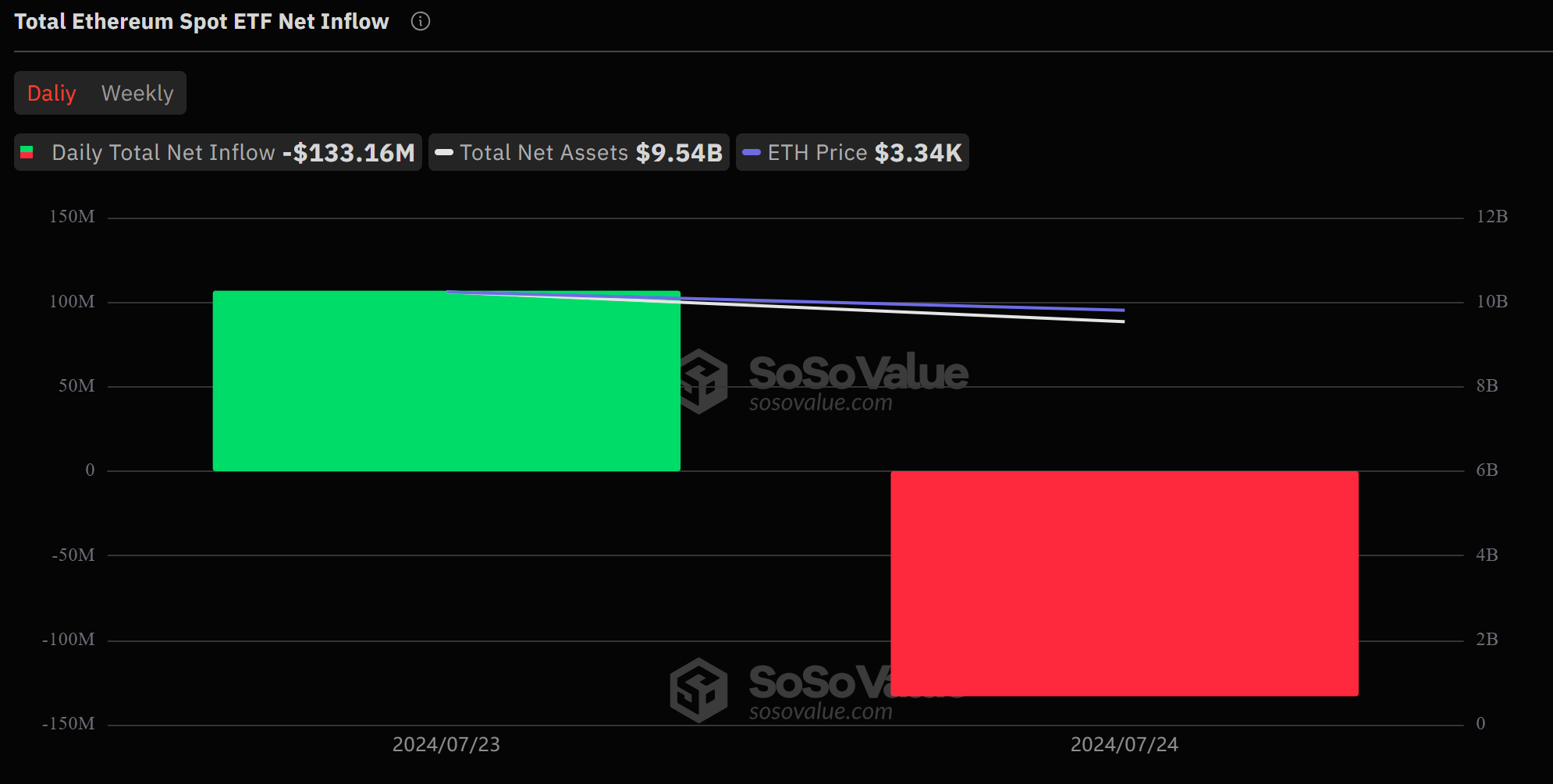

The spot Ethereum exchange-traded fund (ETF) saw a net outflow of $133 million on Wednesday, its first negative haul since its launch two days ago. Data from Sosovalue shows that the fund couldn’t neutralize massive outflows from Grayscale despite hitting a similar trading volume as it did on its first trading day.

Ether ETF recorded a net inflow of $107 million on Tuesday, with Grayscale’s ETHE fund seeing a negative inflow of $484 million. The Ethereum product saw a trading volume of $1.1 billion, just about 25% of Bitcoin’s spot ETF on Day 1.

However, Wednesday’s $1.05 billion trading volume couldn’t ensure that the Ethereum ETF saw a consecutive inflow streak on its second day. The fund saw a net outflow of $133 million despite Grayscale’s ETHE recording a lower single-day outflow of $326.8 million.

Other Funds See Inflows

With Grayscale’s ETHE being the only asset manager with a net outflow on Wednesday, seven other funds saw inflows totaling $193 million.

