BitMEX co-founder Arthur Hayes has thrown in his thoughts on the possible reason behind the recent Bitcoin crash, as the market saw one of its worst few days in history. In a tweet on Monday, the crypto veteran linked the market capitulation to selling pressure from a whale in trouble.

“My TradeFi birdies are telling me somebody big got smoked and is dumping all crypto. No idea if this is true, I won’t name names, but let the fam know if you are hearing the same?????,” Hayes said in the tweet.

A Possibility

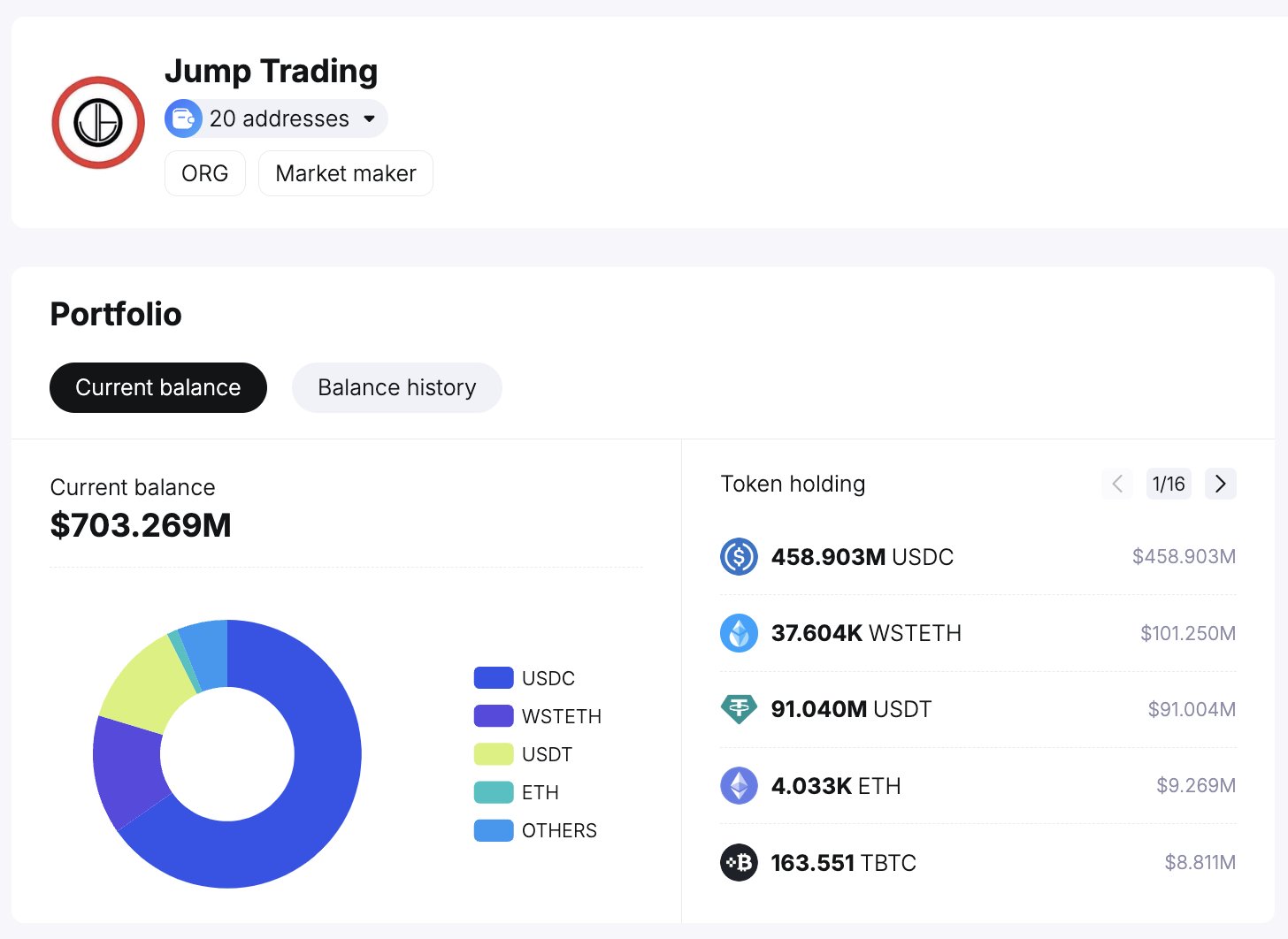

Hayes’ speculations might be correct, considering an increased Ethereum liquidation from the US-based trading firm Jump Trading. The firm has transferred Ethereum worth $238 million to exchanges in the past week.

