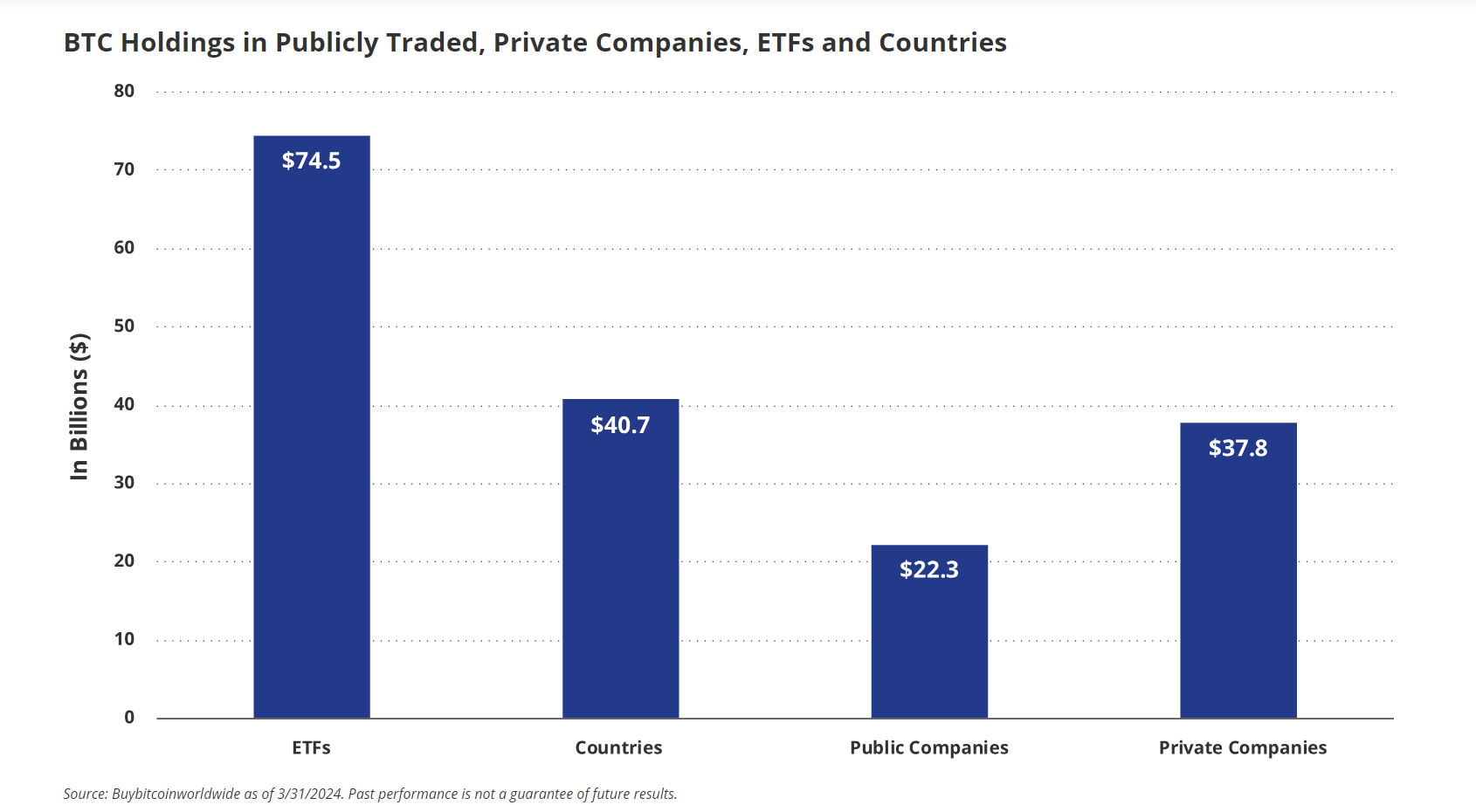

American-based asset manager and one of the 11 US spot Bitcoin exchange-traded fund (ETF) providers, VanEck, has revealed that an estimated $175 billion worth of bitcoin (BTC) is currently held across a spectrum of entities, including ETFs, countries, and both public and private companies.

In a Wednesday report, VanEck elaborated on the $175 billion bitcoin claims, stating that ETFs held $74.5 billion, while countries held over $40 billion of the largest cryptocurrency. The asset manager also showed that public and private firms owned $22.3 million and $37.8 million worth of bitcoin, respectively.

“Bitcoin interest among institutional investors has also increased. Hedge funds, asset management firms, and endowments are increasingly recognizing bitcoin’s potential as a store of value,” VanEck said in the report.

The total figure VanEck speculated to be held by the aforementioned entities accounted for about 15% of the total amount of bitcoin in circulation. About 19 million bitcoins are already in the market, a large chunk of its 21 million maximum supply.

Bitcoin As “Digital Gold”

In the report, which aimed to promote Bitcoin as a digital gold, the asset manager listed the qualities of the digital currency that support its claims.

