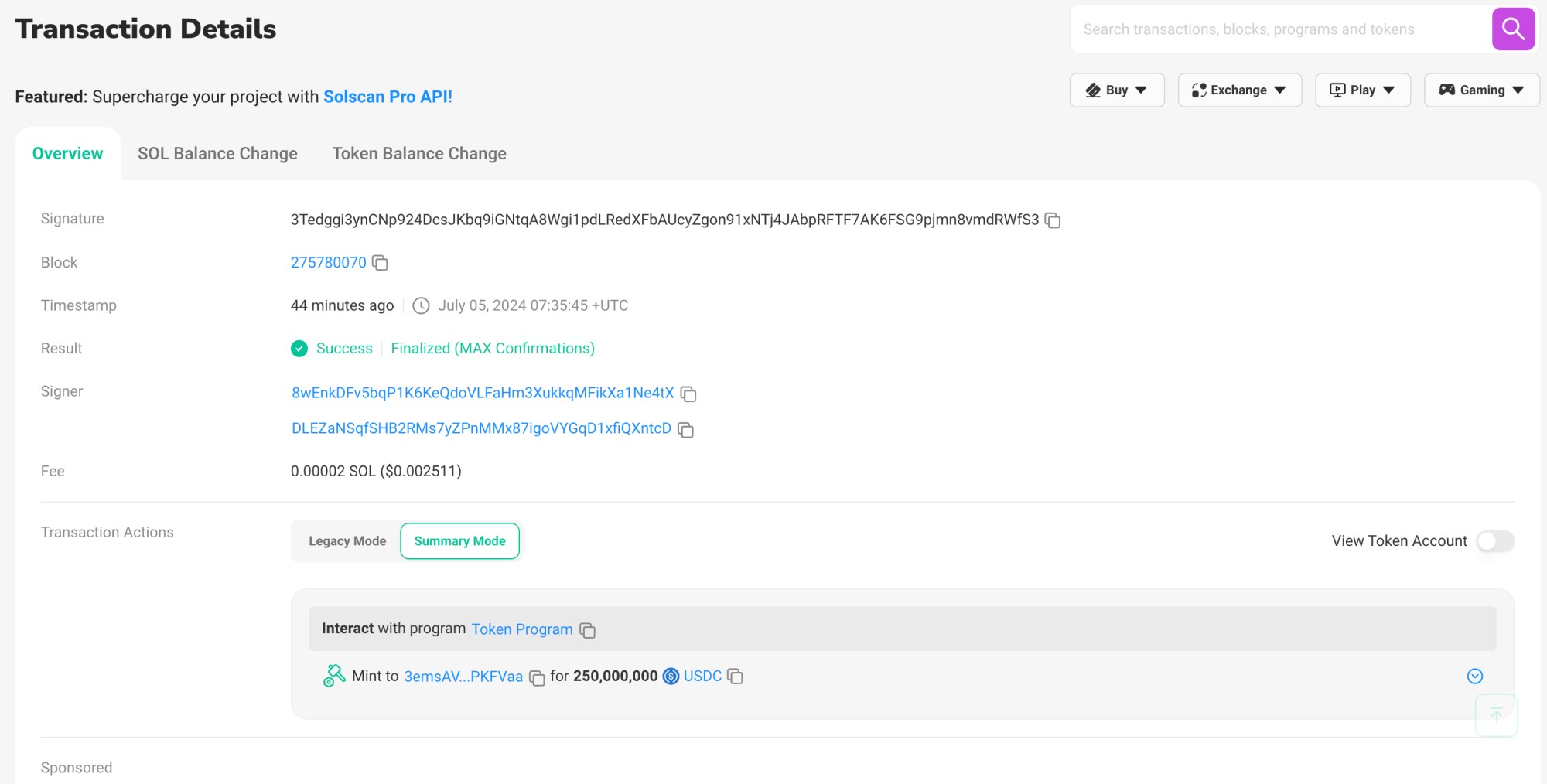

Stablecoin issuer Circle minted 250 million USDC tokens on the Solana network in the hour before press time. The latest development comes as the crypto market has struggled, with over 8% of the total market cap ($160 billion) wiped out in the past 24 hours alone.

The increase in a stablecoin’s supply is typically considered bullish for the cryptocurrency market, especially during tumultuous periods such as this week. Stablecoin issuers like Circle typically mint new coins in response to customer demand. Customers would usually have to deposit the USD equivalent of the tokens in a Circle-designated bank account to receive the stablecoins, which could be invested in the crypto market.