Jump Trading converted $410 million worth of wstETH to ETH on Sunday and moved them to Binance and OKX. Data from Spotonchain showed the firm had transferred 17,576 ETH ($46.75 million) to exchanges in the past 24 hours, spiking intense volatility in the Ethereum price.

Notably, the US-based trading platform still holds 37,600 wstETH ($101 million) and 11,500 SETH ($26.3 million). Jump Trading is also rumored to be in the process of unstaking Lido Finance, the highest holder of staked Ethereum.

Over $1B in Crypto Liquidation

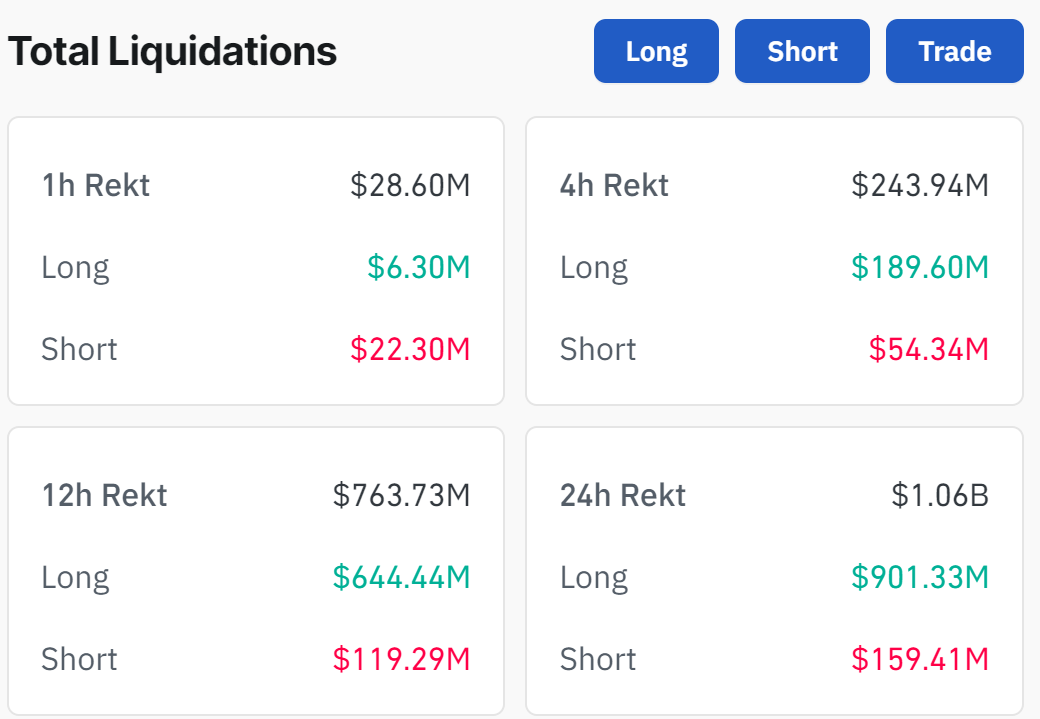

The recent selling pressure from Jump Trading and other unfavorable macroeconomics has pushed BTC and ETH prices down 13% and 19.55%, respectively. Data from Coinglass shows that the price capitulation has seen over $1 billion in leveraged traders liquidated in the past 24 hours.

Bitcoin led the liquidation crunch, with over $359 million of traders’ assets liquidated in the past 24 hours. Bull traders lost $301 million, while short traders lost $58.4 million. Ethereum keenly contested topping Bitcoin’s liquidation heatmap, as about $344.8 million worth of opening futures trades were rekt. $297 million of the total funds liquidated were from long traders, while $47 million was from short traders.

Solana also saw a notable amount of trader liquidation, with about $59.19 million in leveraged positions liquidated in the past 24 hours. The highest singular liquidation was seen from a Huobi trader, who lost $27 million trading BTC/USD on the platform.

At press time, Bitcoin had regained $50,000 and traded at $52,789, while Ethereum was trending at $2,358. Solana exchanged hands for $123 and has returned to 5th in the crypto ranking by market cap.