VanEck cited Bitcoin’s limited supply quality, its potential to hedge against inflation, and its increasing adoption as reasons why it is a good investment. The asset manager further noted that Bitcoin might outshine gold, stating that the divisible and decentralized nature of the largest crypto asset could draw investors to it more than gold.

Adoption on the Increase

During its early days, Bitcoin appealed mainly to a small community of tech enthusiasts, facing challenges in accessibility and acceptance due to limited utility and merchant support. In 2021, El Salvador attracted international attention by becoming the first country to legalize Bitcoin as an official currency alongside the US dollar.

In 2023, Bitcoin’s adoption went mainstream, with more businesses embracing Bitcoin as a payment method due to its improved infrastructure and user experience. The emergence of user-friendly wallets, exchanges, and marketplaces also aided the adoption process, making it easier for the general public to engage with Bitcoin compared to its early years.

“Now, more than ever, merchants and businesses are accepting bitcoin as a form of payment, and infrastructure has been built to make it more convenient for the average person to use,” VanEck stated.

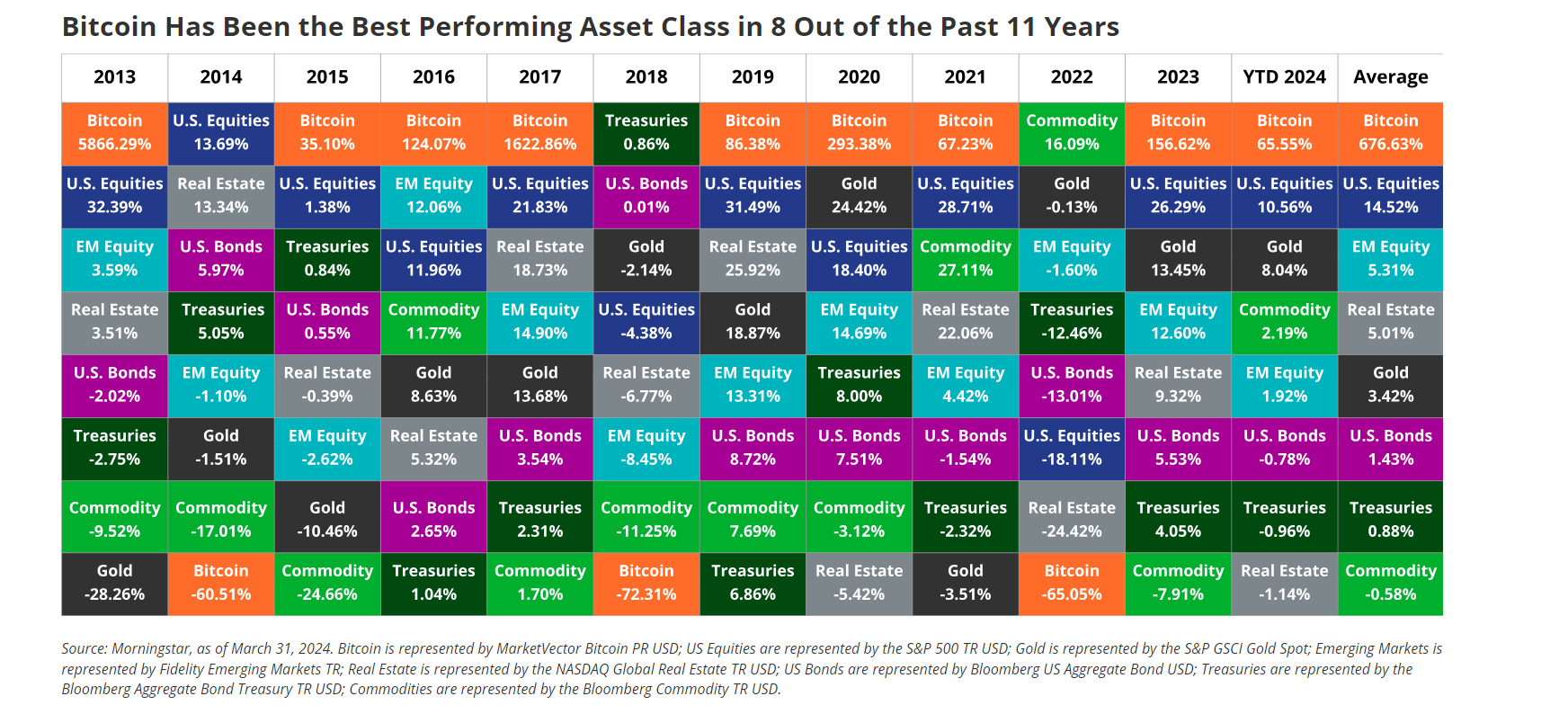

Bitcoin’s outstanding performance in recent years has also aided its adoption. According to the VanEck report, the cryptocurrency has outperformed traditional assets in the past decade.

Bitcoin has emerged as the best-performing asset in eight of the last eleven years and has managed an incredible 18,716.44% increment in the last ten years.

At press time, Bitcoin traded at $57,762, with a market cap of $1.1 trillion.