ETH recently reclaimed $3,400 less than 24 hours after losing. The recent price trend suggests significant demand concentration as the largest altcoin continues to bid for further price improvement.

In the latest development, the crypto market has bounced back from a recent slump that saw it plummet by more than 3%. The global cryptocurrency market cap reached a low of $2.2 trillion, marking the lowest point in over a month.

Key events that garnered attention during the previous trading session included the resolution of the Mt. Gox case and the German government’s sale of $300 million worth of BTC.

Additionally, miners disclosed selling $2 billion worth of Bitcoin over the last twenty days. As market sentiments shift, many cryptocurrencies are poised to regain their previous levels.

However, concerns loom over the potential impact of the German government’s contemplated resumption of sales on the market.

Top Five Cryptocurrencies to Watch

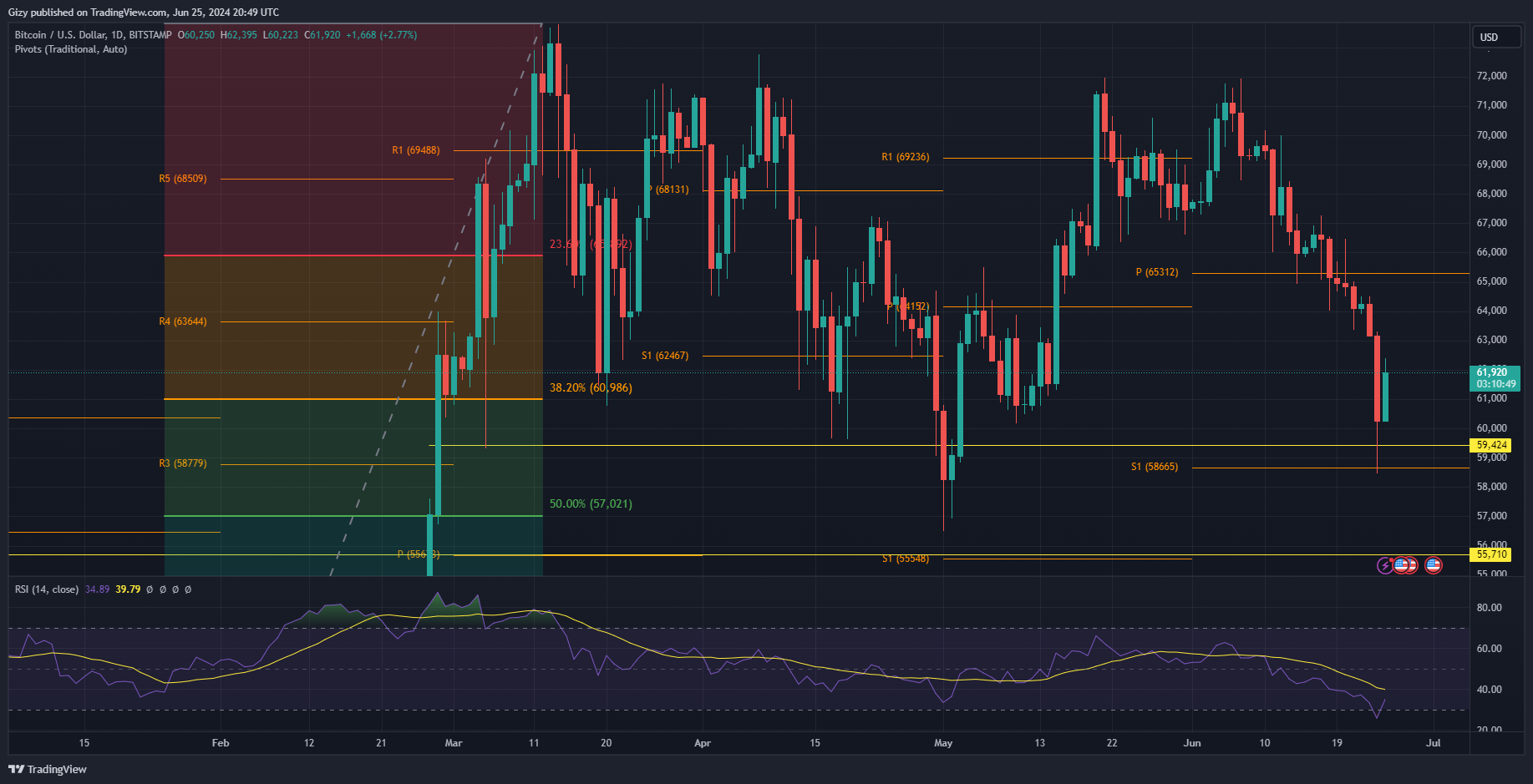

BTC/USD

Bitcoin experienced a significant intraday loss of nearly 5%, dropping below the $60,000 mark for the first time in over a month. The cryptocurrency became oversold due to consistent declines, reaching a low of $58,400 before partially recovering and closing at $60,000.

This decline follows a previous drop on Sunday when Bitcoin fell from $64,000 to close at $63,154.

Despite this bearish trend, Bitcoin made a notable push to reclaim lost levels, briefly surging above $62,000 and reaching a high of $62,395.

Currently, Bitcoin has gained almost 3%, with bullish sentiment aimed at absorbing the asset’s excess supply.

The relative strength index (RSI) has significantly improved after dropping below 30 and reaching a low of 25. The RSI is now back above 30 in response to the recent change in sentiment.

Additionally, the accumulation and distribution channel indicates a potential continuation of the price increase, with an uptrend and considerable trading volume.

Although Bitcoin’s trading volume has decreased by over 20% in the last 24 hours, multiple indicators are not providing clear signals for future price action.

Looking ahead, Bitcoin aims to continue its upward movement and retest the 50-day exponential moving average. If it surpasses $64,000, it will likely attempt to reach the pivot point around $65,000. However, news of increased selling pressure may prompt Bitcoin to retest the $60,000 level by the end of the week.

