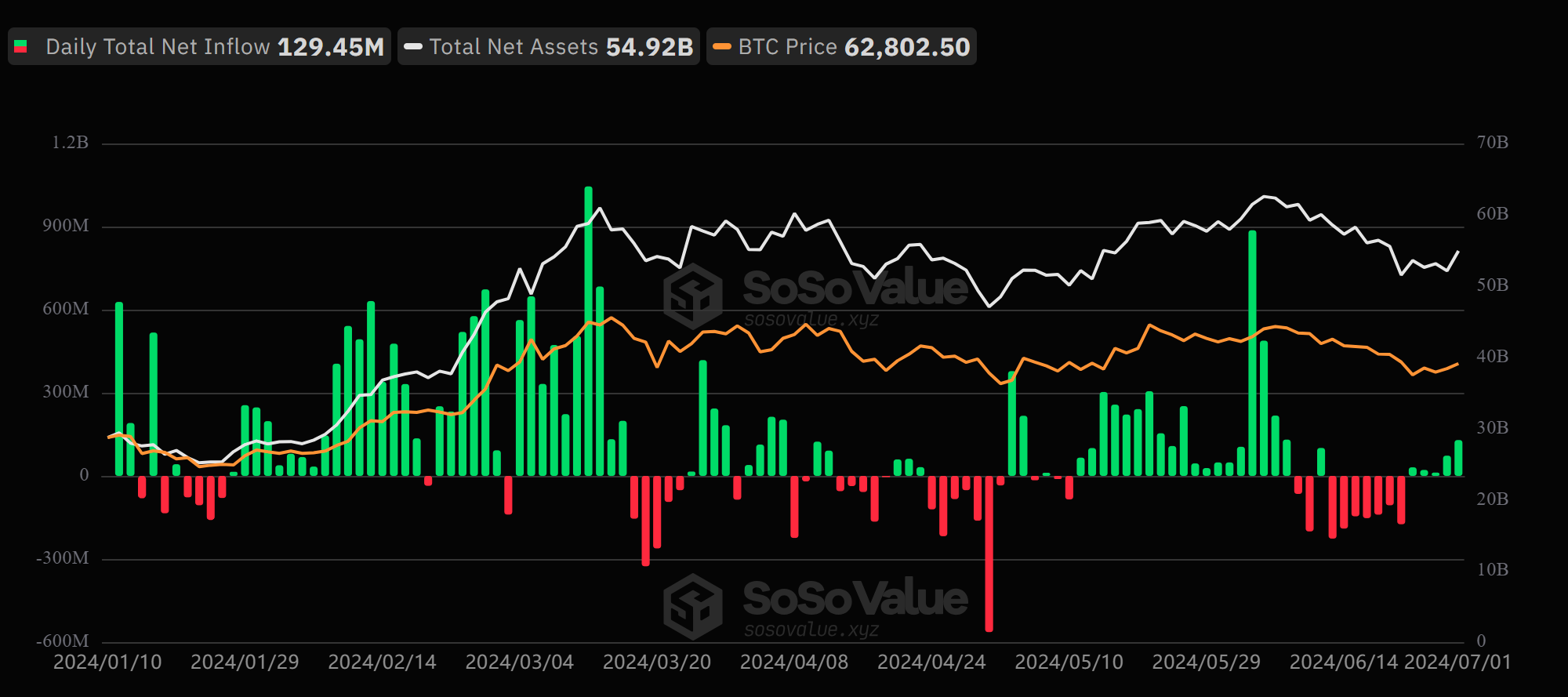

The US Spot Bitcoin exchange-traded fund (ETF) saw a single-day net inflow of $130 million on Monday, marking five consecutive trading days of positive flow.

Monday’s positive flow was also the largest single-day net inflow into the Bitcoin product in three weeks, with the last such inflow coming on June 7. Since June 25, the US ETF has seen a $267 million net inflow after a seven-day streak of net outflows.

Strong Start to July

The US ETF kicked off the month on a positive note and, in turn, impacted Bitcoin’s price. The largest crypto asset rose over 2% on Monday, reaching as high as $63,832.

Fidelity’s FBTC led inflow in the day, according to data from SosoValue, posting a single-day net inflow of $65 million. The fund accounted for half of all inflow on Monday, with the other ten issuers producing the other half.

Bitwise’s BITB recorded $41.4 million in inflows, taking its net asset under management (AUM) to $2.42 billion. The asset manager has been in fine form recently, having raked in the second-highest fund for the product in the past five days.

Ark Invest’s ARKB saw an impressive $12.65 million single-day inflow on Monday. VanEck’s HODL saw an influx of $5.37 million, while Invesco and Franklin Templeton saw inflows of $3.16 million and $1.84 million, respectively.

Grayscale, BlackRock, and Valkyrie saw zero flow on June 1. BlackRock has seen no inflow or outflow in six of the last seven trading days, as inflows seem to cool down from the leading Bitcoin ETF issuer.

The US ETF saw a trading volume of $1.36 billion on Monday. This positive flow brought the total net inflow of US ETF products to $14.65 billion.

Bitcoin traded at $62,787 at press time, with a 24-hour volume of $27 billion.