Bitcoin had another significant drop a few hours ago. It halted its previous recovery, dipping to its lowest in the last seven days.

BTC peaked at $102,747 in the early hours of Thursday, sparking hopes of a complete turnaround. However, the bulls failed to sustain the uptrend, resulting in a trajectory reversal. The apex coin lost the $100k support for the second time this week.

Currently trading at $96k, the largest cryptocurrency rebounded from a low of $95,500. The market registered significant losses in response. Traders lost over $1 billion in the last 24 hours, with most of the liquidations happening in the last 4 hours.

Data from Coinglass shows that liquidation in the last four hours exceeded $540 million, with the bulls losing the most. REKT capital from long positions is over $471 million. Nonetheless, liquidation on the apex coin exceeds $248 million.

Why the Dip?

Bitcoin’s dip follows the wider trend in the US economy, with several stocks declining. Companies like Microsoft, Alphabet, Meta, Tesla, and Broadcom all shed notable value over the last 24 hours. The S&P 500 followed the same bearish trend.

The dip correlation suggests that the macroeconomy played a major role in the ongoing dip. The apex coin dipped to $100k, losing over 5% during the previous intraday session. This comes after Federal Reserve chairman Jerome Powell announced the outcome of the just-concluded FOMC meeting.

The chairperson announced a rate cut of 25 basis. Such news steers massive optimism in the market but failed to have the same effect this time. Many expected the cut to exceed 25 basis points; they expected a 30bps slash and were disappointed when it never happened.

Some analysts believe this change may reflect the fact that the US economy is not completely out of the danger zone. This assertion holds some truth, as the Feds announced possible inflation next year. The crypto market has since failed to recover.

Data from CryptocurrenciestoWatch shows a significant increase in trading volume over the last 24 hours. The 9% hike shows more trading actions on the asset. However, massive profit-taking is the reason for such change.

Data from CryptoQuant indicates that US traders are currently bearish and leading the selloff. This region has low buying pressure, as the Coinbase premium is negative. Asian traders join the selloff, with most dumping their assets. The funds premium is negative due to less inflows into ETFs and other products.

Will Bitcoin Surge?

It is worth noting that another reason for the ongoing decline is due to the impending festivities. It is no news the apex sees significant declines in December as traders take profit for the holidays.

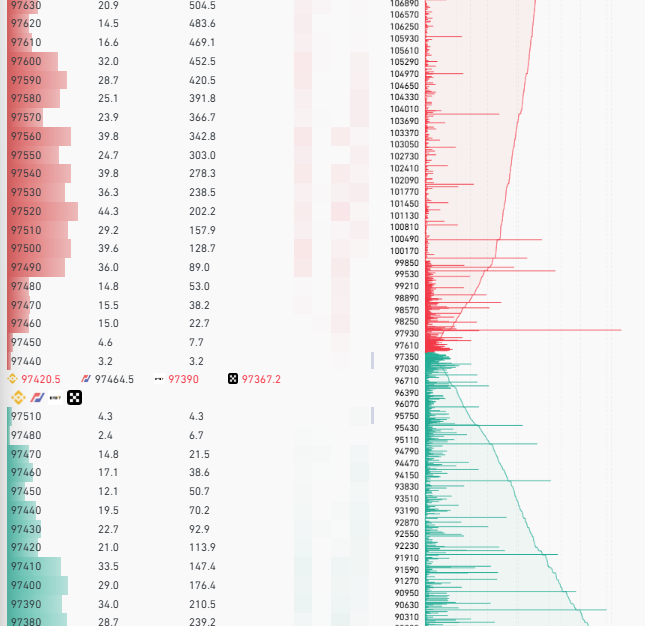

With this in mind, assertions of a surge to $110k remain bleak. Data from Coinglass shows the bears staging selling congestions at $100k. They also staged notable sells orders are $98k as seen in the chart above.

Previous price movements suggest that BTC’s latest dip sent it back to a channel from which it previously struggled to break out. The chart below shows that the asset traded between $95k and $102k for more than fifteen days before breaking the trend. A repeat of this movement will rule out any notable attempt at the highlighted barrier.

The one-day chart indicators point to a possible rebound. The relative strength index is at mid-level, currently at 48. This metric shows that BTC lacks the needed buying pressure. Nonetheless, the latest attempt at recovery shows the bulls gradually building momentum.