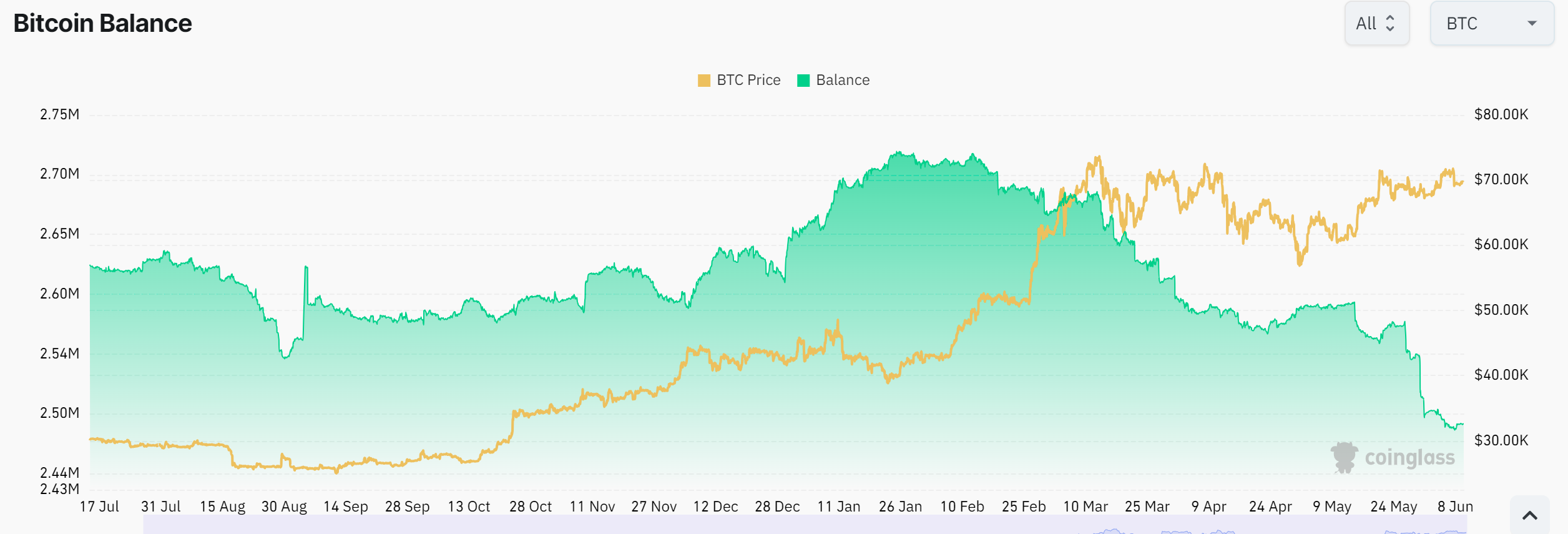

The amount of bitcoin (BTC) on crypto exchanges has hit an all-time low as demand for the largest crypto asset has continued to rise. As of June 9, only about 2.49 million bitcoins are left on exchanges.

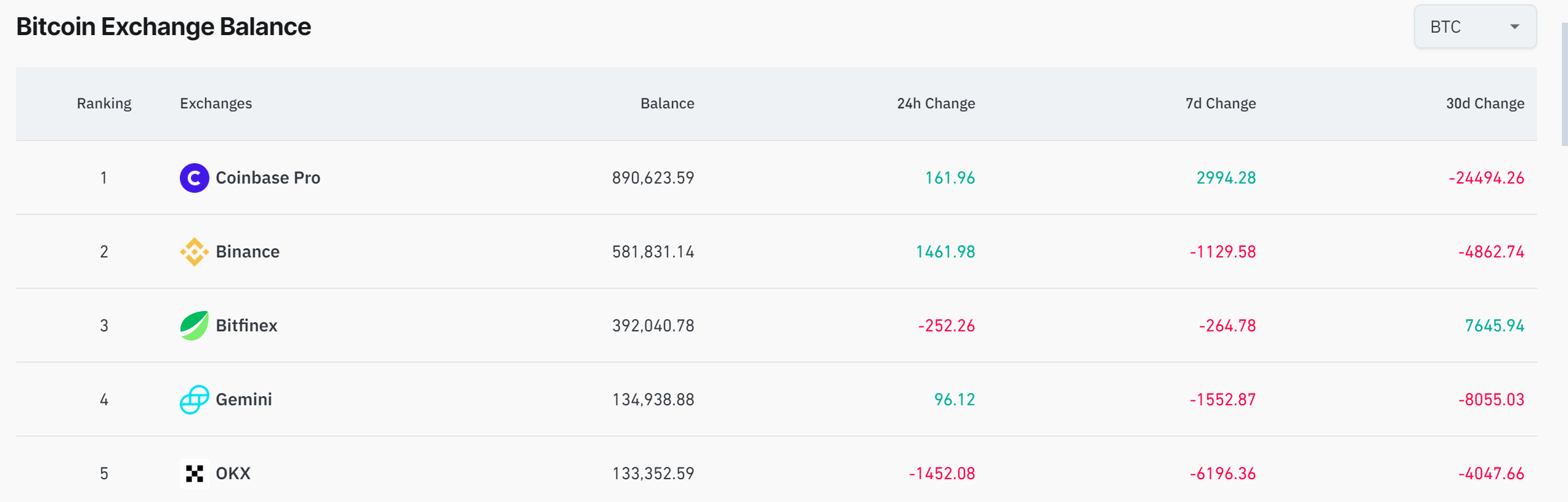

Coinbase, the custodian of most US exchange-traded funds (ETFs) holdings, holds the lion’s share of Bitcoin, with a staggering 890,623 BTC. Similarly, Binance, a leading crypto platform, exerts substantial influence with its second-largest Bitcoin holdings, accounting for almost 582,000 of the largest crypto asset.

