Sui may close the day with gains exceeding 10%. The margin of the price change also places as the top gainer in the top 100.

The coin started the day at $1.77 but surged as it has a massive increase in buying volume. Coinmarketcap points to a more than 80% increase in trading volume as the catalyst for the latest price surges. Nonetheless, it broke above the $2 barrier and peaked at $2.10. The uptrend ended at this mark as the asset retraced.

Currently trading at $2, SUI is up by over 15% and may maintain this margin until the day ends. The latest increase comes barely a day after the massive decline during the previous intraday session. It dipped to a low of $1.60 but rebounded and closed at its opening price.

Why did SUI Surge?

Sui saw a significant addition to its ecosystem. The creators of the Telegram-based game MemeFi have revealed a major change to their token launch strategy: they will now use the Sui layer-1 network instead of the Ethereum layer-2 network Linea. The decision comes a few weeks before the expected token launch, which is set for November 12 and will feature a player airdrop.

Previously, MemeFi, a well-known tap-to-earn fighting game on Telegram, intended to introduce its token on Linea. To improve their launch plan and marketing initiatives, the team said they are working with Mysten Labs, the company that developed the Sui network.

Aside from the latest addition, crypto firm Transak announced a 300% increase in transaction volume in Sui wallet for September alone. The massive increase shows an increased investors’ interest in the asset since the third quarter.

It is also worth noting that the asset is moving as the rest of the crypto market. It benefits from the extra boost the market gets from the upcoming polls. While bulls go on a rampage on other assets, SUI buyers are waking up after almost two weeks of slumber.

How Indicators are Reacting

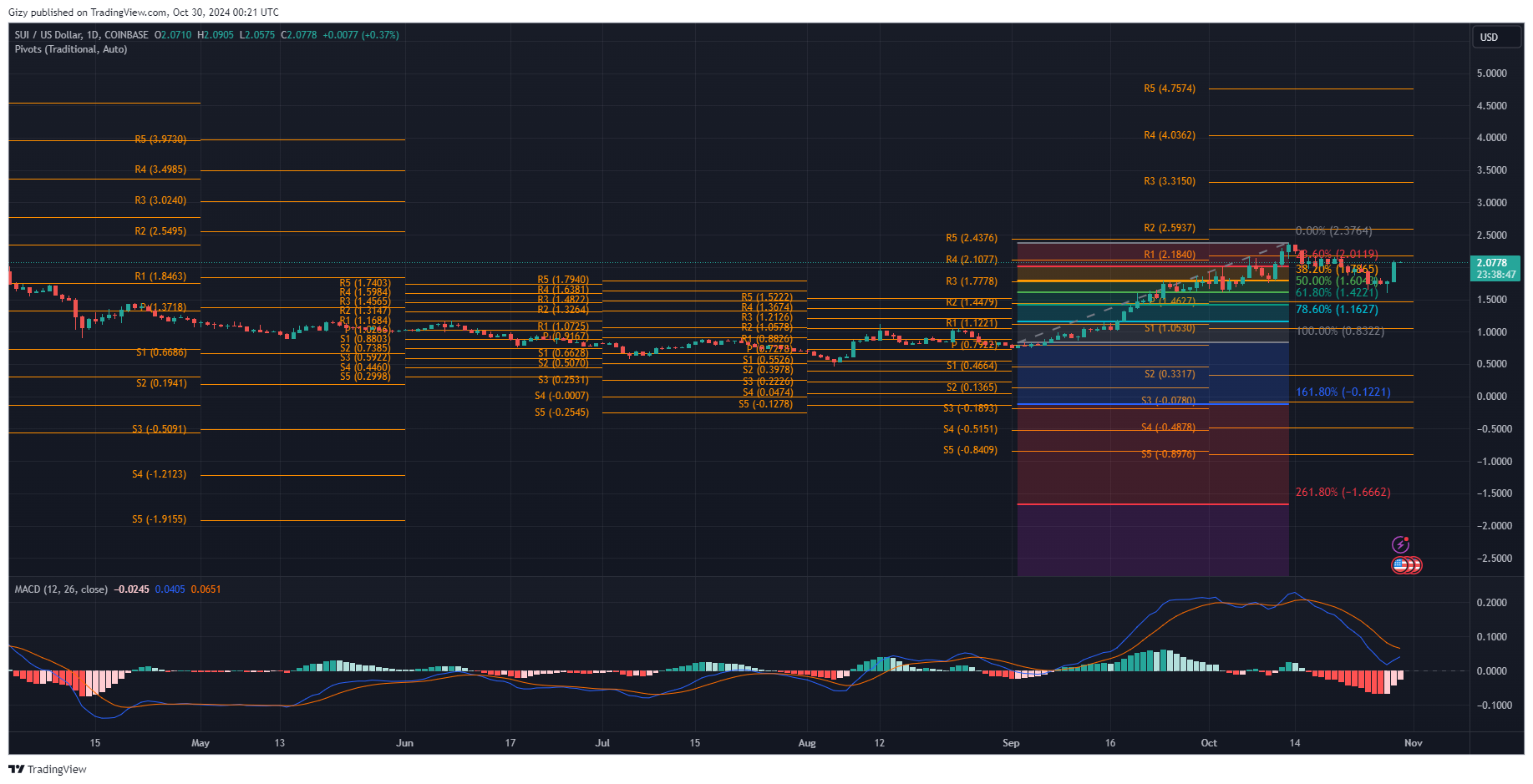

Most indicators on the one-day chart are positive in response to the most recent change in price trajectory. One such is the moving average convergence divergence. It displayed a negative divergence on Oct. 16, following an 8% drop in price the day before. Both EMAs have since been on the decline but halted the downward trend.

The 12-day EMA is on the uptrend and sets course for the 26-day EMA. The ongoing bullish convergence may result in further price surges. The relative strength index, which is at 56 from a low of 40 a few days ago, shares the same sentiment.

SUI also surged above the middle band of the Bollinger bands. The metric also hints at further increases as the altcoin will look to return to its previous peaks. The Fibonacci retracement level points to a high chance of this taking place as the coin is trading above the 23% fib level and may retest the next critical mark at $2.37.

FLOKI Prints Buy Signals

In other news, FLOKI also registered massive increases over the last 48 hours. It started the previous intraday session at $0.000135 but retraced to a low of $0.000128 before rebounding. The bulls staged several buybacks and pushed the price as high as $0.000145. However, it retraced as they failed to sustain the momentum.

The current day is mostly bullish as it peaked at $0.000152 but faced massive rejections that resulted in a small drop to $0.000147. FLOKI may close with gains of almost 4%.

MACD prints buy signals at the time of writing.

The 26-day EMA is set by the 12-day EMA, which is now on an upward trend. The current bullish convergence could result in more price spikes. The relative strength indicator echoes this trend, currently at 56 after dropping to 40 a few days ago.

Additionally, the memecoin jumped above the Bollinger bands’ middle band. As the altcoin attempts to reach its prior heights, the indicator also suggests further growth.