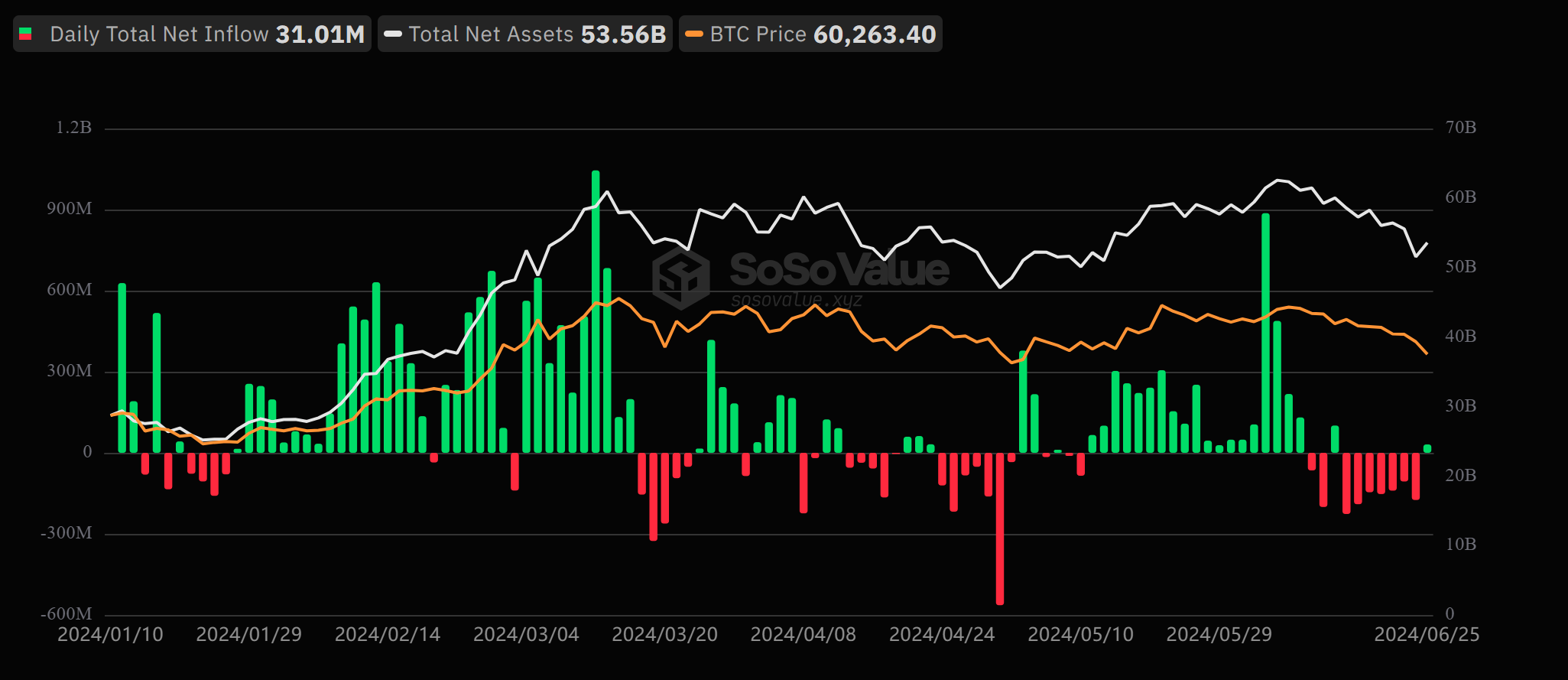

The US spot Bitcoin exchange-traded fund (ETF) saw a net inflow of $31 million on Tuesday, its first positive flow since June 12. The single-day net inflow broke the bitcoin product’s seven-day outflow streak, during which it lost $1.13 billion.

