The cryptocurrency market has had an April to forget. Since hitting a peak of $2.7 trillion earlier this month, around $470 billion has been wiped off the table, with the total market capitalization currently standing at $2.23 trillion. The decline has largely been a result of worsening macroeconomic conditions and war tensions in the Middle East.

Nonetheless, there could be more trouble on the way, with several crypto projects set to witness large token unlocks in May. Basically, token unlocks represent inflation of a cryptocurrency’s circulating supply, a move that dilutes existing holders as more tokens flood the market in search of buyers.

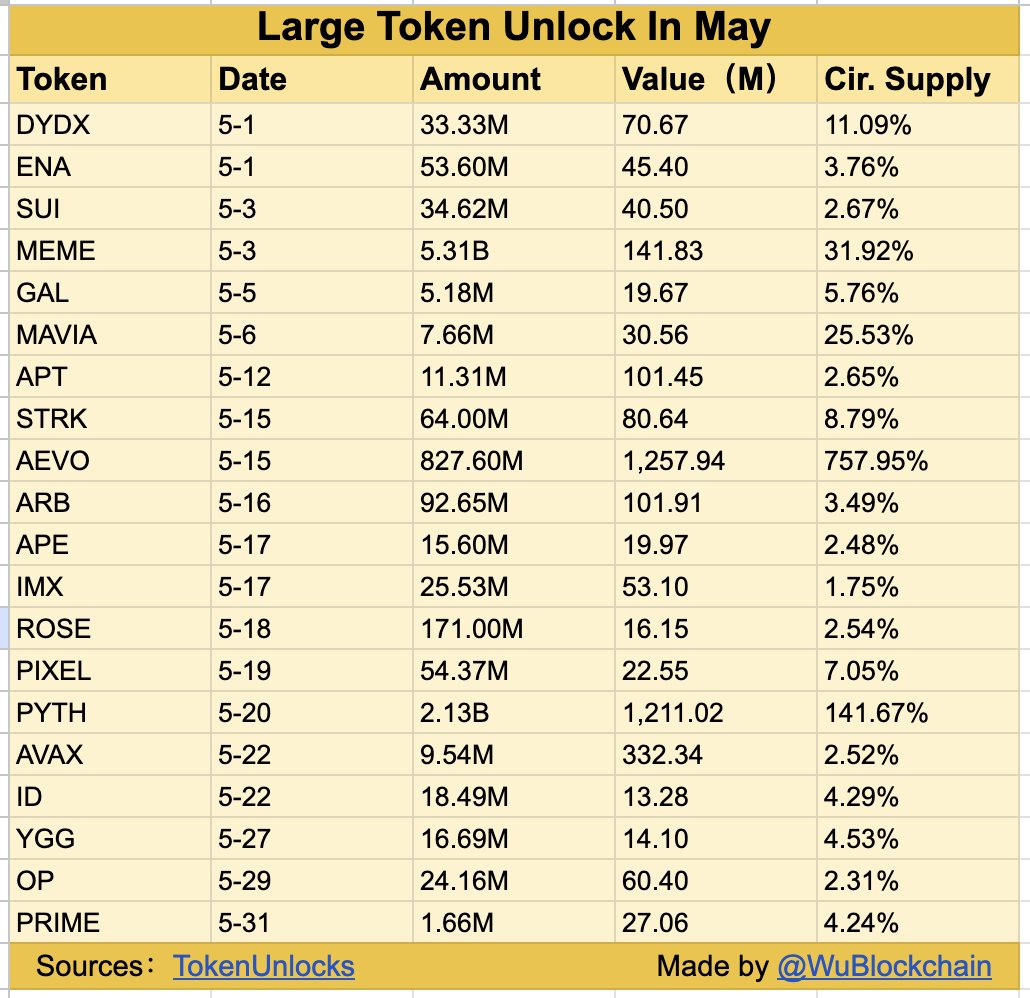

According to data from Token Unlocks, curated by independent crypto reporter Colin Wu, the total amount of tokens to be unlocked in May is an estimated $3.6 billion worth of assets. Aevo (AEVO) and Pyth Network (PYTH) top the charts for largest unlocks by value, with the projects set to unlock $1.25 billion and $1.2 billion worth of assets, respectively.

Meanwhile, other coins such as Avalanche (AVAX), Meme (MEME), Aptos (APT), and Arbitrum (ARB) fall within the $100 million+ unlock club. As the full chart below shows, over $330 million worth of AVAX is set to be unlocked, while MEME, APT, and ARB will see unlocks of $141 million, $101.91 million, and $101.45 million, respectively.

Bleak or Blissful May Ahead?

Evidently, the impending token unlocks do not bode well for an already bearish crypto market. As many analysts have pointed out, Bitcoin’s performance in April, especially, means the cryptocurrency is on track for its worst month since the FTX debacle in late 2022.

However, it is worth noting that the underperformance is not entirely surprising and typical of Bitcoin and broader crypto market action in the aftermath of a halving event. Ideally, many bullish investors expect the market to regain momentum in the coming months, even though there is no clear way to determine whether this resurgence will begin in May.

Either way, the general market outlook remains bullish on the long-term horizon. Bitcoin could still continue its history of setting a new all-time high within twelve months after a halving, with various predictions tipping the leading cryptocurrency to soar as high as $180,000.