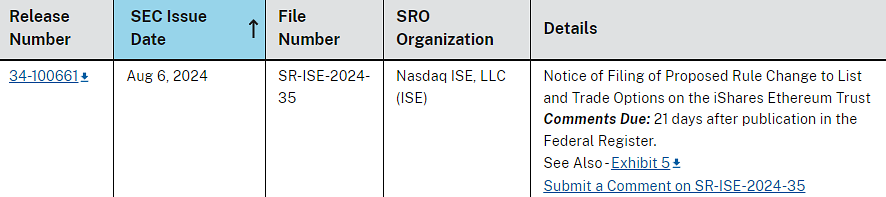

The world’s largest asset manager, BlackRock, has filed to create options for its freshly-listed spot Ethereum exchange-traded fund (ETF). In the Tuesday filing with the US Securities and Exchange Commission (SEC), the issuer intends to list and trade its iShares Ethereum Trust (with ticker ETHA) on Nasdaq.

“The Exchange believed that offering options on the Trust will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions,” the filing said.

First of Its Kind

BlackRock’s rule-changing filing is the first of its kind, and if the SEC approves the fund, it will be the first of its kind to be listed in the market. ETHA options would allow users to speculate on the asset’s movement and either buy or sell it at a pre-determined price for a specified period.

“The Shares are intended to constitute a simple means of making an investment similar to an investment in ether through the public securities market rather than by acquiring, holding, and trading ether directly on a peer-to-peer or other basis or via a digital asset platform,” the filing said.

Decision Likely in 2025: Analyst

Reacting to the filing, Bloomberg’s analyst James Seyffart has noted that the SEC will likely decide by April 9th, 2025.

“Nasdaq and BlackRock’s filing to add options on Ethereum ETFs has hit the SEC site. Final SEC decision on this from SEC likely to be around April 9th, 2025. (SEC is not the only decision maker on adding options here. Also need signoff from OCC & CFTC),” Seyffart tweeted on X.

The public has a 21-day period to comment on the filing.