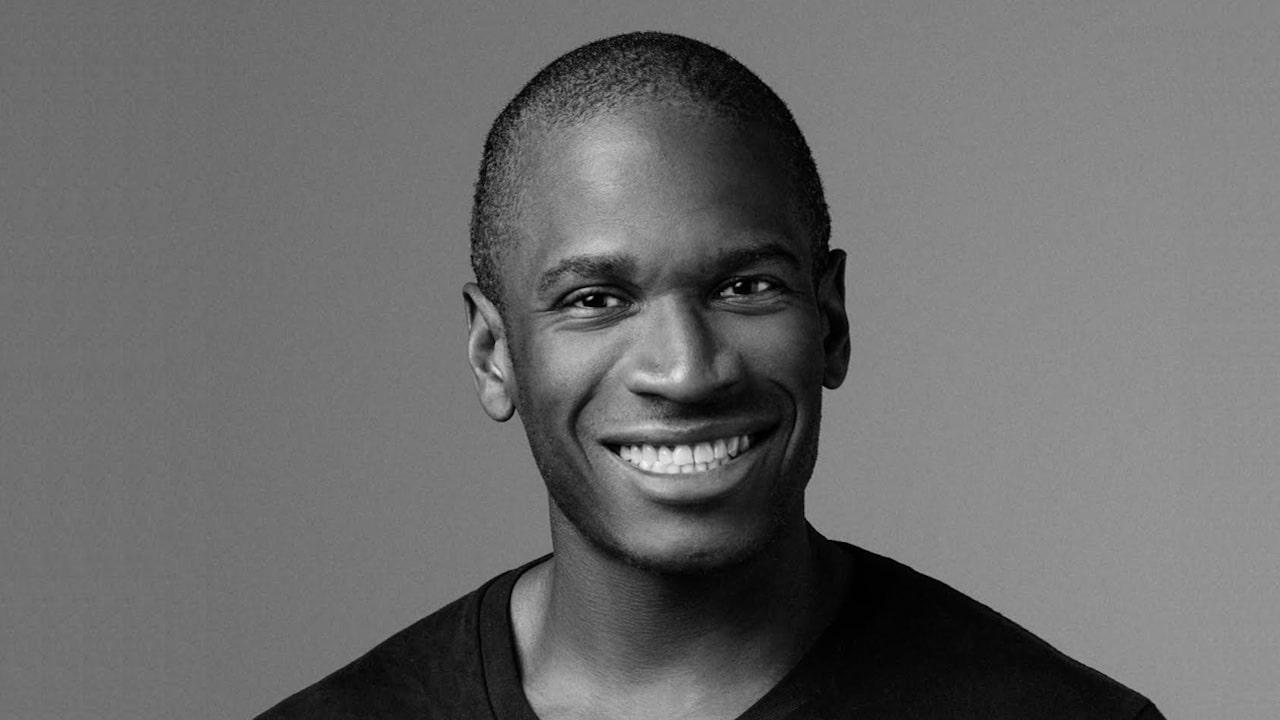

Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange Bitmex, has expressed his support for tariffs, suggesting that they can help fuel the Bitcoin rally despite causing a global economic eruption.

Some of y’all are running scurred, but I LOVE TARIFFS, some chart porn to understand why.

Global imbalances will be corrected, and the pain papered over with printed money, which is good for $BTC. pic.twitter.com/jc5eZ2VIEa

— Arthur Hayes (@CryptoHayes) April 4, 2025

His comments come just a day after it was announced that Donald Trump’s administration would impose a 10% tariff on all countries starting April 5. Some countries will face even larger rates, such as China, which will face a 34% tariff, the European Union, 20%, and Japan, 24%. These aggressive trade measures led to a nearly $2 trillion wipeout in the United States market.

Hayes Highlights the Positive Impacts of U.S Tariffs

Despite the increased market turbulence, Hayes explained that tariffs positively impact Bitcoin’s value for several reasons. He noted that the weakening U.S. dollar, driven by foreign investors selling U.S. tech stocks, is also favourable for the largest crypto asset and gold.

He then stated that Chinese investors may play a role in Bitcoin’s future price action. Hayes especially highlighted that a 65% effective tariff placed on China might lead the country to allow its currency, the yuan (CNY), to weaken past 8.00 against the dollar. This devaluation could push Chinese investors toward Bitcoin as they will likely seek to preserve their wealth.

Additionally, he called for easing measures from the Federal Reserve, predicting that the market anticipates interest rate cuts and potential quantitative easing (QE) to counter negative economic impacts from the tariffs. Suggesting that a weak yen policy could lead to significant movements in the USD/JPY exchange rate, Hayes highlighted the need for increased liquidity from the Bank of Japan. He urged investors to remain patient and nimble despite the current market condition.

Bitcoin Outlook

Bitcoin has struggled in recent months despite reaching all-time highs above $100,000 earlier this year. Despite the sluggish performance, institutional interest in the asset continues to grow. The cryptocurrency trades at $83,105, representing a 0.23% decline in the last 24 hours.

While Bitcoin’s price has been holding firmly above the $83,000 support, on-chain data highlights a potential shift in the market. According to crypto analyst Ali Martinez, long-term holders transferred more than 1,058 BTC on Wednesday, indicating signs of profit-taking by long-term investors.