BTC closes the week with notable losses following its failure to reclaim lost levels. It sank to its fourteen-day low as selling pressure spiked midweek.

The global cryptocurrency market cap significantly declined, retracing from $3.60 trillion to $3.20 trillion a few days ago. The bulls failed to respond with definitive uptrends to the massive selloffs, resulting in price remaining under critical levels.

Fears of the new US administration increased worries of pressure in the treasury market. The $28 trillion surged by 5%, causing a significant decline in global liquidity. The crypto market felt the impact as it thrives on constant liquidity influx.

The market also quivered on news of the US Department of Justice (DOJ) giving permission to sell roughly 69,370 Bitcoin that was seized from the Silk Road darknet marketplace, with a total value of the haul now estimated to be over $6.5 billion.

The US Senate Banking Committee is getting ready to create its first-ever subcommittee on cryptocurrency. FOX Business reports that Cynthia Lummis, a Republican senator from Wyoming, will be the subcommittee’s chair.

The week saw several major asset display notable volatility, let’s see how they performed.

BTC/USD

Exchange reserves slightly decreased over the last seven days. It is surprising as the apex coin saw massive selloffs on Wednesday. The latest reading suggests the bulls are buying buy. However, it remains the same over the last 24 hours.

Exchange netflow total are also negative as investors move assets off these trading platforms. The latest decline comes as miners halt selling. Nonetheless, investors are becoming increasingly active. Over the last 24 hours, transfer volume increased by 67%, active addresses surged 10%, and transactions added 30%.

The BTC/USD pair prints another doji following a similar price performance the previous day. CryptoQuant’s data suggests that trading sentiment remains the same. The Coinbase premium is negative as US traders show less buying pressure. The same reading is present in the Korea Premium, indicating weaker buying pressure from the region.

Indicators on the one-day chart trended flat following price actions in the last 48 hours. The relative strength index is 46 as the moving average convergence divergence continues downwards. MACD’s 12-day EMA is unaffected by the steady price trend.

ETH/USD

The ETH/USD pair may close Sunday within the same price levels it trended within in the last three days. It remains below the $3,200 barrier after several days of failing to break above it. Nonetheless, its onchain metric closely mimics BTC’s.

Exchange reserves slightly declined over the past seven days. However, the asset grapples with ongoing selling pressure that saw the reserves increase slightly in the last 24 hours. CryptoQuant points to South Korean traders as the reason for the ongoing dump. The Korea Premium is negative and displays higher selling pressure.

Nonetheless, indicators on the one-chart remain stable. MACD had a bearish divergence a few days ago, with the 12-day EMA and 26-day EMA continuing downwards. The relative strength index trends flat in reaction to unfolding trend.

It is worth noting that the largest altcoin currently trades above the 50% fib level. Prices may remain above this critical level due to the notable demand concentration around it.

