The much-anticipated launch of exchange-traded funds (ETF) in Hong Kong on Tuesday failed to meet expectations, as the product underperformed on its first day.

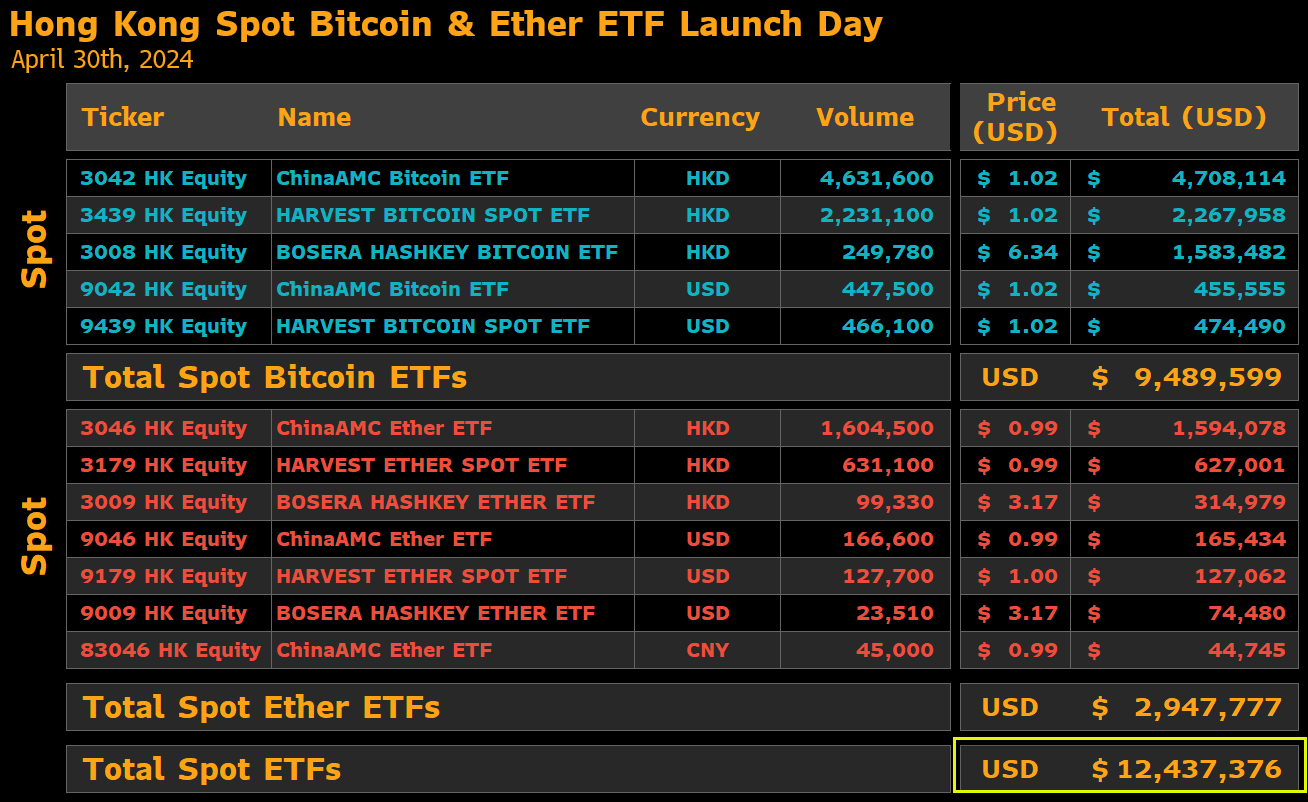

Against hype from Hong Kong’s local media of a trading volume of over $100 million, the ETF product only managed just above 10% of that. The total trading volume for Bitcoin ETFs amounted to $9.48 million, while Ether ETFs saw only $2.94 million in trading volume.

