In the hours before press time, Bitcoin’s price surpassed $82,000, setting a new all-time high. This surge and the accompanying market euphoria have led many to conclude that Bitcoin is poised for new highs, including a possible surge to $150,000 within the next few months.

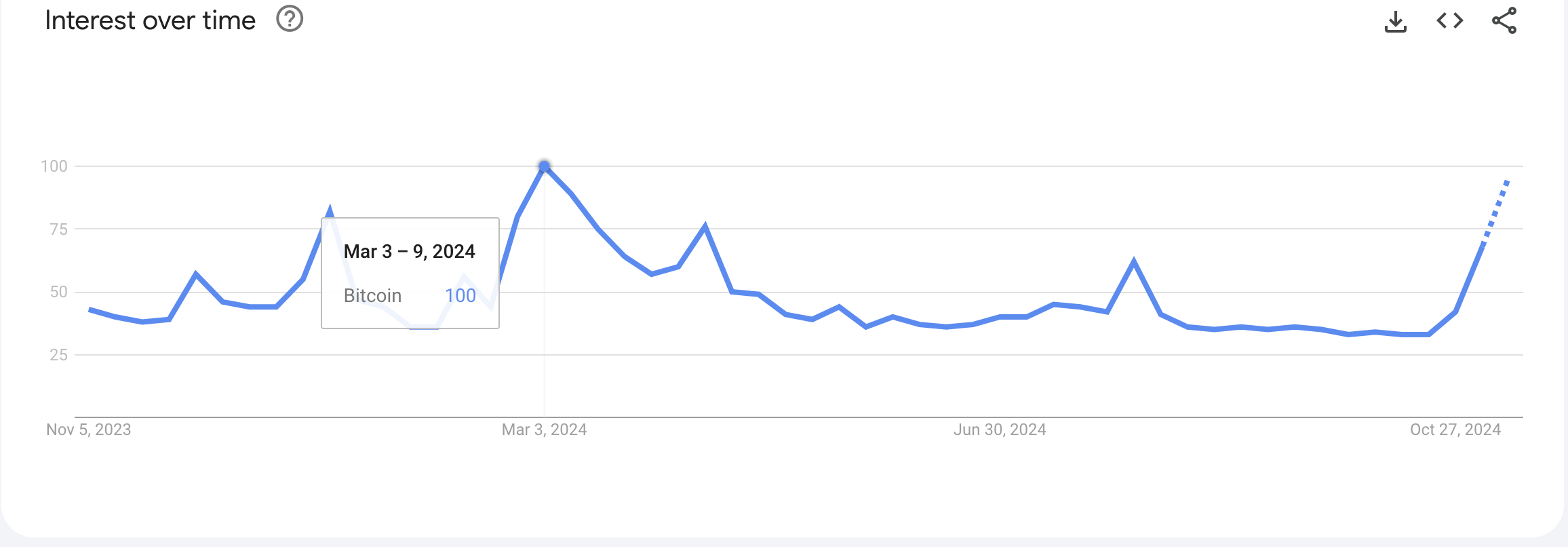

However, Google Trends data shows that retail interest in cryptocurrency has reached a crucial level. Precisely, the search volume for “Bitcoin” on Google is now in the same range as it was in March 2024. At the time, Bitcoin reached a new all-time high of around $73,000 before dropping as low as $53,000 in the months that followed.

Reaching the same level of interest seems to suggest that contrary to the earlier stage of the current market uptrend, more retail investors have started paying attention to Bitcoin. Their involvement could propel Bitcoin much higher but could also lead to a market correction as retail participants are more likely to exit their positions at the slightest indication of a downtrend.

Is This Bitcoin Uptrend Different?

It remains to be seen how the increased involvement of retail investors will shape Bitcoin’s price in the coming weeks. Nonetheless, some may argue that macroeconomic conditions in March and now are significantly different, and rightly so. Donald Trump’s victory in the United States Presidential election has largely inspired the latest BTC run. The Bitcoin-friendly president-elect is expected to support the creation of policies that favor Bitcoin and the rest of the cryptocurrency industry.

Additionally, the U.S. Federal Reserve recently lowered interest rates for the second time in two months, paving the way for more capital to flow into other assets. This marks a different macro environment to March when hiked rates and uncertainties about a potential rate cut hovered over the financial market.

Lastly, Bitcoin’s increase is linked to an influx of institutional involvement, a class of investors with more substantial capital and a long-term investment horizon. If institutional investment power prevails in the coming months, then perhaps the surge in retail investors may not be much of a concern as Bitcoin proponents eye a move to the six-digit range.