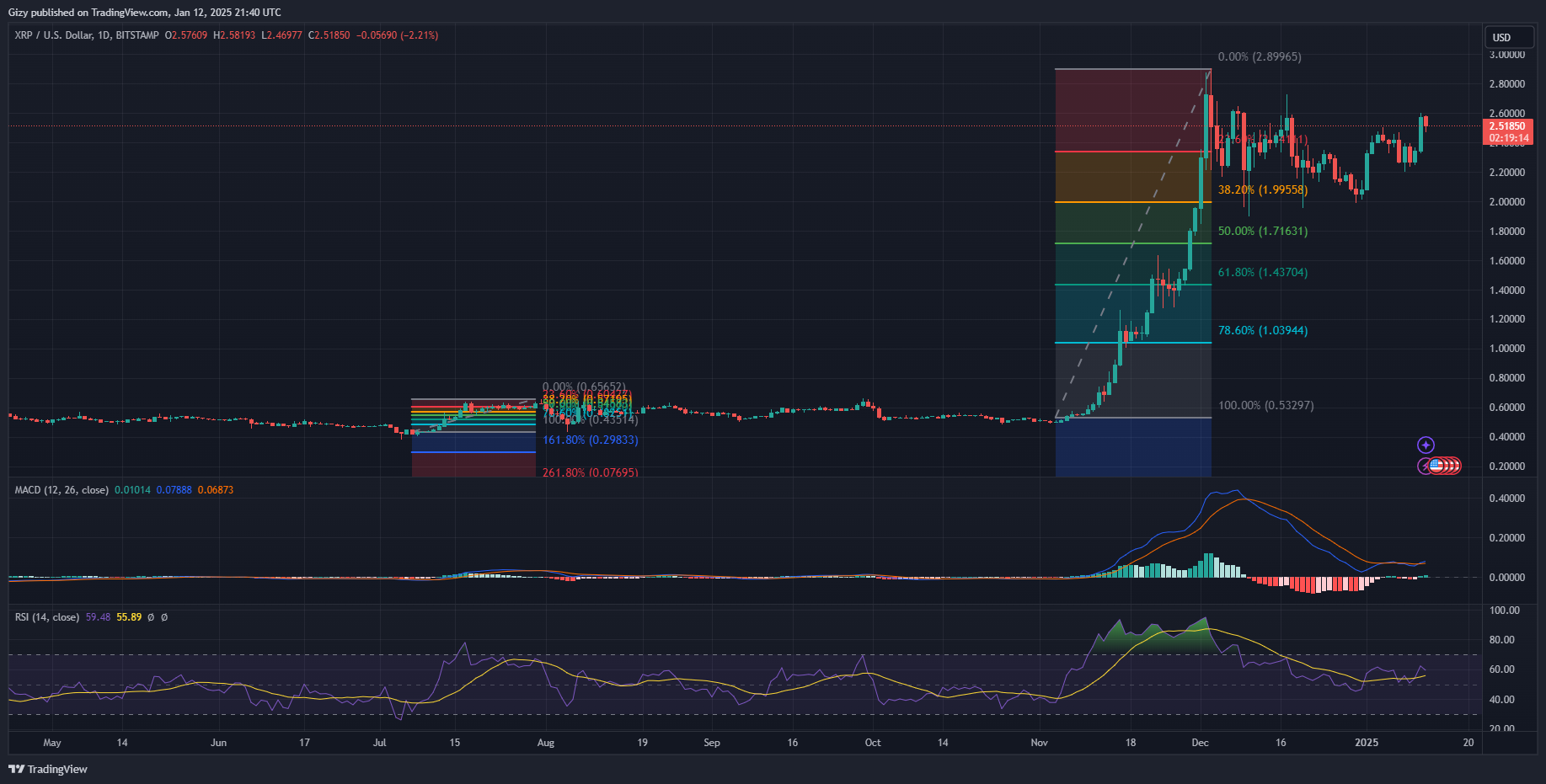

XRP/USD

XRP ‘s recovery slows after it faced massive rejection at $2.60 the previous day. It started Saturday at $2.34 but surged and closed after a slight decline. The altcoin gained almost 10% during the session but struggles to continue the uptick.

It retraced to a low of $2.46 a few hours ago as selling pressure peaked. Currently trading at $2.52, the XRP/USD pair is down by over 2%.

Nonetheless, indicators are positive amidst the ongoing trend. The moving average convergence divergence is showed a positive interception on Saturday as buying pressure increased. RSI surged in respond and remains close to 60.

SOL/USD

The SOL/USD sees a similar price movement as BTC, remaining within the some range over the last three days. It tested the $190 mark a few hours ago but failed to break it, printing yet another doji. The latest trend happened as trading volume declined.

Nonetheless, MACD remains bearish. A few days ago, it displayed a negative divergence as it grappled with massive selling pressure. The slight increase on Friday failed to change its trajectory. RSI is also indifferent to the green candles as it trend flat.

Solana trades close to the 61% fib level. The bulls must decisively flip the mark as it may guarantee a return to $200.

BNB/USD

The one-day chart reveal that BNB tried reclaiming the $700 barrier during the last 48 hours and had limited success. It briefly reclaimed the mark on Friday but retraced as it lost momentum. The same movement played out the next with the same result.

The bulls are unable to sustain another attempt as prices struggle to surge. Printing a red candle, it veers closer to the 38% fib level. Failure to keep the price at the current mark may send it below $280.

Nonetheless, MACD remains bearish. A few days ago, it displayed a negative divergence as it grappled with massive selling pressure. The slight increase on Friday failed to change its trajectory.

DOGE/USD

Dogecoin is down by almost 2%. The latest decline comes after a two-day increase that saw it test $0.35. Friday’s price action saw it gain nearly 4% as it reclaimed $0.34. The asset remains above the 38% fib level amidst its latest descent.

The moving average convergence divergence prints bearish signals at the time of writing. The slight increase on Friday failed to change its trajectory. Its 12-day EMA is in contact with the 26-day EMA as a bearish divergence may start in the next 24 hours.

The relative strength is on a downtrend in reaction to the ongoing selloffs.