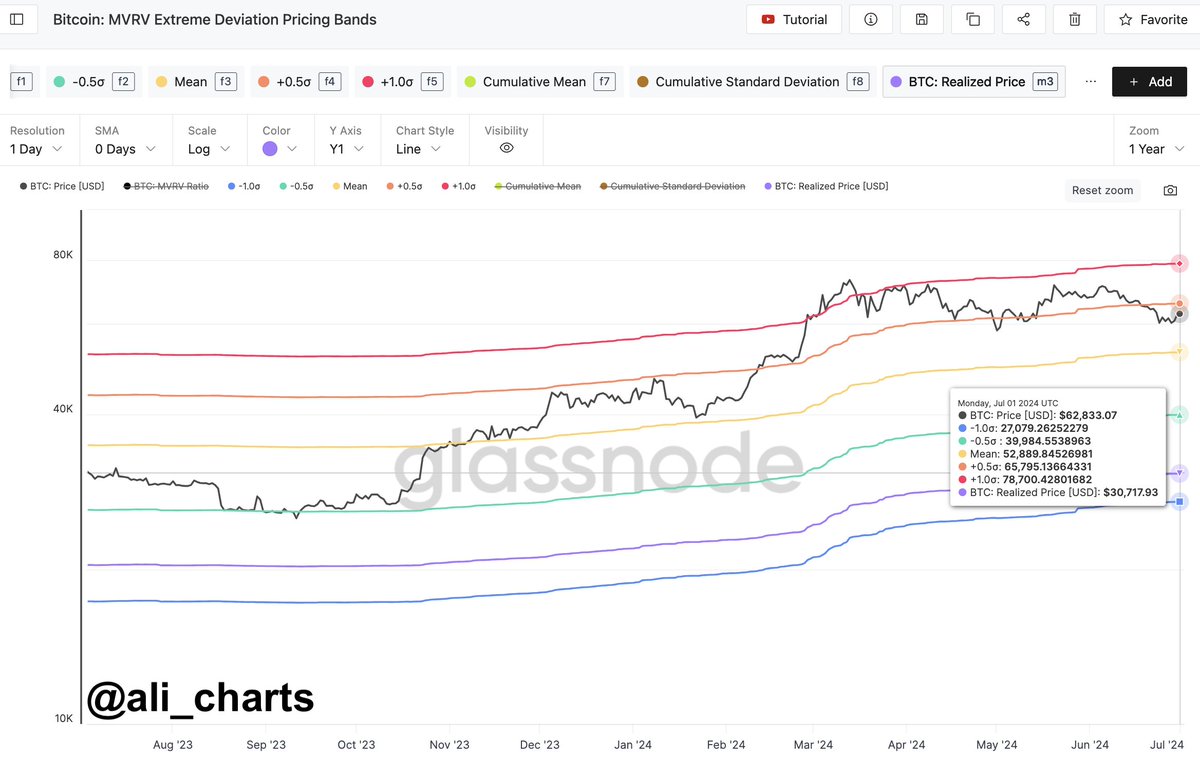

Bitcoin could soar as high as $78,700 if it breaks a key resistance level, experienced market analyst Ali Martinez recently shared. The latest analysis comes as Bitcoin tries to overcome a downtrend that pushed it below the $60,000 mark for the first time in several weeks.

Following the steep decline, Bitcoin has bounced back to nearly $62,000 in the past 24 hours and even hit a high of $63,800 within the same timeline. However, the $65,795 mark represents a major resistance BTC must overcome before reaching new highs.

The resistance level is determined by Bitcoin’s current MVRV (Market Value to Realized Value) and extreme deviation price band data available on Glassnode. This metric suggests that in the case of an extreme deviation and break above the $65,795 price range, Bitcoin could rise to $78,700, which would mark fresh highs for the cryptocurrency.

At the same time, a mean value of $52,889 suggests that this lower range could support Bitcoin if prices drop further in the coming weeks. However, historical performances and improved macroeconomic conditions indicate an uptrend for Bitcoin’s price, especially after an underwhelming June return.

Bitcoin ETFs Resume Inflow Streak

Beyond the earlier positive indicators, inflows and outflows into the U.S.-based spot Bitcoin ETFs have become a primary way to gauge investor sentiment toward BTC. These funds have posted net positive inflows in the past three days, defying an earlier period of massive outflows. A continuation of the current streak might just be what Bitcoin needs to break the key resistance level mentioned earlier and reach new highs.

Meanwhile, it is also worth noting in “reality check” that Bitcoin’s price still faces some headwinds. The German government’s continued selling of seized bitcoins has reportedly hindered price progression and may have a major impact if buying demand does not increase. There is also perceived negative news regarding the potential distribution of $9 billion in Bitcoin (BTC) and Bitcoin Cash (BCH) by the long-defunct exchange, Mt Gox.

Overall, bullish investors have significant work to do to get Bitcoin back on track to new highs. Nonetheless, market sentiment remains fairly balanced, with a Feer and Greed Index reading of 49 suggesting that things could move dominantly in either direction in the coming days.