TRX has been on the uptrend over the last seven days. It surged to its highest in over three years as the latest integrations and improvements on Trondao yielded significant results. The chain recently flipped Solana’s daily revenue as developers move their projects.

The global cryptocurrency market has since seen slight increases. However, the latest surge in a few altcoins did not impact valuations, as most assets in the top 10 are grappling with low volatility or trading volume.

The apex coin is yet to break out. Nonetheless, many traders are looking forward to when this trend will change and are pointing to the release of the former Binance CEO from prison as a possible trigger.

Reports suggest that Chang Zhao has been moved from the maximum security facility to a lesser concentration in preparation for his exit in September.

Amidst all the reports, let’s see how some assets performed since the week started.

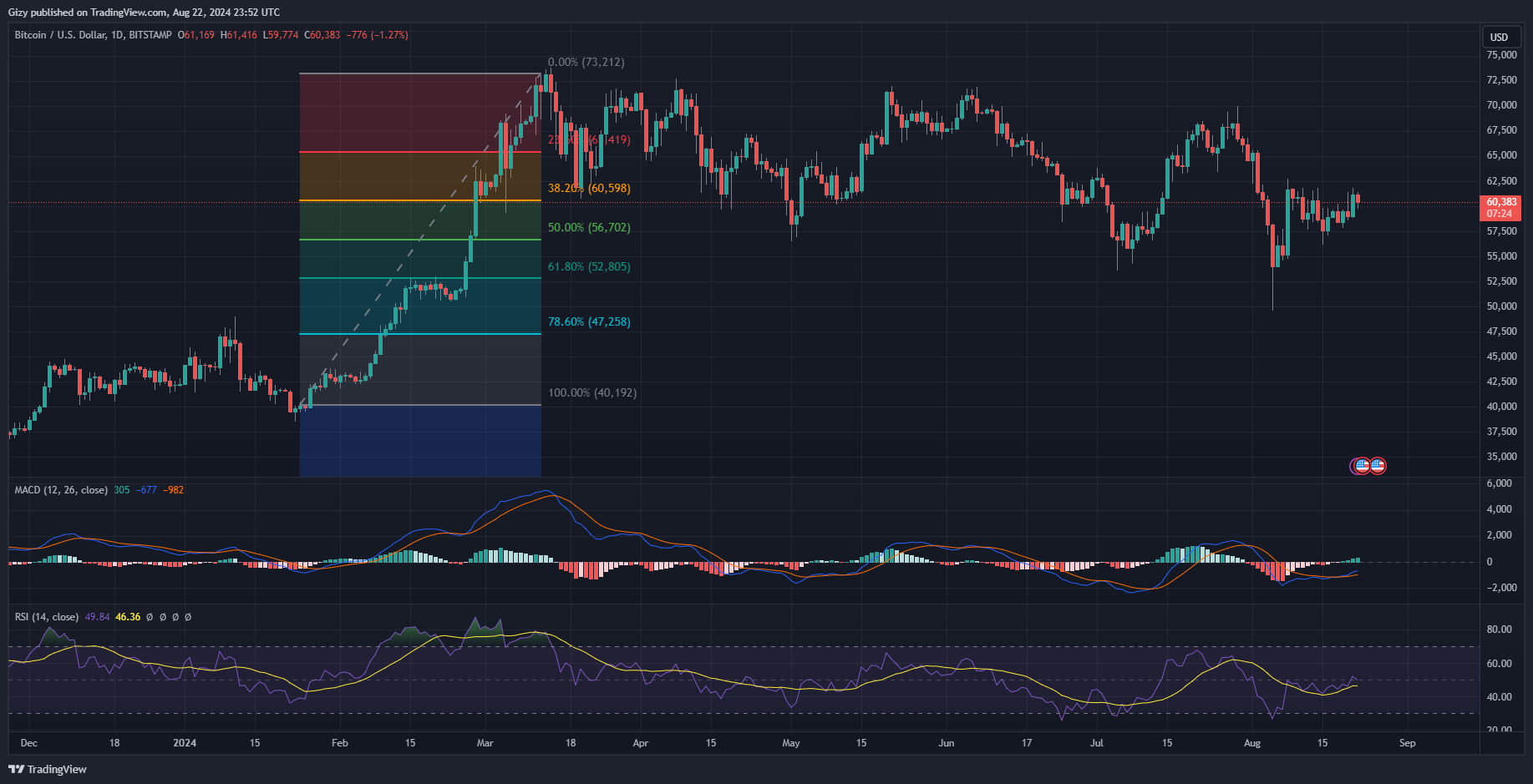

BTC/USD

Bitcoin has yet to break its fourteen-day high, but it approached it more than once in the last three days as it saw small increases in buying volume. This comes after several reports of improvements in holding by some investment firms.

