Bitcoin experienced one of the biggest dips in the last month. It started trading at $65,293 but retraced to a low of $61,169. It closed a little higher, with losses of almost 6%.

The decline spurred much speculation about its cause. Some speculated that tension in the Middle East was the reason for the downtrend. A recent report of Iran issuing threats of imminent attacks on Israel keeps the fear of escalations in the region fresh.

However, on-chain data shows that a large transfer was responsible for the decline. Genesis Trading secured the approval to start repaying its creditors. It transferred a whopping $1.5 billion in BTC and ETH to different wallets.

The large movement of assets has since caused huge panic across the market. The global cryptocurrency market also lost a couple of hundred million. It dropped by over 2% in during he previous intraday session.

However, another on-chain data points to the coin seeing more decline.

Coinbase Premium Flips Bearish

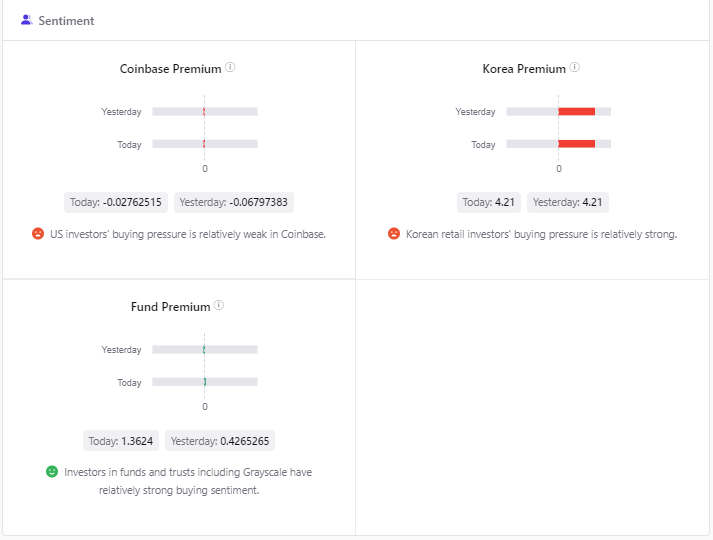

The Coinbase premium is a metric that shows US traders’ sentiment at the time. It is negative at the time of writing, indicative of investors losing confidence in the apex coin. It also shows a huge decline in buying volume over the last seven days.

Korean investors are also bearish at this time as the Korea Premium declined by many fractions in the last two days.

There is no indication of an impending change to the current sentiment as fundamentals are getting more negative. Some crypto market observers announced that the most recent drop is the end to the bulls market.

On-chain data is hinting at further price declines as more traders deposit more BTC from their cold wallets to exchanges. A clear indication of this is the NetFlow these platforms had. It has been negative in the last seven days. However, more coins are leaving exchanges as the reserve is decreasing.

The Net Unrealized Profit and Loss metric is also moderate. The current reading is alarming because most traders were in profit a few days ago. It is also indicative of some take-profit actions from other traders.