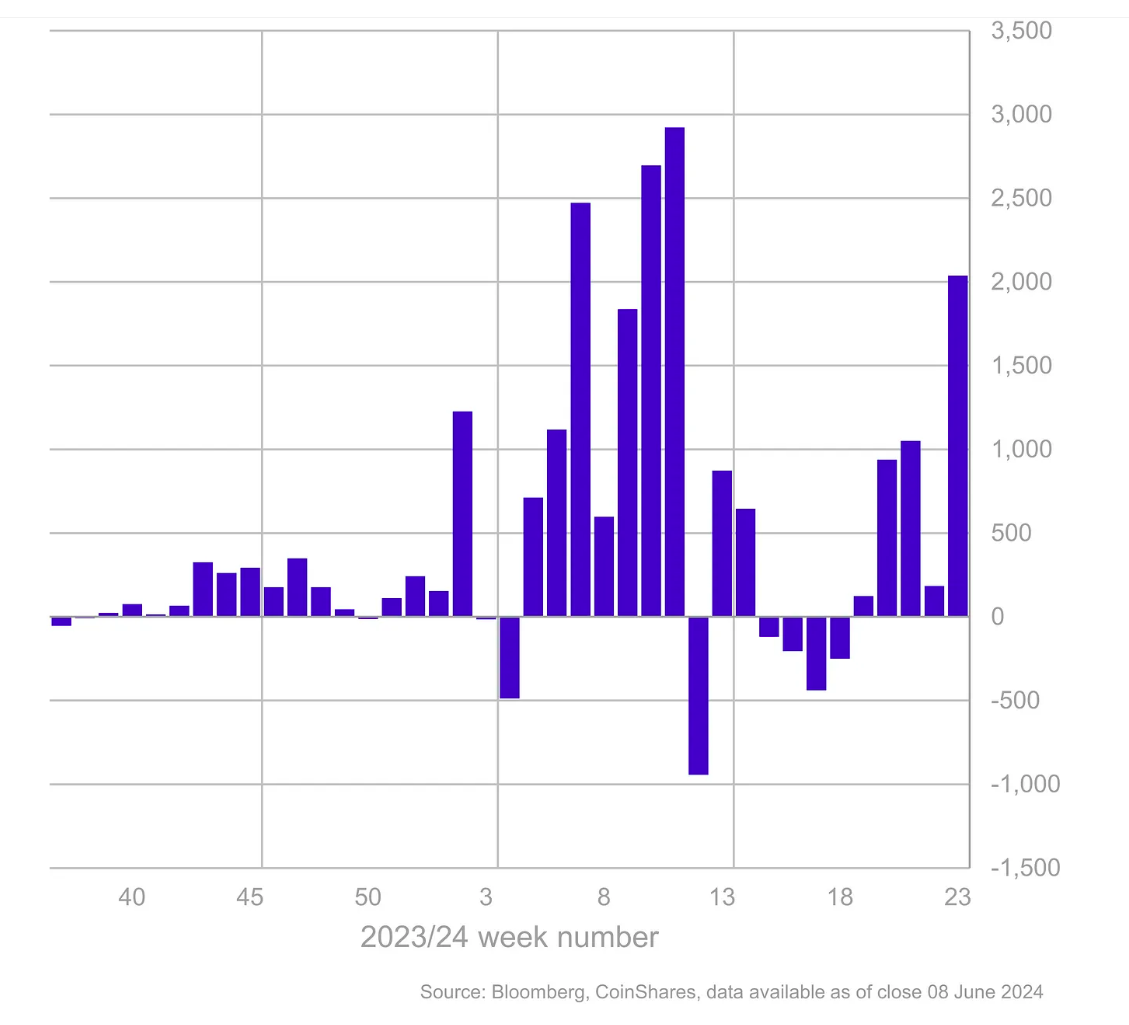

Data from CoinShare has shown that $2 billion flowed into crypto investment products last week. With the net inflow, digital assets are now on a five-week positive flow streak, accumulating $4.3 billion in the process.

