As the victory of President Donald Trump in the 2024 U.S. presidential election resonates within the crypto community, Senator Cynthia Lummis has reaffirmed plans to create a strategic Bitcoin reserve.

Known as the “Bitcoin Bill”, the proposal aims to have the U.S. purchase 1 million BTC over five years, which is about 5% of the asset’s total supply.

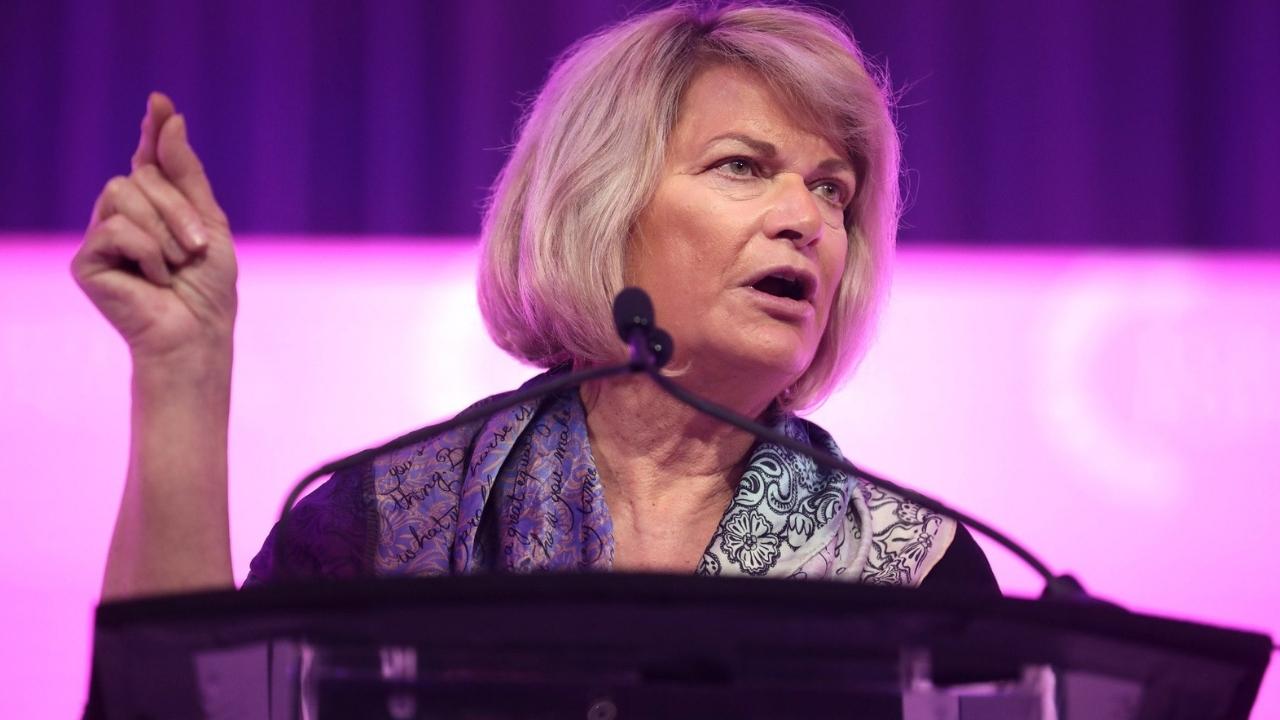

Senator Lummis Advocates for Strategic Bitcoin Reserve

Known for her support of cryptocurrencies, the Senator initially revealed this plan at the July Bitcoin 2024 conference in Nashville. Lummis emphasized the importance of accumulating the crypto asset to strengthen the U.S. dollar and address the rising national debt.

Then, Trump, who has positioned himself as a strong advocate for cryptocurrencies, also announced his intention to stop selling Bitcoin held by the U.S. government. Instead, he would use the asset strategically to hedge against the dollar’s devaluation signaling a significant shift in the country’s economic policy.

Historically, the U.S. has relied heavily on gold reserves to stabilize and strengthen the dollar. If passed, this initiative would reinforce the country’s influence in the digital asset space and set a precedent for integrating Bitcoin into national reserves.

In operational terms, the U.S. Department of Treasury could manage this reserve, similar to how it handles gold.

Bitcoin reached a new all-time high of $75,358 following Trump’s victory in the presidential election, reinforcing optimism about a crypto-friendly government.

Moreover, the Republican party has majorities in both the Senate and House of Representatives, thereby improving the bill’s chances of passage. However, this proposal has been met with both praise and scepticism.

Proposal Might Face Challenges

It is worth mentioning that even with Trump’s crypto-friendly stance, implementing this initiative might face notable challenges as some members of the Senate and House would likely scrutinize the risk of adding such a volatile asset to the national balance sheet.

If this bill gets enacted and Trump follows through on his crypto promises, the U.S. could become the first major world power to recognize Bitcoin as a national reserve asset.