Bitcoin’s recent rally has seen most addresses holding the asset become profitable. Data published by IntoTheBlock on Monday showed that about 93% of Bitcoin holders are in profit.

This increased profitability percentage among Bitcoin addresses coincided with the asset’s price uptick. Bitcoin traded above $67,000 on Monday, continuing the bullish momentum seen the day before. The asset had a weekly closing above $68,000 and is now up over 20% from its $53,400 lows earlier in the month.

The number of Bitcoin addresses in profit reached 96% on Sunday after the asset briefly traded above $68,000. Bitcoin saw a 2% increment on June 21 after reports that incumbent President Joe Biden would not be going for reelection in November.

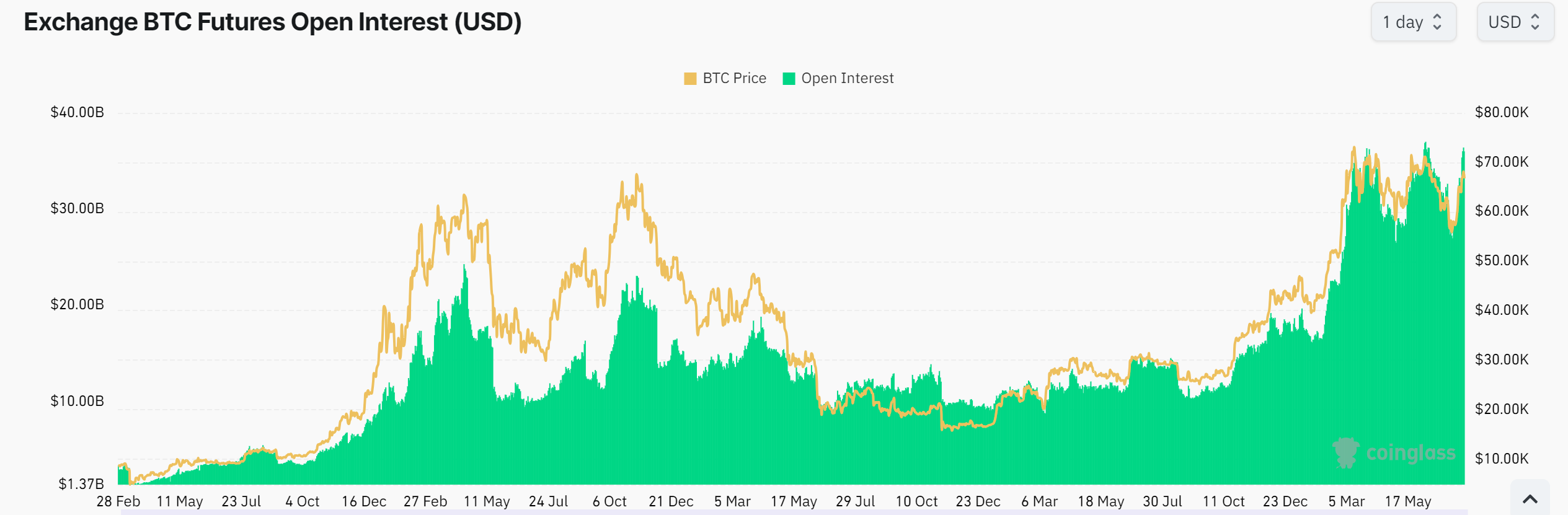

Open Interest Nears New ATH

Data from CoinGlass shows that open interest among crypto traders is nearing its all-time high, with bulls in the driving seat. At press time, the market had an unrealized profit of $67.9 billion, with 24-hour trading volume up over 72% to $153 billion.

Bitcoin traders account for over 50% of the open interest, seeing almost $36 billion in gains. The largest crypto asset has been in fine form recently, growing over 12% the previous week. Data shows that the highest Bitcoin futures open interest is $36.87 billion, seen on June 6.

Analysts Expect More Price Uptick

A Monday report by Bernstein showed that the analyst expects a further price uptick, particularly as pro-Bitcoin Republican candidate Donald Trump’s odds of victory in the November election continue to increase. The analyst noted that the crypto market has not yet priced in a potential positive shift in the regulatory environment if Trump is elected president.

Standard Chartered has already predicted that Bitcoin will hit $150,000 if Trump wins the election in November. The crypto market expects some fireworks on July 27 as Trump is scheduled to speak at the Bitcoin 2024 conference in Nashville.