As the legal tussle between Consensys and the United States Securities and Exchange Commission (SEC) continues, the SEC chair expresses the conviction that the second-largest cryptocurrency Ethereum (ETH) was classified as a security for a minimum of a year. The surprising information has triggered a sudden price drop for ETH.

Consensys vs. the SEC

On April 25th, Consensys, a software company known for supporting the Ethereum blockchain, sued the SEC over the “unlawful power grab” involving Ethereum.

The SEC, under the administration of its chairman Gary Gensler, has stood on the claim that Ether is a security, a financial instrument that can include stocks, bonds, notes, and more. These assets must be registered with the U.S. SEC before being offered to local investors.

The financial agency took steps further by issuing a Wells notice to Consensys, indicating an impending regulatory crackdown. The court document from the software company showed that the SEC alleged that Consensys broke securities law by facilitating ETH trades through its flagship wallet, MetaMask.

By suing the American agency, Consensys wants a federal court to rule that ETH is not security. Recall that the former SEC chairman, Jay Clayton, publicly declared that ETH was not a security. Another former top SEC executive Bill Hinman made a similar claim in his 2018 speech.

With Gensler doubling down his outlook on the second-largest cryptocurrency, millions of ETH holders globally may be impacted as the asset faces a potential regulatory clampdown.

Meanwhile, the SEC’s latest move may likely reduce the chances of the regulatory agency endorsing a spot Ethereum exchange-traded fund (ETF) soon. Such financial product tracks ETH’s price and allows investors to gain exposure to the asset.

Impact on ETH’s Price

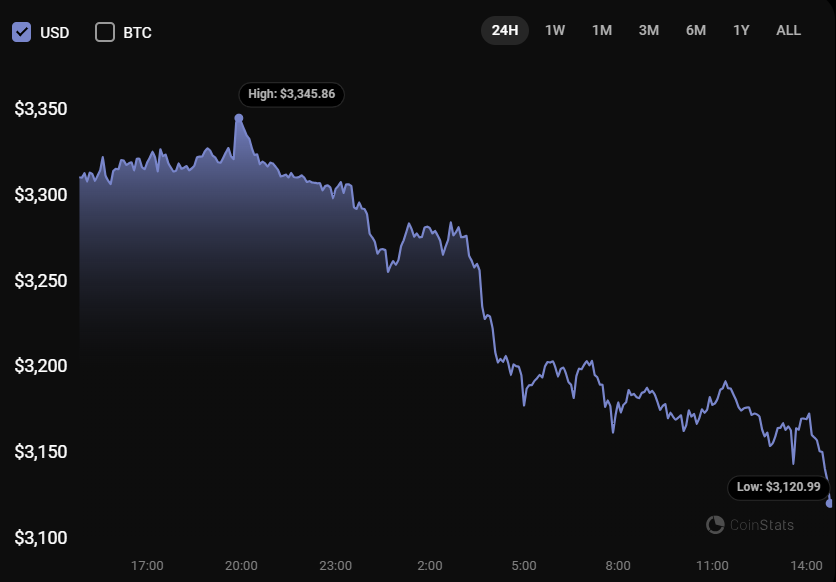

The SEC’s regulatory crackdown on Consensys has caused Ether’s value to tank by nearly 6% at the time of writing. According to the price-tracking website CoinStats, ETH traded at $3,150.