Bitcoin has been down by 4% since its halving. Following a successful halving, the asset is seeing a notable decline in trading volume. As a result, its trading volume is down by over 25% in the last 24 hours.

The decline in trading volume also means a decrease in investors’ interest as, for the first time since bitcoin ETF approval, BlackRock iShare Bitcoin Trust (IBIT) saw a $0 inflow on April 25.

Before the halving, there were speculations about the supply and demand of the apex coin. One source claimed that exchanges will run out of BTC in nine months. Other reports show traders expecting a massive demand shock. However, data shows miners plan to dump $5 billion worth of the largest cryptocurrency.

How will these affect bitcoin in 2024 and the coming years?

Bitcoin Price Prediction 2024

The apex coin is struggling to keep prices above $63k, losing momentum after a failed attempt at $67k. The most recent price is a surprise, as many expected more price increases following the halving. Nonetheless, indicators are hinting at further short-term declines.

The moving average convergence divergence underwent a bullish convergence a few days ago but halted as the bulls failed to sustain buying pressure. The 12-day EMA did not complete the interception and has continued its decline. The growing distance between both EMAs gives the bears an advantage.

The relative strength index is also in a downtrend and has slipped below 50. It is currently at 42, and if the downtrend continues, a possible return to 38 is plotted.

A few hours ago, BTC edged close to testing the 50% fib retracement at $61,905 as it dipped to a low of $62,405. Nonetheless, it tested the first pivot support and rebounded. Per the pivot point standard, the bulls must defend the S1 or risk a drop to S2(53,650).

They will look to build demand concentration around 61% fib at $59,217 in anticipation of a pullback. The chart drawing also points to possible drawbacks to $55k if the downtrend continues.

Nonetheless, when it resumes its uptrend, bitcoin will look to reclaim its pivot point at $68,131. This means the asset must gain stability above $67k to achieve this, as the bears have recently staged several selloffs around $67k. The Fibonacci retracement also points to a return of $73k once the bull cycle resumes.

How high will the apex coin go in 2024?

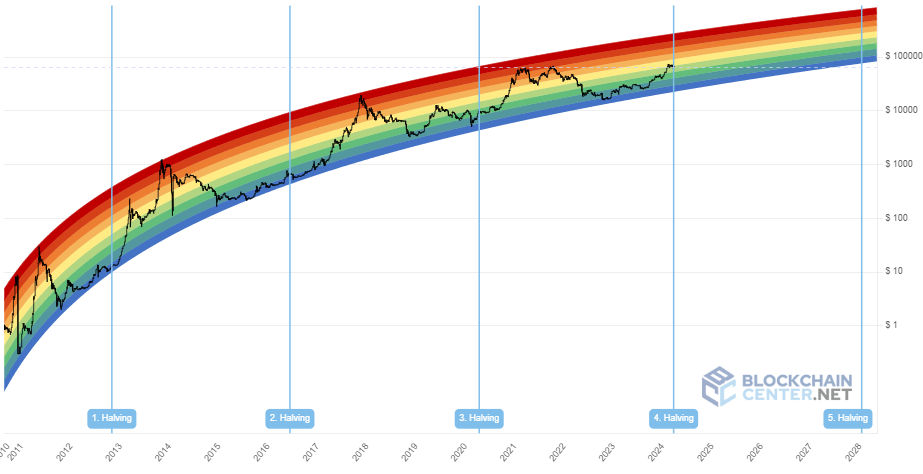

Bitcoin Rainbow Chart

The bitcoin rainbow chart points to further levels the apex coin will retest after the uptrend starts. Nonetheless, it is worth noting that the question of when the uptrend will restart is one only time will answer.

The chart above illustrates price action before and after each halving. A dominant trend after this significant move is the time it takes for BTC to resume its uptrend. Per previous movements, it takes between 4 and 8 months.

For example, in 2016, the event occurred in the sixth month. However, the coin failed to surge until the first month of the following year. Another case study is 2020. Following the halving in May, it took another four months to clock in the bull run.

If the same happens this time, BTC will start the next bull run between August and December. If the run starts early, the asset will look to reclaim the lost levels within the eighth month or earlier. Afterward, it will look to test $80k.

Per the rainbow chart, the apex coin is more likely to end the year between the yellow and orange regions. This means it will close the year with prices between $85k and $113k. Narrowing this down, the median figure for this prediction is $99k

Price Prediction 2025

Based on the rainbow chart, the following year after a halving is the peak of the bull run. This played out in the last two halvings. For example, after the 2016 event, the apex coin gained over 1300%. In 2021, BTC surged to a high of $69k but retraced and closed with gains of almost 60%.

It is also worth noting that there are no lined-up bullish or bearish fundamentals that could affect the price of the largest cryptocurrency in 2025. If the Russo-Ukraine war continues, this will be the fourth year since the invasion started. The crypto community has moved past this phase until fresh geopolitical escalation looms.

With this metric, 2025 will be one of the most bullish periods for the apex coin. It will surge to levels not seen.

Using the chart, it is worth noting that the cryptocurrency peaked within or close to the highest points in the rainbow chart on all bullish occasions after a halving. With this in mind, traders can expect the asset to gain stability at six figures.

Having closed 2024 at around $99k, the BTC will look to hold prices between $110k and $120k during the first quarter. During Q2, the coin will continue its rally and surge trend between $131k and $160k. Q3 will see the apex coin trend between $140k and $180k. Bitcoin could surge as high as $200k during the fourth quarter.

Price Prediction 2026

Based on previous actions on the rainbow chart, Bitcoin may end its bull run toward the end of 2025 and continue the bear market in 2026. This happened during the last two halvings. For example, BTC dropped from $1,206 in 2013 to $322 in 2014. A similar event took place in 2017. It dipped from $18k to $4k in 2018.

The most recent action from 2020 to 2022 also proves that the trend occurs. In 2021, it surged to a high of $69k but retraced to a low of $16k in 2022.

It is also important to note the margin of the declines. For example, in 2013, the apex coin lost almost 60%. In 2018, it was down by over 73%. In 2022, BTC lost 64%. On average, the coin loses 65% during this period.

With this in mind, traders should expect a similar drop. A close at around $200k will make the largest cryptocurrency return to five figures. It will drop to a low between $70k and $50k.

Price Prediction 2027

After one of its most significant declines in 2026, the coin will look to reclaim lost levels in 2027. This is based on previous trends. The market pattern indicates that the year leading to the next halving will be relatively calm with small uptrends.

This unfolded in 2019 when the apex coin surged from its low of $3,694 to a close at $7,168, gaining 94%. In 2023, BTC recovered from a low of $16,530 to a close at $42,258, representing a 155% increase. On average, the asset gains are over 124%.

This will mean that the largest cryptocurrency will return to six figures, putting the 2027 close at around $140k.