PayPal’s PYUSD has experienced a remarkable surge since its launch on the layer-1 blockchain Solana. On-chain data from the blockchain analytics platform Dune reveals that $110 million of the stablecoin has been minted on the Solana network, with most of this growth attributed to Solana’s lending platforms, particularly Kamino Finance.

PYUSD Grows on Solana

PayPal’s PYUSD was launched on the Solana mainnet on May 29, 2024. Before then, the stablecoin lived solely on the Ethereum network. PayPal’s decision to deploy a stablecoin was largely recognized as a mainstream adoption, given that the payment company had an established multinational presence in traditional finance.

Following its debut on Solana, various decentralized applications (dApps) onboarded the stablecoin into their platforms. For example, Kamino Finance, a Solana-based lending dApp, welcomed users to earn a 23% annual percentage yield (APY) on PYUSD assets. Tom Wan, a blockchain analyst for 21Shares, noted that over 38% of PYUSD’s current circulating supply of $110 million has been lent on Kamino.

$110M PYUSD is minted on Solana. The supply has increased by 88% over the past 7 days.

A lot of the success can be attributed to @KaminoFinance. Over 38% of the supply has been lent on Kamino with a 23% APY

This is also a huge step for the adoption of token extension in DeFi pic.twitter.com/acOV5wShQe

— Tom Wan (@tomwanhh) July 5, 2024

PYUSD’s Ethereum Market Retains Dominance

While PayPal’s PYUSD has seen applaudable growth in its Solana market, the stablecoin’s Ethereum market performance retains the dominating metrics. With a nine-month headstart, PYUSD’s Ethereum market accounts for 78.43% of the stablecoin’s market metrics, leaving its Solana market with 21.57% of the market share.

It is worth noting, however, that if the stablecoin’s Solana market continues to grow at its current rate, it could surpass its Ethereum-focused counterpart in the coming months.

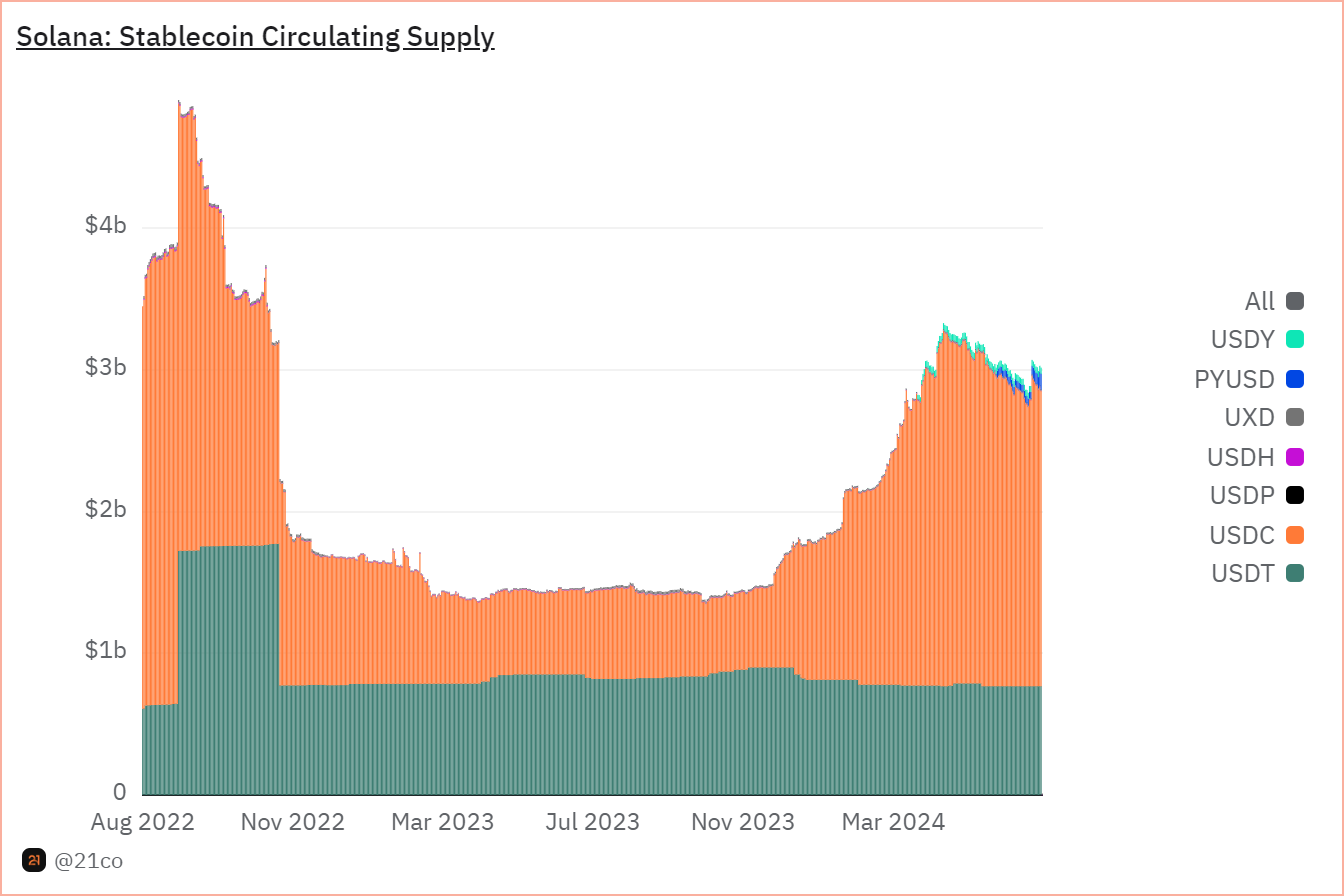

Zooming out to PYUSD’s overall market performance in the stablecoin market, we see that it ranks #7 with a market cap of $510 million at the time of writing. It trails leading stablecoins like Tether’s USDT and Circle’s USDC, which hold billions of dollars in market shares.