A recent report by New York Digital Investment Group (NYDIG) revealed that Bitcoin remains the best-performing asset so far this year despite a weak third quarter.

According to NYDIG’s research head, Greg Cipolaro, the leading cryptocurrency, gained 2.5% during the third quarter, although it faced significant selling pressure throughout the period.

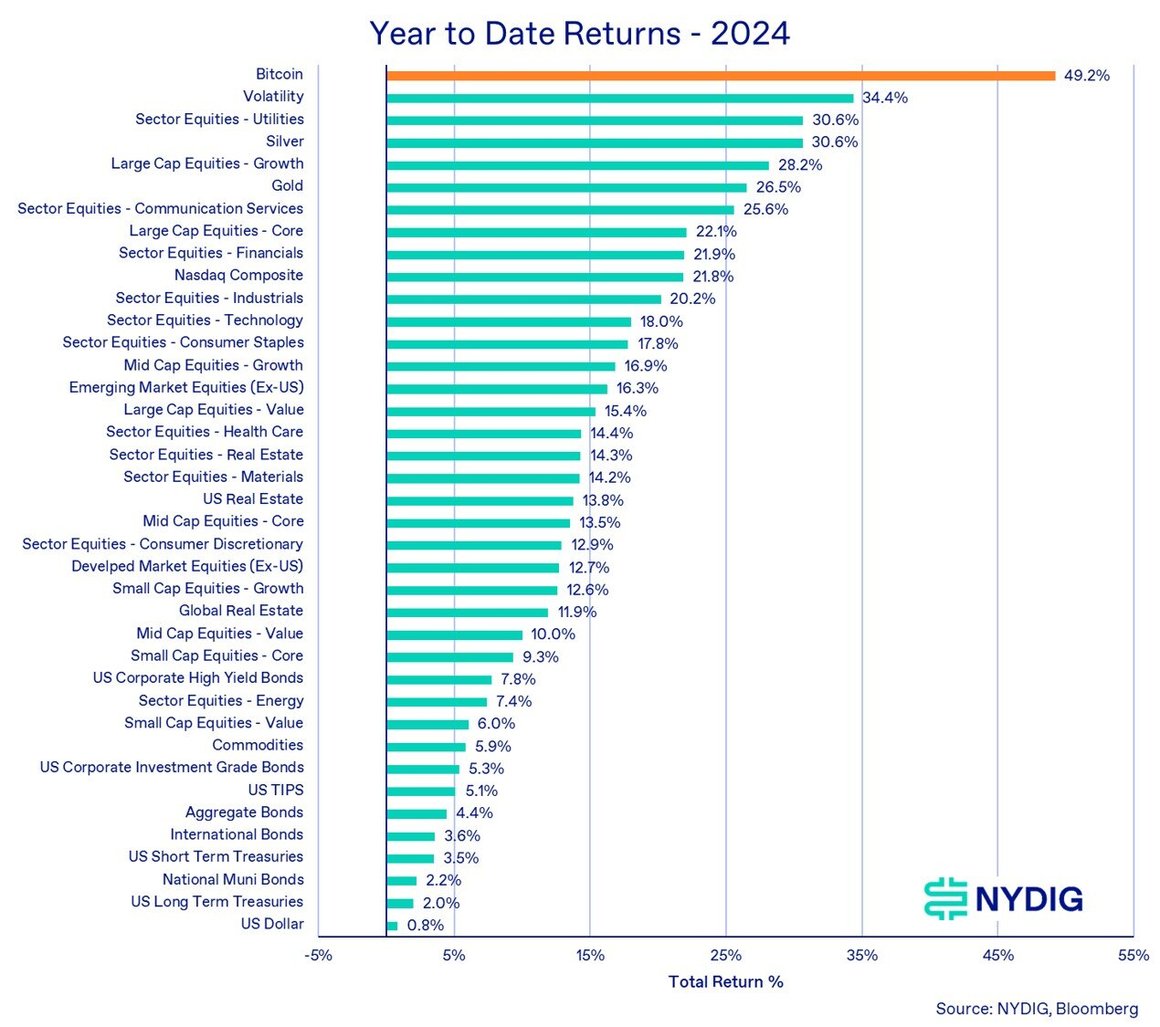

With this modest gain, the crypto asset recovered from its decline in the second quarter. He noted that Bitcoin has registered a year-to-date increase of 49.2%.

Source: NYDIG

Bitcoin Tops Despite Challenging Conditions

Cipolaro highlighted that Bitcoin trading has remained largely range-bound over the past six months amid several headwinds, such as distributions totaling nearly $13.5 billion related to Mt. Gox and Genesis creditors.

Additionally, substantial sales of Bitcoin by the German government contributed to the market pressure.

Cipolaro noted that other asset classes, such as precious metals and certain equity sectors, have made gains, narrowing the gap between their performance and that of Bitcoin.

He remarked that most asset classes have had a “banner year,” highlighting the competitive landscape Bitcoin is navigating.

Interestingly, Bitcoin defied seasonal expectations by registering a notable 10% increase in September, a month typically associated with bearish trends for the asset. Several factors influenced its performance, including ongoing demand from U.S. spot exchange-traded funds (ETFs), which attracted $4.3 billion in total flows during the quarter.

Furthermore, there has been a noticeable rise in corporate ownership of Bitcoin, with notable purchases from MicroStrategy and crypto miner Marathon Digital.

Cipolaro also said that Bitcoin’s rolling 90-day correlation with U.S. stocks rose during the third quarter, ending the period at 0.46. He emphasized that although the correlation remains relatively low, Bitcoin offers significant diversification benefits to multi-asset portfolios.

Upcoming Presidential Election to Influence Crypto Market

Cipolaro highlighted that Q4 is historically a bullish period for Bitcoin, suggesting several factors could lead to a positive outcome. He pointed out that the upcoming U.S. election on November 5 would significantly affect market performance in Q4, suggesting that a victory for Donald Trump might drive more significant gains for the crypto market.

“While both candidates will be improvements over the Biden administration regarding their attitude towards crypto, Trump if he wins, will deliver bigger gains for the asset class given his full-throated endorsement of the industry,” Cipolaro said.