The Fidelity Ethereum Fund (ETHH) led the inflow on Wednesday, recording an influx of $74.4 million. Grayscale Ethereum Mini Trust (ETH) saw a $45.9 million inflow and $29.6 million flowed into the Bitwise Ethereum Fund (ETHW).

VanEck Ethereum ETF saw an inflow of $19.8 million, while BlackRock’s IShare Ethereum Trust ETF (ETHA) recorded a second consecutive inflow of $17.44 million. Franklin Templeton and Invesco Ether ETF funds saw a cash influx of $3.8 million and $2.5 million, respectively.

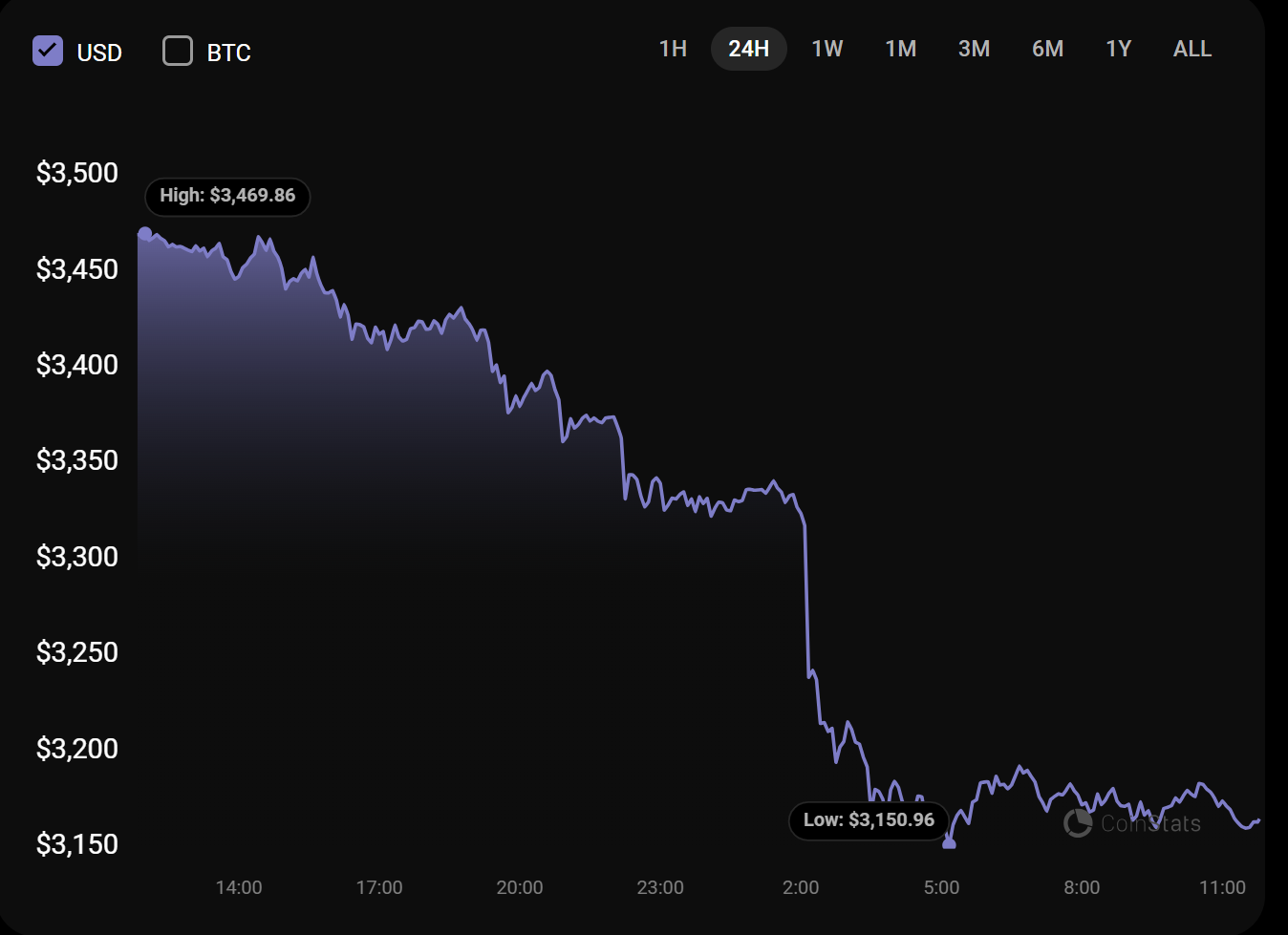

Ethereum Struggles

The negative flow from the Ether spot ETF impacted the Ethereum price, as the asset fell over 8% in the past 24 hours. Its price downturn has seen over $100 million in leveraged positions liquidated in the past day.

Ethereum’s price correction seems to mirror a similar pattern as the one seen when the Bitcoin spot ETF resumed trading in the US in January. Bitcoin fell over 10% a few days after its ETF product went live as Grayscale’s Bitcoin Trust investors pulled billions from the issuer upon launch.

Ethereum was trading at $3,164 at press time, with a market cap of $381 billion.