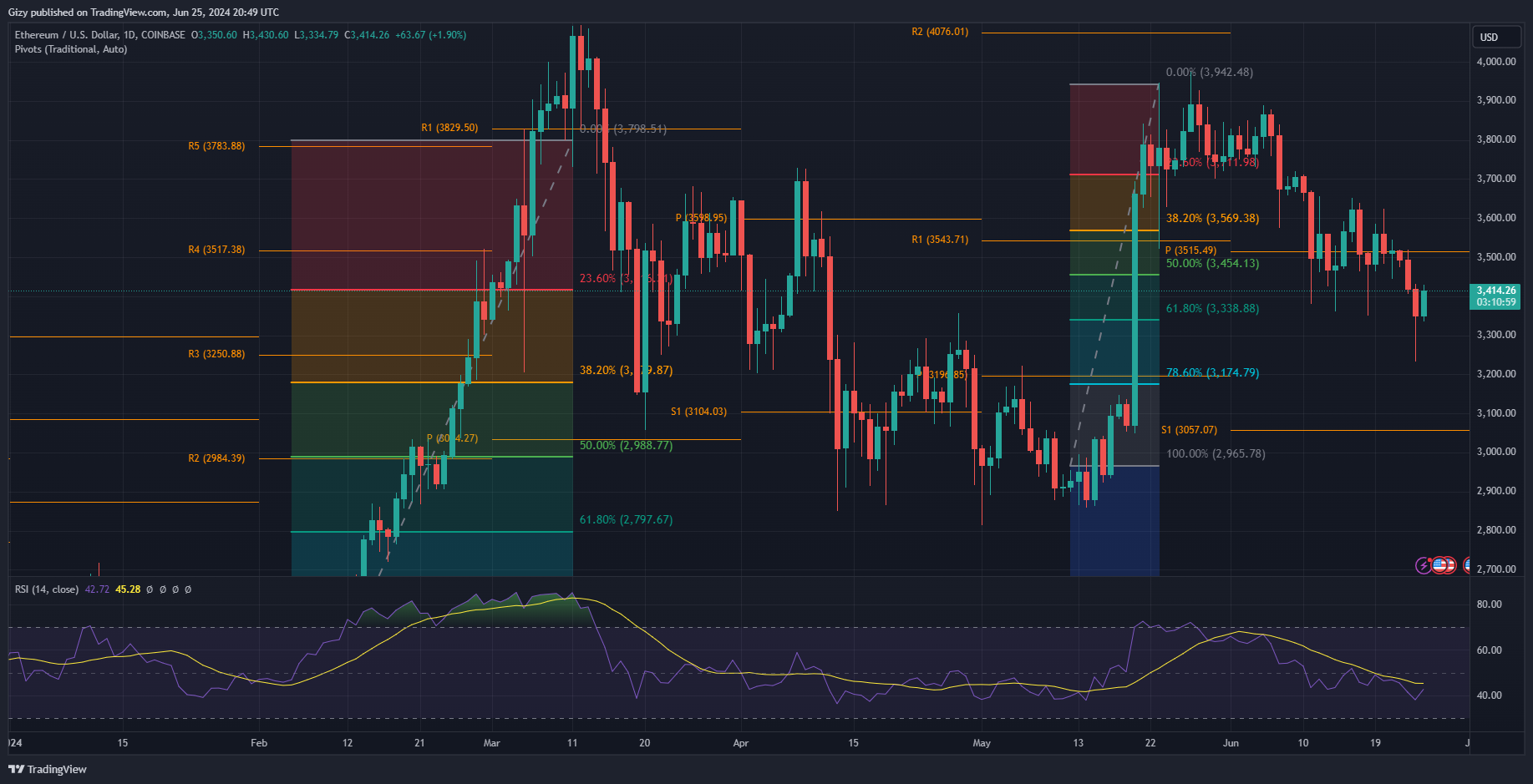

ETH/USD

It’s worth noting that Ethereum has been recovering from the recent downtrend. It opened trading at $3,418 and then dropped to $3,233.

This decline marked the asset’s first closing below $3,400 in over a month. It came just after the asset experienced a loss of more than 2% on Sunday.

On June 24, the asset saw losses of nearly 2%, but the bulls managed to rally the coin following the dip, leading to a recovery. The largest altcoin has since regained the $3,400 support, and the current day’s candle indicates that previous losses have been successfully corrected.

It’s important to note that the relative strength index has dropped to its lowest point since May, signaling nearly equal selling pressure.

However, there is an upward trend in buyback activity. Now that the bulls have regained composure above $3,400, they will likely attempt to sustain this momentum.

Traders are monitoring the coin’s pivot point, which is set at $3,515. Many traders consider this a pivotal level, and the asset will aim to ascend beyond it.

The Fibonacci retracement level suggests that surpassing $3,450 could give the climb to this critical level an additional boost, thanks to significant demand concentration.