Data from Coinglass reveals a trend of Bitcoin withdrawals from exchange custody, with investors increasingly opting for self-custody. This shift not only depletes the Bitcoin reserves of exchanges but also signals a growing demand for the crypto asset.

Supply Shock

In the past seven days, four of the top five exchanges in terms of Bitcoin balance have seen a significant withdrawal of the asset from their custody. Binance, Bitfinex, Gemini, and OKX saw 1129 BTC, 264 BTC, 1152 BTC, and 6196 BTC moved out of them, respectively.

With supply getting thinner, the incessant demand from US ETF products would soon drive a shock across the Bitcoin market. Last week, the 11 funds acquired 25,729 BTC, which is eight times bigger than the 3,150 BTC produced by miners during the same timeframe.

The amount of bitcoin that US ETF issuers bought last week is just 3,863 BTC away from all the bitcoins they acquired in May. The last time such pent-up demand came from US ETF products, Bitcoin traded at a new all-time high of $73,679.

Meanwhile, Bitcoin Still Struggling

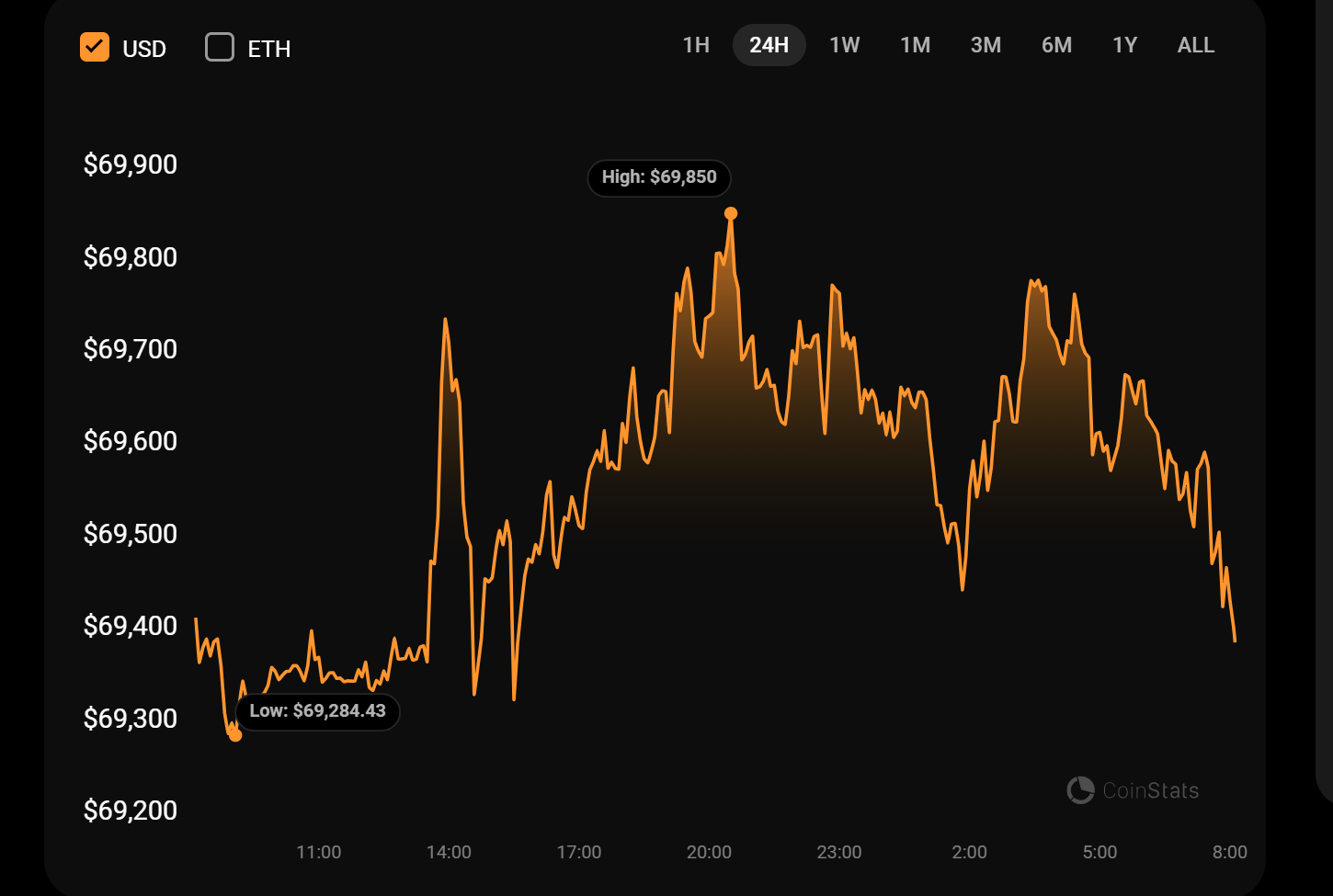

Amidst the incoming supply shock, Bitcoin has failed to impress in price. The asset again didn’t break the resistance in the $72,000 region and capitulated to $69,000 in a few hours.

The dip came after the Non-Farm payroll data came in hotter than expected, a metric that puts the Federal Reserve System (Fed) on its toes in its push to fight inflation. On Wednesday, the Fed will release its Consumer Price Index (CPI) data, which will play a significant role in its decision to either cut interest rates or keep them the same.

Despite predictions that it would move to a new ATH during the weekend, Bitcoin was trading at $69,432 on Monday morning. The asset maintained a market cap above $1.4 trillion and a 24-hour trading volume of $15 billion.