Dogwifhat recently flipped a critical level. It surged above $2.40 during the previous intraday session for the first time since June 17.

Why Dogwifhat Needs $2.40

While the hike spiked speculations of the asset seeing more price increases, it is important to understand why the mark is critical.

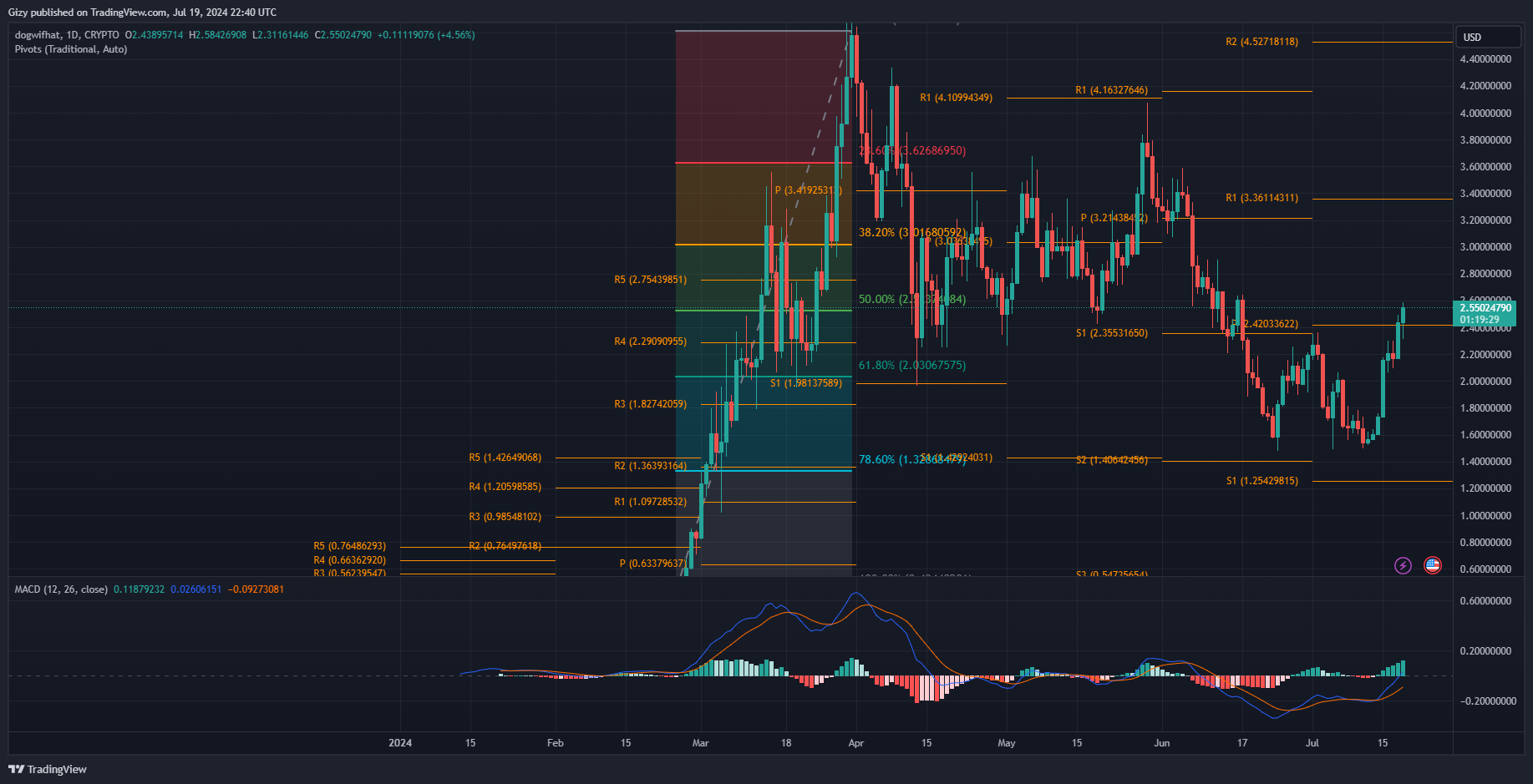

Aside from the fact that WIF is breaking it after over a month, it is also the pivot point. The pivot point standard identifies key levels: support, or resistance. $2.40 was a tough negative barrier as the token failed to break it on two trials.

It is also a critical support. Several downtrends have halted around this in last four months. One of the most significant was in May, when the token had several declines that rebounded off the highlighted mark.

With the price level’s precedent, WIF surge above it opened a new tough support for the bulls. However, it is important for the asset to gain more stability to solidify the flip and the mark’s strength.

It appears the surge is slowing down, which may be cause for concern. The chart shows reduced volatility, as the token prints a smaller candle than the previous day. It started that session at $2.17 but saw a notable increase in buying pressure. As a result, it shot up, peaking at $2.49. It ended with gains exceeding 12%.

With a less than 5% positive change on Friday, the bulls may be gradually getting exhausted. Nonetheless, the asset attempted $2.60 but retraced at $2.58. Although it had a small retracement, its current price indicates the growing distance from the highlighted level.

Indicators are Still Bullish

Amidst the gradual decline in volatility, indicators are still bullish. One such is the moving average convergence divergence. The 12-day EMA and 26-day EMA are on the uptrend with no signs of halting. The 12-day EMA is surging and is above 0. With the histogram’s increasing bars, the uptrend may stretch for two or three days.