Meanwhile, the decision to mint USDC on Solana underscores the blockchain network’s growing dominance in the industry. As recently reported by CoinTab, Solana is the leading destination for USDC stablecoin transfer, with the total USD volume since January 2023 now approaching $8 trillion.

Stablecoin Supply Remains Relatively Stable Amid Market Drop

Beyond the recent increase in the USDC supply, the market dynamics around stablecoins hint that the latest happenings in the crypto market is not capital fleeing the market. In the past 24 hours, the USDT supply has remained large, as is often the case with broader market sell-offs.

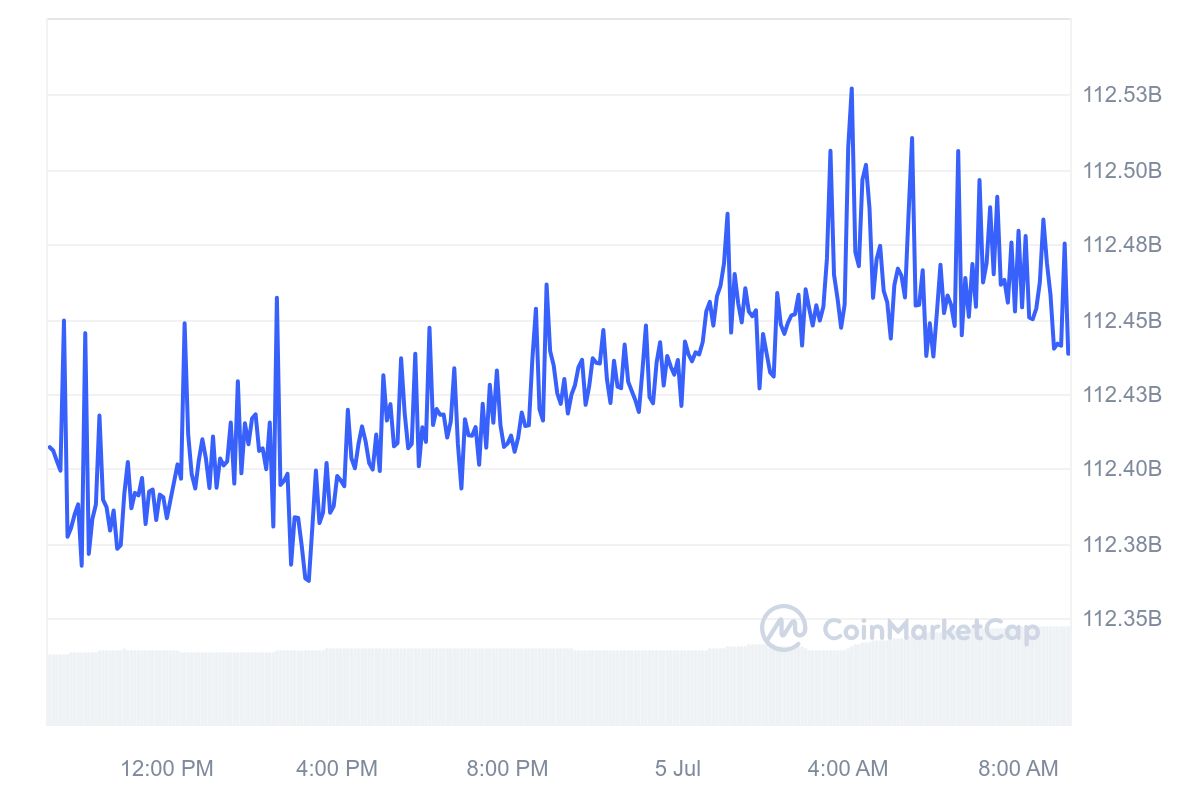

The chart below from CoinMarketCap shows that the circulating USDT supply grew by nearly $200 million before dropping by $80 million from its peak. During the period being considered, the stablecoin’s supply has grown rather than dropped, hinting that capital remains within the crypto market.

As mentioned earlier, the same can be said of Circle’s USDC, whose supply grew by $250 million. It remains to be seen whether relatively strong stablecoin metrics will provide a bedrock for the crypto market to bounce from its recent downturn.

In the meantime, the total crypto market cap is hovering above $2 trillion, its lowest value since February 2024. Bitcoin (BTC) remains finely poised at near $54,000, maintaining a year-to-date (YTD) return of 40%.