The asset was en route to $62k when it halted its advances at $61,424 on Tuesday. It saw a short squeeze that fizzled out a few hours after it started. Nonetheless, it surged higher the next day after it closed at $59k.

BTC peaked at $61,838 during the previous session and closed with gains of over 3%. Currently down by a few percent, the news of CZ getting closer to its release date did not generate the reaction many hoped for. Nonetheless, the apex coin is up by over 3% on the 1-week scale.

The indicators are sightly bullish following the slight increase in the asset. The moving average convergence divergence is on the uptrend, with the 12-day EMA continuing its surge. The metric is unaffected by the most recent slight decline.

Nonetheless, BTC is trading above a critical level that may decide when the $62k resistance will break. The highlighted mark broke on several occasions following the start of an attempt from $59,900. The bulls may hold this mark in a bid to stage a breakout.

TON/USD

Toncoin has been on the decline since the start of the week. It started the downtrend following Sunday’s 7% surge, which saw it flip several vital levels. Since its short breakout above $7, the cryptocurrency has not registered any notable attempt to continue the trend.

Monday kicked off with the asset struggling to keep the price above $7 but failed. It dropped to its lowest this week during the previous intraday session following a more than 2% decline that resulted in a low of $6.48. TON erased all Sunday’s gains in the last three days and is at a critical support.

Toncoin retraced to a low of $6.43 but rebounded, printing a doji at the time of writing. The current low is the coin’s seven-day low and may spell further price declines in the event of a slip. The last drop below this mark saw the asset retest $6. It also served as a launchpad at the $7 resistance a few in previous times.

Nonetheless, indicators are gradually turning bearish. The MAD is printing a negative signal as the 12-day EMA halts its advances following price performance in the last three days. The relative strength index indicates a massive drop in buying pressure over this period.

DOGE/USD

The DOGE community reeled up on a picture of Elon Musk on a governmental podium. While many claimed it may indicate that he may get a post when Donald Trump wins the election, others are looking at what it will mean for Dogecoin.

While those speculations hang in the air, active cryptocurrency users surged recently. With more users come more transitions that will impact prices and impact they did! The asset gained over 7% in the last three days.

The previous intraday session saw the coin gain over 3% as it edged close to retesting its fourteen-day high. However, it faced massive rejections at $0.107 and halted its advances at $0.11.

DOGE is printing a red candle as the bulls are exhausted as it failed to continue the three-day uptrend. Although it’s yet to register any significant price change, the asset is at risk of dropping as low as $0.10 if the decline continues.

Nonetheless, on-chain that a more than 19% drop in trading volume resulted in the latest price actions. The relative strength index also points to small increase in selling pressure as another culprit. MACD is relatively silent amidst the unfolding trend.

TRX/USD

Trondao is the latest big thing in the crypto space. The launch of the first memecoin Sunpump has gained much attention with more traders looking to get in on the trend. The token saw increased trading volume, which resulted in price increases.

The ecosystem is also inviting developers to build their memecoins on Tron. With the blockchain seeing more activity, the native token is seeing massive increases. It has gained over 15% since the start of the week.

Tuesday was the most bullish day for the asset, registering massive gains. It started trading at $0.14 on Tuesday and peaked at $0.16, the highest in over three years. The surge continued until the end of the day, gaining over 12%.

The previous day was one the most bearish this week. It retraced after peaking at $0.166 and closed with losses of over 5%. The relative strength index explains the reason for the drop. It surged above 70 on Monday and continued above it on Tuesday. The latest decline is in reaction to the asset being overbought.

TRX is printing a doji at the time of writing. It comes after it peaked at $0.16 but failed to sustain the uptrend. It soon retraced to a low of $0.148 but rebounded and is trading close to its opening price

The cryptocurrency’s inability to surge was due to the asset still being overbought. RSI is at 71 which may indicate further price decline in the coming hours. Nonetheless, the bulls must defend price above the 50% Fibonacci retracement level at $0.145.