The spot Ethereum Exchange Traded Funds (ETFs) met analyst expectations by surpassing $1 billion on its first day of trading, reaching about 25% of the Bitcoin ETF’s first-day trading volume.

The fund started the trading session slowly, recording $59 million in trading volume in the first 30 minutes of launch, under 50% of Bitcoin’s early volume. However, the ETF quickly gained momentum, reaching $320 million in trading volume within 90 minutes and closing at $1.1 billion.

Following the SEC’s final approval, nine Ether ETF issuers went live on Tuesday. Seven of the nine issuers traded on the Chicago Board Options Exchange (CBOE), while Grayscale Ethereum Trust and Bitwise Ethereum Fund traded on the New York Securities Exchange (NYSE).

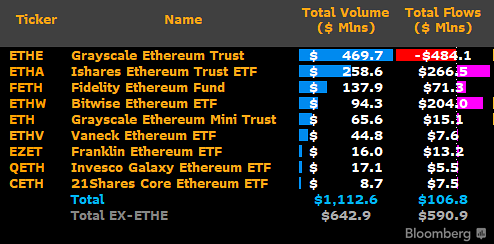

Ethereum ETF Sees $107M Inflow

The Ethereum spot ETF attracted a healthy $107 million in inflows on its first trading day, about 16% of what flowed into the Bitcoin spot ETF on day one. The net positive flow was particularly impressive, especially considering the significant outflow from the Grayscale Ethereum Trust (ETHE).

ETHE recorded a net outflow of $484 million on Tuesday, becoming the only issuer to record a negative flow. This outflow, however, was neutralized by BlackRock’s (ETHA) $266 million and Bitwise’s (ETHW) $204 million net inflows.

Other funds, such as Fidelity’s FETH, Grayscale Mini’s ETH, and Franklin’s EZET, among others, attracted a combined inflow of $120.2 million.

Ethereum Eyes $4,000 Following ETF Launch

Traders are closely watching Ethereum, anticipating a potential rise to $4,000 following the highly anticipated Ether ETF launch. Activity has surged, with trading volume spiking more than 110% just a day before the ETF’s debut. On its first day, the Ethereum ETF’s trading volume surpassed $1 billion, suggesting that similar trends may continue in the coming days.

Crypto-analytic research firm ASXN projects that spot Ethereum ETFs could attract monthly inflows of $1.2 billion. Consensys’ CEO Joe Lubin noted earlier that with the amount of Ethereum already locked, investor interest from ETFs would cause a supply shock bigger than Bitcoin’s.

Should bullish investors maintain their positions during the early weeks of ETF trading, Ethereum will likely soon achieve a new all-time high. At press time, Ethereum traded at $3,439, down less than 1% in the last 24 hours.