Whales holding at least 1,000 bitcoins collectively purchased 19,760 BTC on Thursday alone.

Bitcoin bulls are not slowing down accumulation despite the dip, as data from IntoTheBlock shows that the asset’s whales bought a large chunk just a few hours before the halving event.

According to the data, Bitcoin whales holding at least 0.1% of the asset’s supply acquired 19,760 BTC on April 18. They collectively bought the dip at an average price of $62,500. On-chain data shows this is the largest whale Bitcoin accumulation since April 2.

It’s worth noting that such accumulations have historically heralded a market uptrend. A case in point is Bitcoin’s surge of over 10% following the last whale purchase on April 2, which saw it rise from a low of $65,500 to trade above $72,000 in just six days.

Accumulating Despite FUD

Bitcoin whales have continued to acquire the dip despite widespread speculation of an incoming dip after the halving event, set to happen between April 19th and 20th. This might suggest increased optimism among large Bitcoin holders that the halving would bring an uptrend in the asset’s price.

On Wednesday, financial giants JPMorgan and Deutsche Bank speculated that Bitcoin would dip after the halving, stating that the event is overbought. JPMorgan noted that Bitcoin’s price is still above its volatility-adjusted comparison with gold, set at $45,000, and its projected production cost at $42,000 after the halving.

The speculation is correlated with an analysis by PlanB, an X market professional who doesn’t see an uptrend for Bitcoin anytime soon. He noted that the asset would resume its bullish trajectory and double in value between six and ten months after the halving.

Bitcoin Bounces on Halving Day

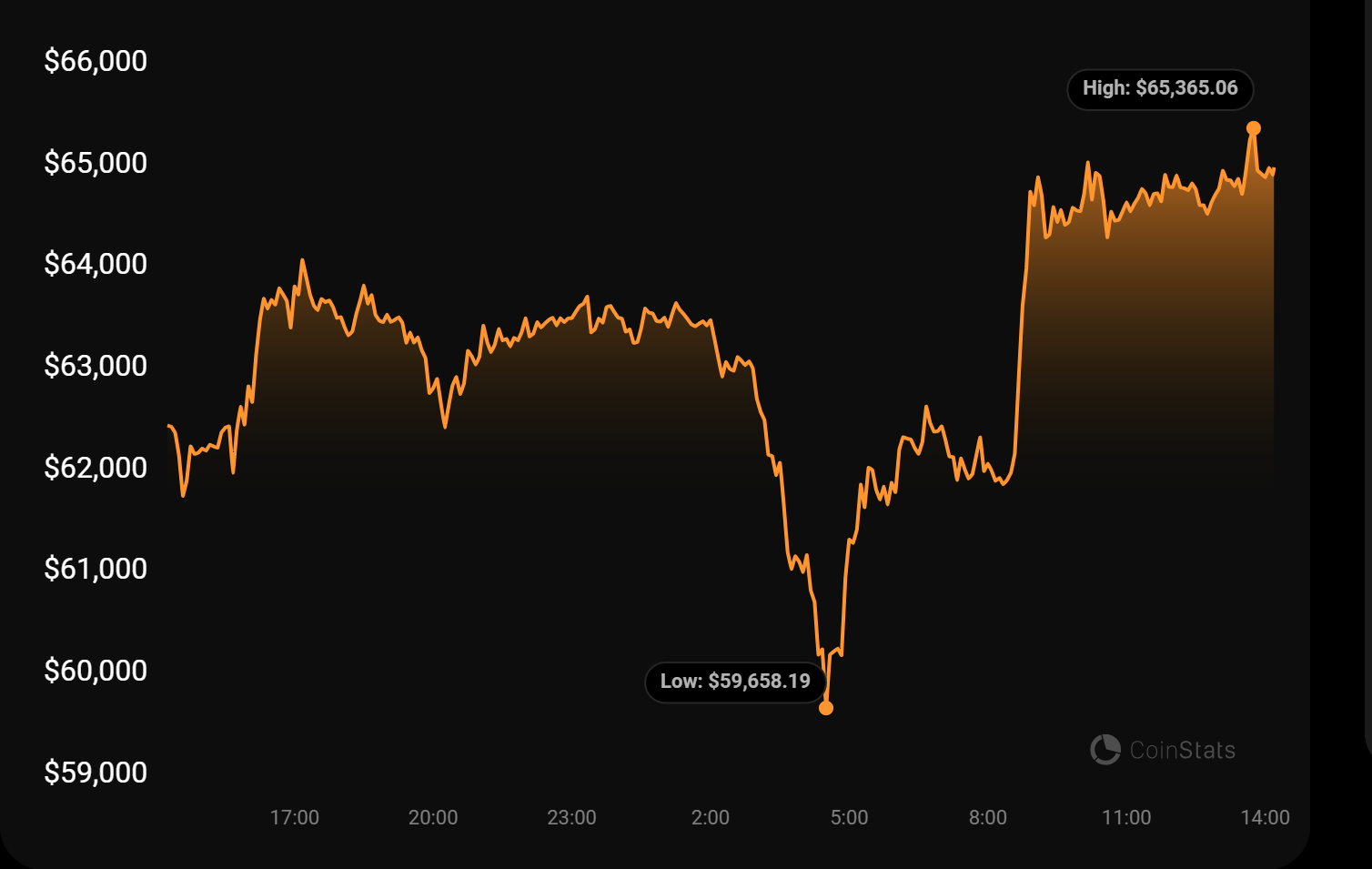

To the joy of the whales that accumulated Bitcoin on Thursday, the asset bounced from its support at $60,000 after the scares of a war break out between Iran and Israel subsided.

Bitcoin fell sharply from $63,470 in the early hours of Friday after Israel launched a counterattack on Iran, hitting as low as $59,658. The asset, however, bounced sharply and is trading at $65,000 at press time.