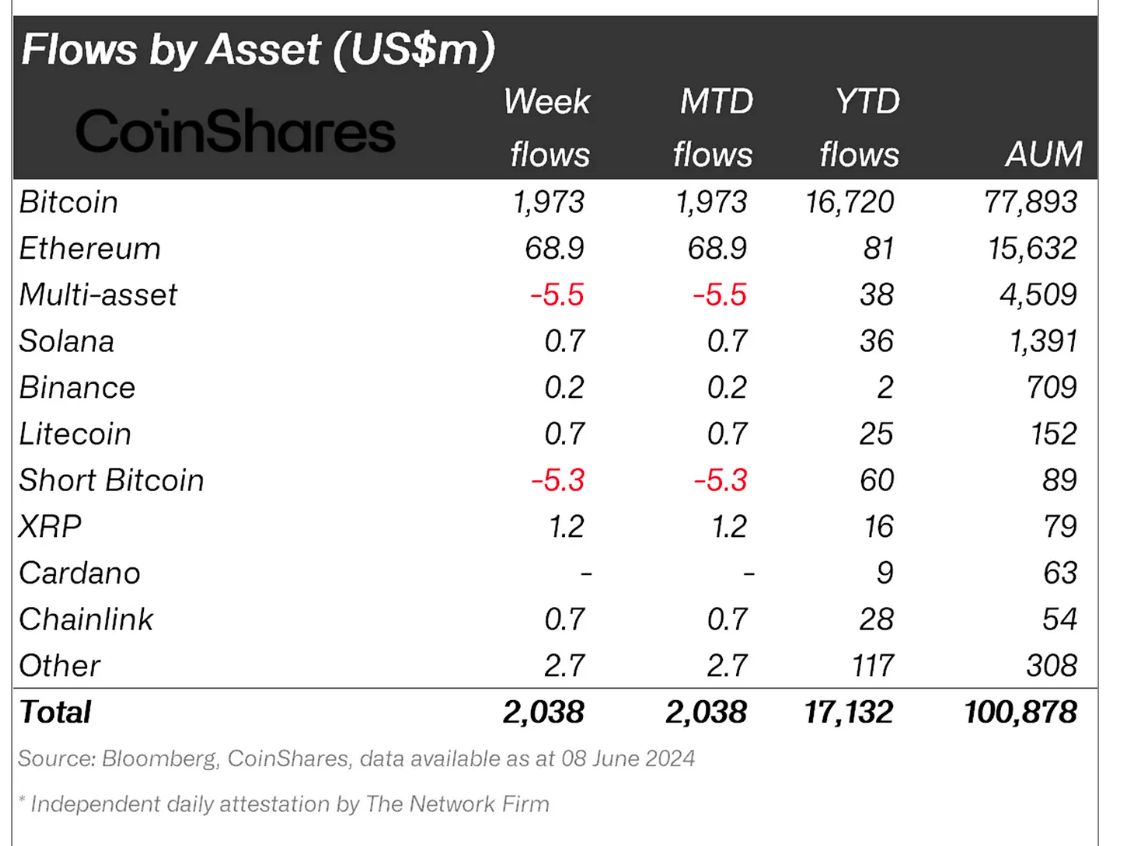

As expected, Bitcoin led the inflow charge, with 98.5% of investments flowing into the largest crypto asset. Bitcoin raked in $1.97 billion, most of it from US exchange-traded fund (ETF) products.

The US ETF product saw a week of massive inflows, recording the second-highest single-day net inflow of $887 on June 4. BlackRock’s IBIT acquired the highest Bitcoin last week, buying about $948 million worth of the asset.

Notably, trading volumes on ETFs rose to $12.8 billion last week, a 55% increment from the previous week. Last week’s net inflow was also the highest in the past five weeks.

Ethereum Shines

With Ethereum still in high spirits after the Securities and Exchange Commission (SEC) approved an Ether ETF last month, the asset recorded its highest weekly net inflow since March. Between June 3 and 7, about $68.9 million flowed into the second-largest crypto asset.

Other assets, such as Solana, Chainlink, and XRP, also saw significant inflows last week. About $700,000 flowed into Solana and Chainlink, while XRP saw a $1.2 million net cash influx.

“Usually, inflows were seen across almost all providers, with a continued slowdown in outflows from incumbents. We believe this turnaround in sentiment is a direct response to weaker than expected macro data in the US, bringing forward monetary policy rate cut expectations,” CoinShares analyst James Butterfill said.

Dominant US

The United States has continued to dominate all other countries in net inflow. It has led the pack since the US SEC approved its first spot Bitcoin ETF in January.

Last week, ETFs in the US saw a net inflow of $1.98 billion. The newly approved Hong Kong ETF saw a positive flow of $26.1 million, taking its AUM to $452 million. ETFs in Canada and Switzerland recorded $12.7 million and $10.6 million, respectively.

Despite the incessant inflow, Bitcoin has remained below its all-time high after failing to break above $72,000 on Friday. Bitcoin was trading at $69,348 at press time, down less than 1% in the past 24 hours. Ethereum, on the other hand, exchanged hands at $3,672.