WIF is also trading above the 50-day exponential moving average, steering clear of all three long-term EMAs.

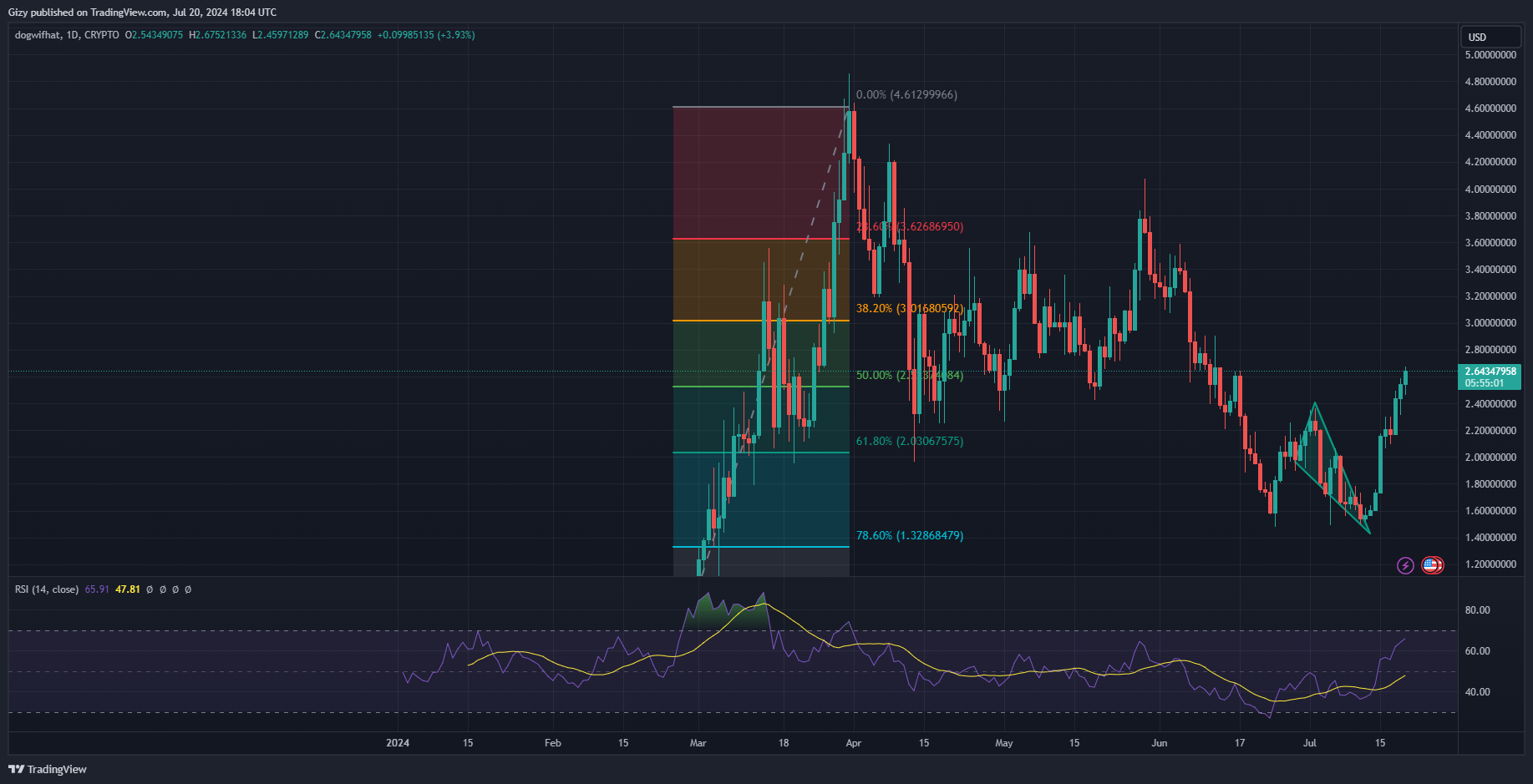

The relative strength index continues its bullish trend. The metric shows the increasing buying pressure the asset is experiencing, which accounts for most of its over $300 million trading volume in the last 24 hours. The indicator is at 66 in response to the most recent trend and may hit 70.

If the current uptrend continues, the index may surge above 70 in the next 48 hours. The assertion is based on the metrics’ speed over the last 48 hours, in which it gained over 5 points.

Nonetheless, the chart offers more insight into the reason for the most recent uptrend. The token went bullish following its breakout from a bullish pennant. The pattern formed after several days of consistent price decline.

In the Coming Days

RSI is indicating a possible downtrend in the next 48 hours if the uptrend continues. The asset will become overbought once the metric crosses 70. Additionally, the steep price climb in price indicates an impending correction.

Dogwifhat will cross some resistances before the bearish predictions take place. The Fibonacci retracement level points to the cryptocurrency trading above a critical level. It is exchanging above the 50% Fib level, which is serving as strong support.

The bulls will look to reclaim the 38% fib level in the coming days. However, the bulls must decisively flip the $2.80 resistance. The price mark is a strong support and may provide an accumulation point to build momentum.

Nonetheless, previous price movement points to the asset struggle at flipping the mark. The struggle may continue and may trigger the start of the uptrend as WIF will become overbought if the bulls don’t consolidate their gains.

The next 24 hours will determine if the token will surge above $3 soon.