A filing with the Securities and Exchange Commission (SEC) has revealed yet another state pension fund exposure to Bitcoin. According to the Friday 13F filing, the State of Michigan Pension owns about 110,000 shares (nearly $6.6 million) of Ark Invest’s ARKB exchange-traded fund (ETF) as of June 30.

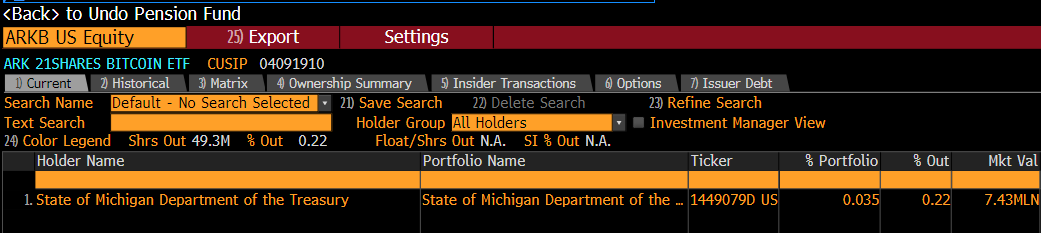

Bloomberg’s analyst, Eric Balchunas, confirmed the State of Michigan Pension’s exposure to the Bitcoin product, sharing a picture to support his claim. Furthermore, he stated the pension manager’s shares were worth $7.4 million, which was a small percentage of its entire valuation.

“Just checked, and yes looks like Michigan’s Pension bought up some ARKB (altho we have it as $7.4m), which is small %-wise for them, but its a start, they now third pension to report opening a btc ETF,” Balchunas tweeted.

The State of Michigan Pension became the second retirement fund to disclose its susceptibility to Bitcoin on Friday, marking a significant shift in institutional investment strategies. Jersey City Pension Fund announced earlier that it intends to invest in the digital asset through ETFs. Wisconsin State Agency was the first pension fund to own Bitcoin ETFs after stating in May that it owned $100 million of BlackRock’s IBIT and $60 million of Grayscale’s GBTC.

Institutions Flocking Towards ETFs

The US spot Bitcoin ETF was launched in January after Grayscale won a case against the SEC, mandating the regulator to approve the product. Since then, the fund has become one of the most successful ETPs ever launched into the US market.

In just six months of trading, the fund has attracted over $17 billion in net cumulative inflows and holds assets worth $59 billion. The US ETF has become one of the notable sources of inflow into Bitcoin.

Many analysts predicted that the Bitcoin ETF would attract hundreds of billions of dollars to the crypto market, as some institutions would prefer the product over directly investing in Bitcoin due to its volatility. This analysis has proved truthful owing to the latest disclosures of a couple of institutions that it is exposed to the Bitcoin product.