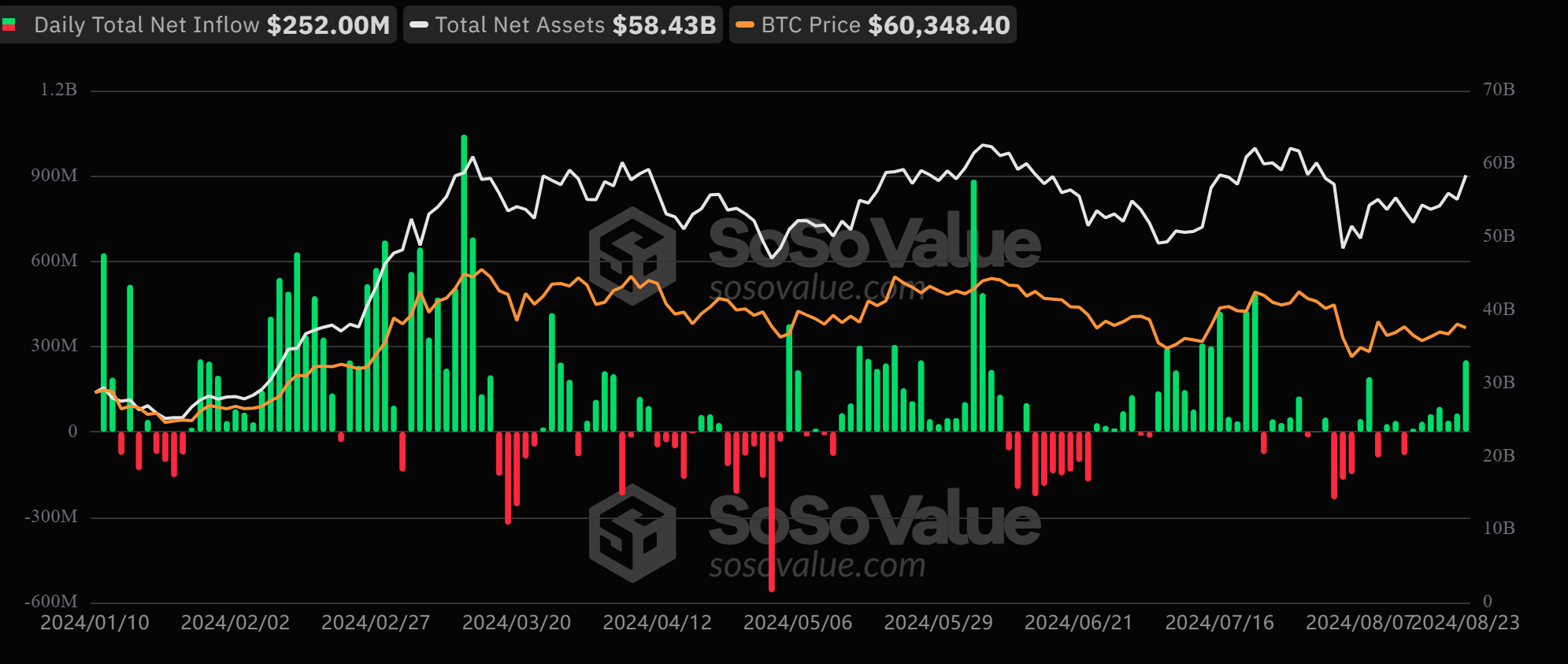

The United States Bitcoin exchange-traded funds (ETFs) saw a single-day net inflow of $252 million, the highest in 31 days. Fund inflows saw Bitcoin’s price boost significantly, with the asset surging over $64,000 within 24 hours.

Friday’s inflow also marked the seventh consecutive positive net flow from the U.S. Bitcoin product. The exchange-traded funds saw the last net outflow on August 14th, when $81.36 million was deducted from the funds.

BlackRock Leads Inflows

Leading asset manager BlackRock led the inflow on Friday, recording a $86.83 million cash influx. Since its launch in January, BlackRock’s IBIT has seen a cumulative flow of $20.7 billion, more than double that of Fidelity.

The third-biggest Bitcoin ETF issuer, Fidelity, saw a net inflow of $64 million, following the path of Bitcoin ETFs’ consecutive inflows. During the seven-day inflow streak, the fund has seen a cumulative inflow of $165.3 million.

Grayscale’s Bitcoin Mini Trust saw a net inflow of $50.8 million yesterday. Since its launch on July 31st, the fund has never seen an outflow day and has raked in $356.7 million. This steady inflow is heavily attributed to its ultra-low, competitive fees, which currently rank as the cheapest among the slew of Bitcoin-based ETF products.

Bitwise’s BITB saw a net inflow of $42.26 million; Ark Invest’s ARKB recorded a $23.81 million inflow, while Valkyrie and Invesco’s funds saw a combined inflow of $5.43 million.

Grayscale’s GBTC was the only fund with a net outflow on Friday. The asset manager saw $35.55 million flow out of its fund, taking its cumulative outflow to $19.73 billion.

Source: SoSoValue

The U.S. Bitcoin ETFs now hold $58.43 billion in net assets, accounting for 4.65% of Bitcoin’s market cap. They achieved this impressive feat with just eight months of trading. Spot Bitcoin ETFs have significantly driven BTC to its current all-time high above $73,000.

Meanwhile, BTC’s price traded at $64,201 at press time, up 4.24% in the past 24 hours.