next price action. Only the answer to when and how the negative trend will wear off will be known. However, if it continues, the asset may retest $4.