Bitcoin is trading at $62k after failing to resume its uptrend. It is currently printing its second red candle of the week, and fears of further downtrends are reaching a new peak.

The fear and greed index is also declining, dropping below 50. There are many speculations as to the reason for the latest price trend. However, the most glaring appears on on-chain data.

A Massive Decline Trading Volume

The apex coin is seeing an over in trading volume over 9% in the last 24 hours. There are also indications that most of the remaining volume is from bearish traders, resulting in the current price performance.

Nonetheless, the Kbears are edging in the struggle for dominance due to a significant change in on-chain conditions. One such change is a substantial drop in buying pressure from several key regions. The investors in the US are currently bearish and are selling instead. Due to this trend, the Coinbase premium is negative. The Asian market is also seeing the same sentiment, as the Korea Premium is negative.

Nonetheless, considering fundamentals, some traders blame the current trend on the latest SEC activity. The regulators went on the hunt for the leading cryptocurrency exchange in the United States, Crypto.com. It is suing the trading platform for allegedly selling assets it classifies as securities without a proper license.

Others believe current price actions are ‘the calm before the storm.’ They considered two important metrics.

Bitcoin Reserve Hits New Lows

The apex coin is gradually becoming scarce. On-chain data shows that trading platforms receive lesser BTC as traders are not selling. Although the asset is seeing less buying pressure, some investors and institutions purchase the remaining little on these platforms.

The total netflow is also negative, as exchanges registered lesser inflows while the outflows continued. Nonetheless, there are indications of impending improvement. One such is the Net Unrealized Profit and Loss. The metric is currently neutral, indicating that fewer buyers are in profit. This means that fewer people are willing to sell.

Bitcoin products are seeing more significant buying pressure than the spots. Data from SoSoValue shows that ETFs received over $200 million in inflow on Monday. On-chain data shows that the bullish trend is ongoing, as the fund premium is positive.

Derivatives are receiving more attention as the funding rate is rising. Traders with long positions are adding more funds to keep their positions open amidst the slight declines, and due to this, the funding rates are predominantly from bullish traders. However, the bears are grinning as more sell orders are getting filled.

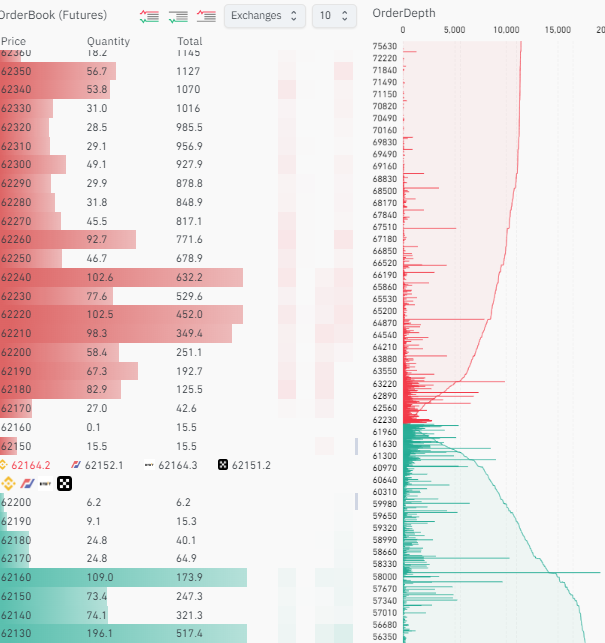

Notable Ask Orders at $64k

Data from Coinglass shows some traders placing ask orders above $64k. Although insignificant, the same amount of ask orders is also at $63k. This means that if Bitcoin reclaims $63k, it is likely to flip $64k. It is worth noting that most of the orders are closer to $65k.

The charts also agree with this assertion, as the apex coin is trading above its pivot point and will look to retest its first pivot resistance. It is also exchanging above its 50% Fibonacci retracement level at $62k. The bull will propel the asset to break the 23% Fib level at $64k.