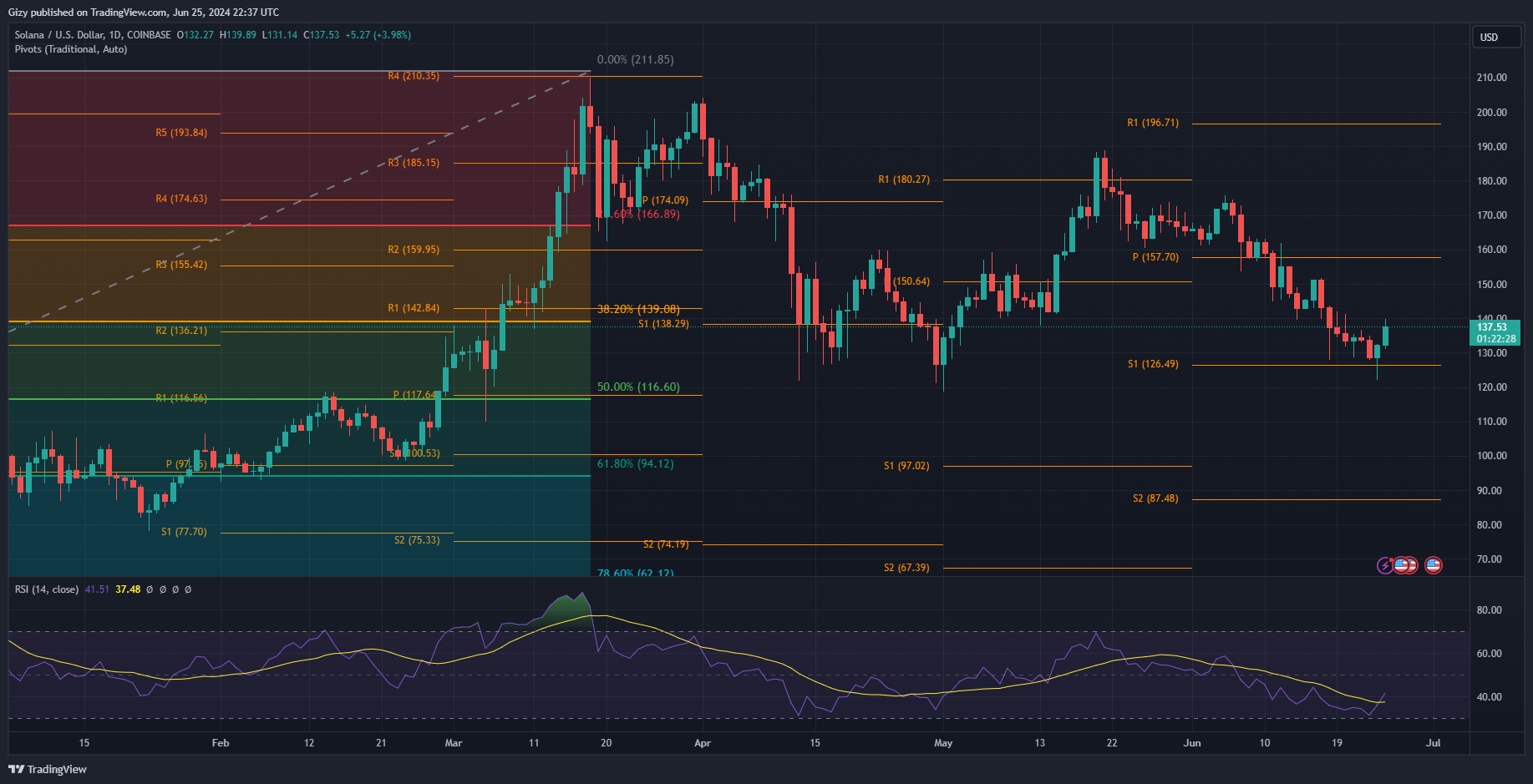

SOL/USD

Solana has shown significant price improvements recently, emerging as one of the top gainers in the top 10 cryptocurrencies during the last intraday session.

Despite the overall bearish market sentiment, the coin started the previous day at $128, retraced to a low of $122 (the lowest since May), but quickly rebounded. It reclaimed $130 and closed the day at $132, marking a gain of almost 3%.

The bullish trend is ongoing, and there are expectations for the coin to reclaim more levels. After bouncing off the first pivot support, the bulls are aiming to regain composure above the pivot point at $157.

Additionally, Solana tested $140 but experienced minor corrections. If SOL stabilizes above $140, it will find support at the 38% Fibonacci level at $137 due to significant demand concentration.

However, reaching $150 this week might be challenging based on previous price movements, indicating a potential upcoming horizontal price trend. It is possible that Solana may trade between $140 and $150 for an extended period before a potential breakout in the following week, given the continuation of the bullish trend.