The nascent nature of the cryptocurrency industry has led to several boom and bust cycles. However, a common theme remains: some of the industry’s biggest believers are handsomely rewarded. This proved to be the case of former Maker DAO employee Henry Doe, as he shared in a recent post.

MakerDAO is the entity because of the popular DAI stablecoin. Around the time the project launched in 2017, Henry Doe noted that he had turned down a job that paid $350,000 to join Maker. The new role represented a 70% pay cut and did not include token allocations, as Maker had not defined that as part of this roadmap at the time.

Meanwhile, the former Maker employee faced a test of faith during the famous March 2020 market crash. Dubbed “Black Friday,” the COVID-19 fear-led market cap saw the market plummet significantly. Bitcoin dropped as low as $4200, while Doe claims his net worth plummeted by 50% since he invested most of his capital into crypto and stocks. As is often the case for most high-potential financial assets, the decline was only temporary, and the market made a comeback later that year and well into 2021.

DeFi Summer Marks a Turn-Around

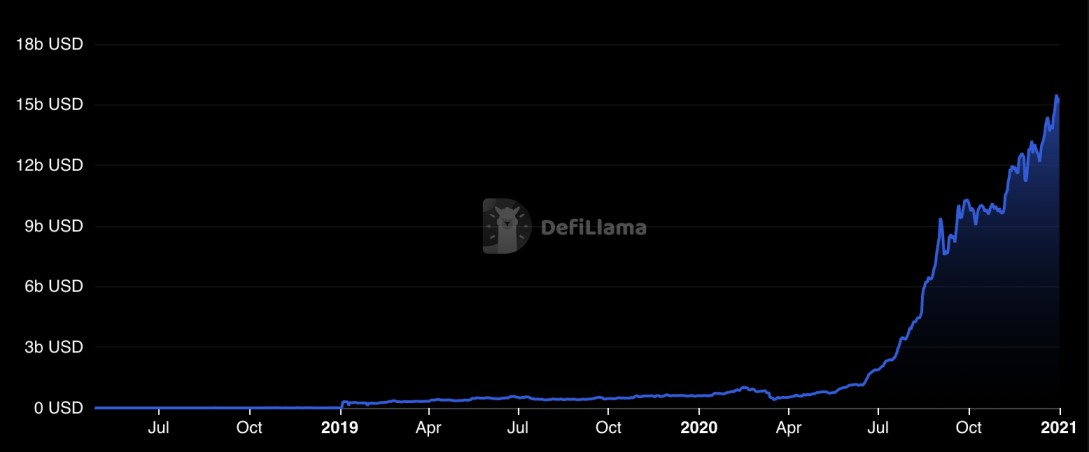

New ones in the crypto space may not have heard of DeFi summer. In the summer of 2020, the crypto market grew significantly, led by demand for decentralized finance (DeFi) protocols, many of which had remained largely unpopular until that point. Between June and December 2020, the total value locked across DeFi apps grew from $1 billion to $15 billion, creating immense wealth for early adopters.

When the market peaked in late 2021, nearly $180 billion was locked across DeFi protocols, with the sector becoming a dominant force. As Henry Doe mentions in his story, DeFi summer “turned many people’s lives around financially, mine included.”

When I joined @MakerDAO in 2017 I gave up a design leadership job paying $350k.

Maker was a 70% pay cut. No coin.

I was living in a 1 bed apartment and the sole income for my young family.

— Henry Doe (@hcdoe) July 14, 2024

Aside from personal returns on investments, Maker DAO had grown into one of the most widely used stablecoins in DeFi. The team also released the MKR token, which included allocations to the founding team.

Fast-forward to the present, Maker remains an ever-present force in the DeFi landscape, ranked fourth on the list of most significant DeFi protocols with an $8 billion TVL. Meanwhile, Henry Doe is currently head of design at Euler Finance, a lending protocol that has yet to reach the same heights as Maker.