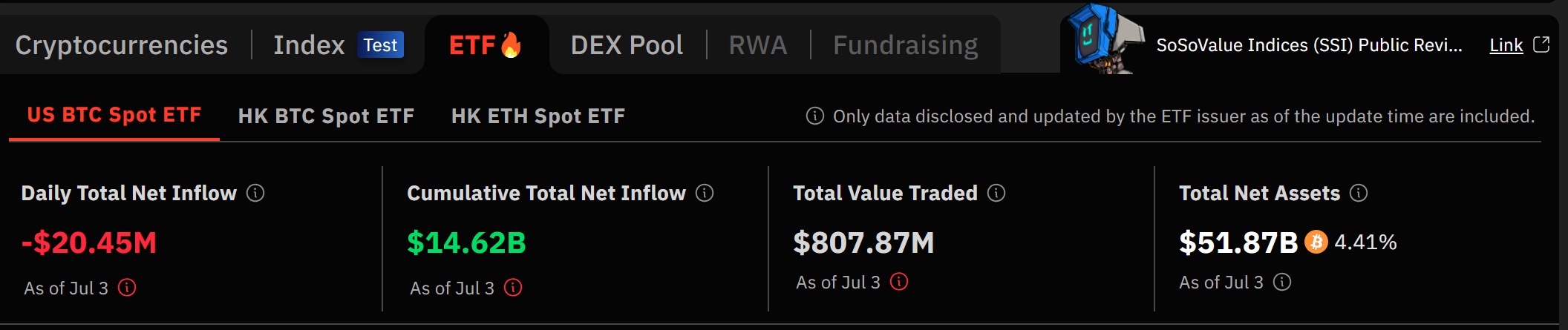

The US spot Bitcoin exchange-traded fund (ETF) saw a net outflow of $20 million on Wednesday, marking a second consecutive outflow day. Bitcoin and the broader crypto market tanked amidst the outflow and selling pressure from exchange Mt. Gox and the German government.

Despite the market correction, US ETF products have maintained a net asset under management (AUM) above $51 billion. This is a remarkable achievement, considering the fund reached this milestone just six months after its launch.

The 11 bitcoin funds hit the ground running immediately after launch on January 11 and at one time went on a 19-day inflow streak. Despite diminishing inflows amidst selling pressure, US ETF still accounts for more than 4% of Bitcoin’s circulating supply.

Zero Flow Wednesday

Nine out of eleven funds recorded zero flows during Wednesday’s US ETF session. Except for Grayscale and Fidelity, all nine other issuers, including the leading issuer by AUM, BlackRock, recorded no inflow or outflow.

According to Sosovalue, Grayscale’s GBTC saw a single-day net outflow of $27 million. GBTC’s incessant outflow seems to have resumed, with the fund recording a net outflow in four of the last five trading days.

Fidelity’s FBTC stood strong amidst the cooling inflows to spot Bitcoin funds. The issuer was the only fund with a net inflow on Wednesday, recording a single-day positive flow of $6.55 million. FBTC has seen net inflows in six of the last seven trading days, raking in $151 million during that period.

Bitcoin Continues to Struggle

Bitcoin hit $58,000 early Thursday, a price last seen in May. The largest crypto asset is now down 14% from the past month.

Altcoins followed Bitcoin’s downtrend, with Ethereum and Solana falling 5% and 8%, respectively. The market still awaits the launch of the Ethereum spot ETF, while the Solana spot ETF has started to gain momentum.

At press time, Bitcoin was trading at $57,987, while Ethereum and Solana were sold at $3,174 and $134, respectively.