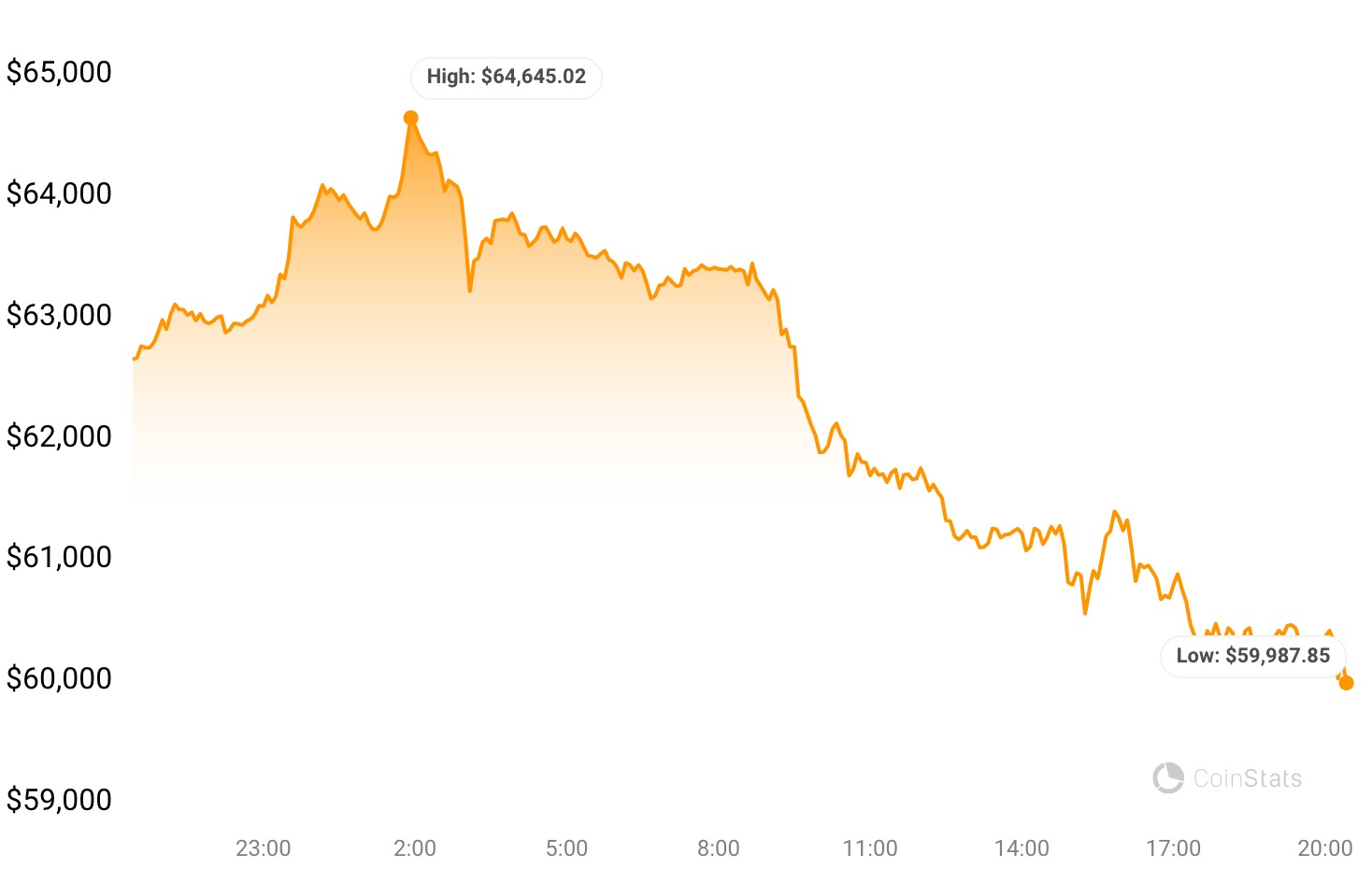

Following the event, Bitcoin slipped below $60,000, losing over 4% in less than an hour. The cryptocurrency continued its downtrend, trading at $59,987 at press time.

Totally Unforeseen

Hopes rose after Hong Kong announced it would debut an ETF product for Bitcoin and Ethereum. The crypto market expected the products to compete with the US ETF products, which were instantly successful after their January 11 launch.

The addition of an Ether ETF and dwindling inflow from US ETF had enthusiasts drooling for the 30th April market launch. However, the product’s performance was far from expectations, as all six ETFs managed just $12.4 million in trading volume, a stark contrast to the $655 million trading volume seen on day one of Bitcoin ETFs in the US.

ChinaAMC Bitcoin ETF showed dominance on the first day, accounting for more than 50% of the entire day’s volume. The product turned over $5,097,700 on its market debut.

The Harvest Bitcoin Spot ETF followed suit, producing $2,742,448, while Bosera Hashkey Bitcoin turned over $1,583,482 in trading volume.

The issuer’s Ether ETF products also saw a market distribution in that order, with ChinaAMC leading the race again. The ChinaAMC Ether ETF saw $1,804,257 in trading volume, the Harvest Ether Spot ETF produced $754,063, and the Bosera Hashkey Ether ETF turned in $389,459.

What Lies Ahead

This underwhelming debut raises questions about the potential growth and adoption of cryptocurrency ETFs in Hong Kong, highlighting the challenges of capturing investor interest in the region’s market. It’s worth noting that while Ether ETFs are permitted in the Hong Kong market, regulators in the Chinese territory do not share the same concerns about Ether being classified as a security, unlike their counterparts in the US. As a result, the regulatory landscape plays a significant role in shaping investor behavior and market dynamics.

Despite the subdued debut, there remains optimism for the long-term potential of cryptocurrency ETFs in Hong Kong. With continued regulatory clarity and growing investor interest, there is hope for increased participation and trading activity in the future.

One notable feature of Hong Kong ETFs is the adoption of an in-kind subscription and redemption mechanism, distinguishing them from their US counterparts. This mechanism allows for swapping underlying assets for fund units and vice versa, enhancing the appeal of these products to investors.