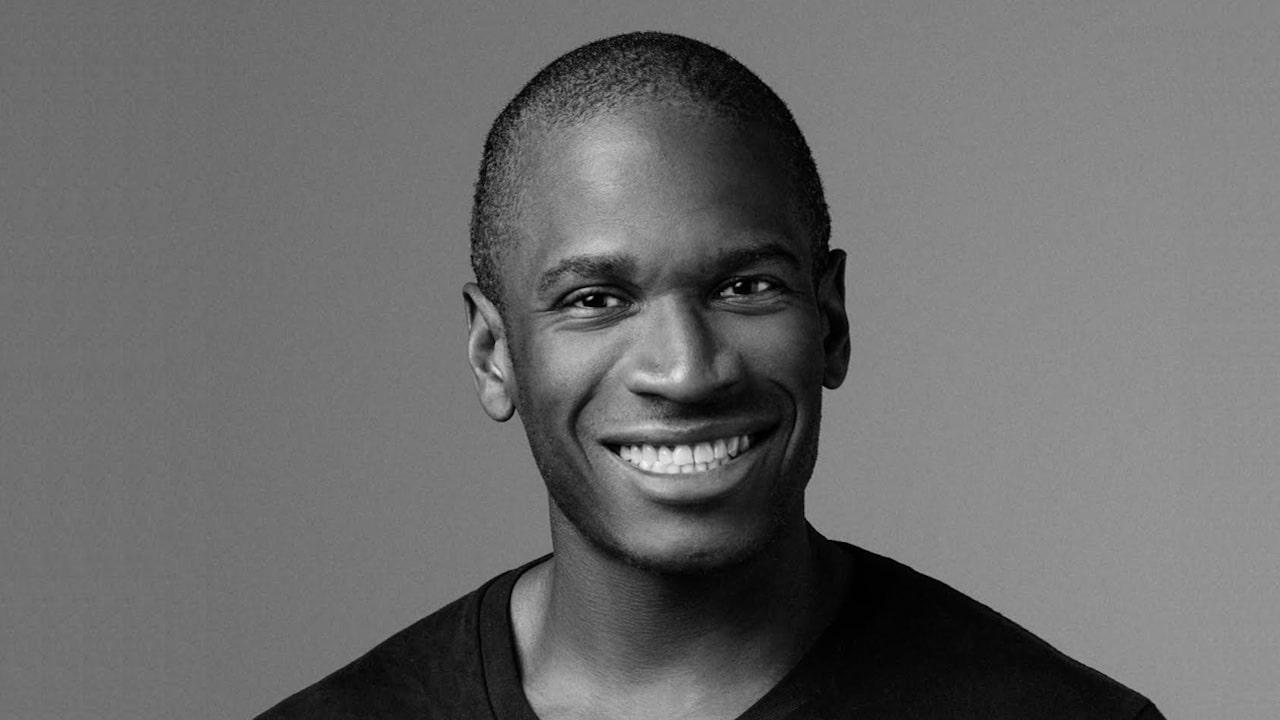

Arthur Hayes, co-founder of the BitMEX exchange, recently suggested that Bitcoin (BTC) is poised to benefit from what he terms the “Volatility Supercycle.”

He believes that ongoing quantitative easing (QE) measures by various governments – essentially the practice of injecting new money into the economy to stimulate growth – could create favorable conditions for Bitcoin and the broader crypto market.

"Volatility Supercycle" is an essay exploring my track record of predictions and why it doesn't matter as long as the elites continue suppressing the volatility of markets using printed money.https://t.co/AUg0nGTD6j pic.twitter.com/AdT1UmVsAs

— Arthur Hayes (@CryptoHayes) September 26, 2024

Hayes outlined his perspective on the potential for market participants to respond to an expected surge in Bitcoin prices influenced by these economic strategies, highlighting Bitcoin’s role in the evolving financial landscape.

The “Volatility Supercycle”

In a recent blog post titled “Volatility Supercycle,” Hayes argued that global governments’ decisions to inject more fiat currency into their economies to curb volatility will ultimately boost Bitcoin.

He explained that the newly printed money needs to be channeled somewhere, and he believes a significant portion will end up in Bitcoin and other cryptocurrencies. Hayes highlighted Bitcoin as a unique hedge against the spending practices of the ruling class in today’s digital era.

His remarks respond to recent economic decisions, including the United States Federal Reserve’s rate cuts and China’s stimulus plan to stabilize its markets. Pan Gongsheng, Governor of the People’s Bank of China (PBoC), announced rate reductions for reserve ratio requirements and short-term interest rates, along with plans to inject liquidity into the stock market to support the economy.

A Bullish Outlook for BTC?

According to Hayes, these QE initiatives provide a bullish outlook for Bitcoin, as some of the excess liquidity will inevitably flow into the digital asset, driving its price higher. He emphasized that the primary aim for investors, traders, and speculators should be to secure Bitcoin at the lowest possible cost.

Hayes outlined different strategies to achieve this, including being paid in Bitcoin, participating in mining activities, or utilizing low-interest fiat loans to purchase BTC. However, he advised against leveraging debt to acquire Bitcoin, stressing that the strategy is built on long-term holding rather than short-term gains.

He also cautioned that the real danger in this approach emerges when authorities lose control over volatility, allowing it to spike to its natural state. According to Hayes, this could lead to a broader financial system collapse. While he expects Bitcoin to drop in value during such a crisis, he noted that its decline will likely be less severe compared to traditional assets.