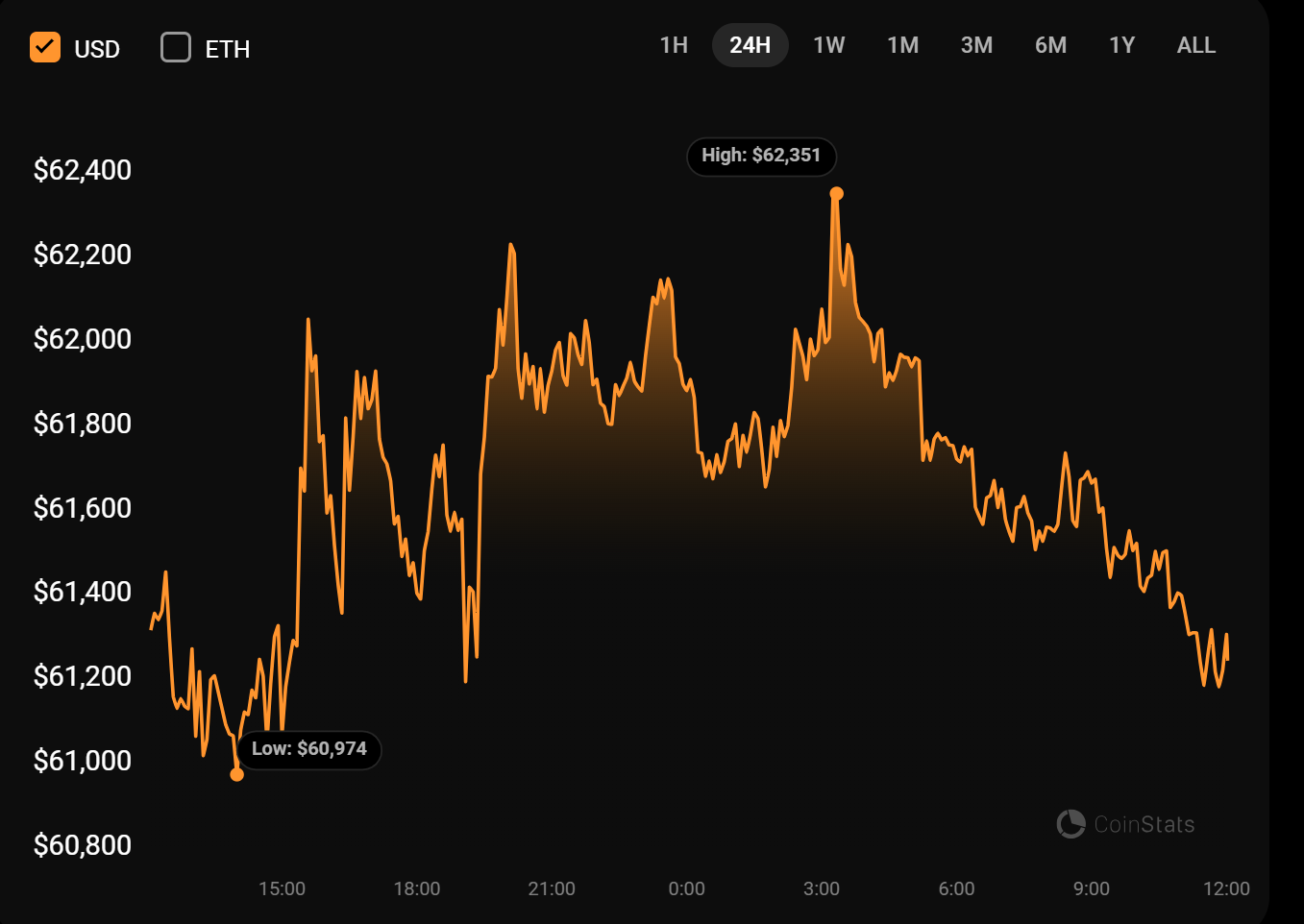

Bitcoin also rebounded over 2% on the day to trade above $61,000 after a market capitulation saw the asset drop to $58,5000 the previous day. After two successive days of downtrend, Bitcoin saw its first green candle on the daily timeframe.

Fidelity, Bitwise Save the Day

Chicago Board Options Exchange (CBOE) traded fund Fidelity led inflows on Tuesday, recording a $48.8 million single-day positive flow. This took its net asset under management to $10.39 billion.

Bitwise’s BITB saw a $15.2 million single-day inflow, breaking its lack of inflow on the fourth day of asking. VanEck’s HODL also saw a $4 million positive inflow, taking its cumulative net inflow to $518 million.

Surprisingly, BlackRock’s IBIT saw zero flows on June 25 but still boasts a cumulative net inflow of $18 billion. Grayscale’s GBTC and Ark Invest’s ARKB were the only funds with a net outflow on the day, seeing $30 million and $6 million outflows, respectively.

Notably, US ETFs have a cumulative total net inflow of $14.42 billion and hold Bitcoin worth $53.5 billion. After trading for just six months, the funds hold 4.39% of all Bitcoin in circulation.

Easing Selling Pressure

The crypto market saw significant selling pressure in the past few days as two significant holders started dumping their bags. Exchange Mt. Gox announced a major update in its ploy to repay its creditors, while the German government also resumed dumping its ceased Bitcoins.

This event saw Bitcoin capitulate to as low as $58,500 on June 24, a price last seen since June 2. However, the June 25 inflow could indicate that the selling pressure has subsided and the market is seeing new funds.

At press time, Bitcoin was trading at $61,207 with a market cap of $1.2 trillion.