The cost of sending a transaction on the Ethereum blockchain has recently hit a five-year low, with low-priority transactions dropping to around 1 gwei, a unit of Ether, since August 10. Meanwhile, high-priority transactions have been hovering around 2 gwei.

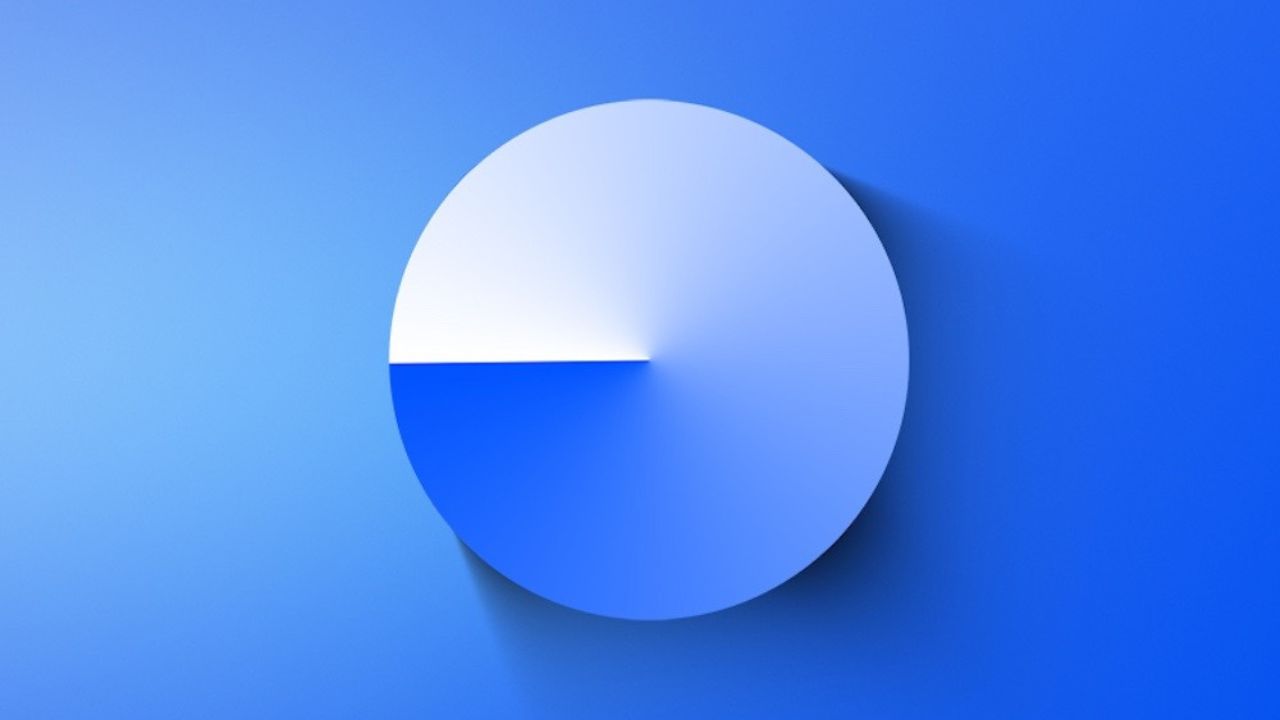

Data from Dune Analytics, a blockchain data platform, shows that Ethereum’s median gas fees fell to 1.7 gwei on August 16, marking the lowest level since mid-2019. This represents a nearly 98% decrease from the year-to-date peak of 83.1 gwei, reached in March.

The Impact of Dencun Upgrade on Gas Fees

The decline in transaction fees follows Ethereum’s Dencun upgrade in March, which implemented nine Ethereum Improvement Proposals (EIPs). One of these proposals introduced “data blobs,” also known as proto-danksharding. The mechanism is designed to reduce transaction costs for layer-2 blockchains by enabling more efficient data handling.

Ethereum’s scaling strategy relies heavily on layer-2 blockchains, which can process more transactions at a lower cost by handling them off the main Ethereum blockchain while still using layer 1 (L1) for transaction verification.

Commenting on the recent drop in gas fees, Gnosis co-founder Martin Köppelmann expressed concerns on X on August 10, saying: “Ethereum needs to get more L1 activity again.”

He pointed out that gas fees need to be at least 23.9 gwei to sufficiently fund staking rewards, which are critical for maintaining a robust validation network. Köppelmann suggested that, even though it may seem illogical at such low rates, increasing the gas limit could still be a strategic move.

ETH Supply Increase

Activity on Ethereum’s layer-2 networks has significantly outpaced that on the base blockchain. Data from L2Beat shows that the Base network alone processed over 112 million transactions in the last 30 days, far surpassing Ethereum’s 33 million. Additionally, Arbitrum and Taiko networks together accounted for another 100 million transactions, highlighting the growing dominance of layer-2 solutions.

With fewer ETH being utilized in transactions and staking payouts, the supply of the crypto asset has increased significantly. Data from Ultrasound Money indicates that approximately 16,000 ETH, valued at $41.7 million, has been added to the supply in the past seven days.

Get Trending Crypto News as It Happens. Follow CoinTab News on X (Twitter) Now