Asset manager VanEck filed for a spot Solana exchange-traded fund (ETF) on Thursday, the first in the US. This comes a few days after a Canadian-based investment firm, 3iQ, filed for a similar product.

If approved, the VanEck Solana Trust will trade on the Chicago Mercantile Options Exchange (CBOE) and “will hold SOL and will value its shares daily based on the reported MarketVector Solana Benchmark Rate,” its filing stated. VanEck was also the first asset manager to file for an spot Ethereum ETF.

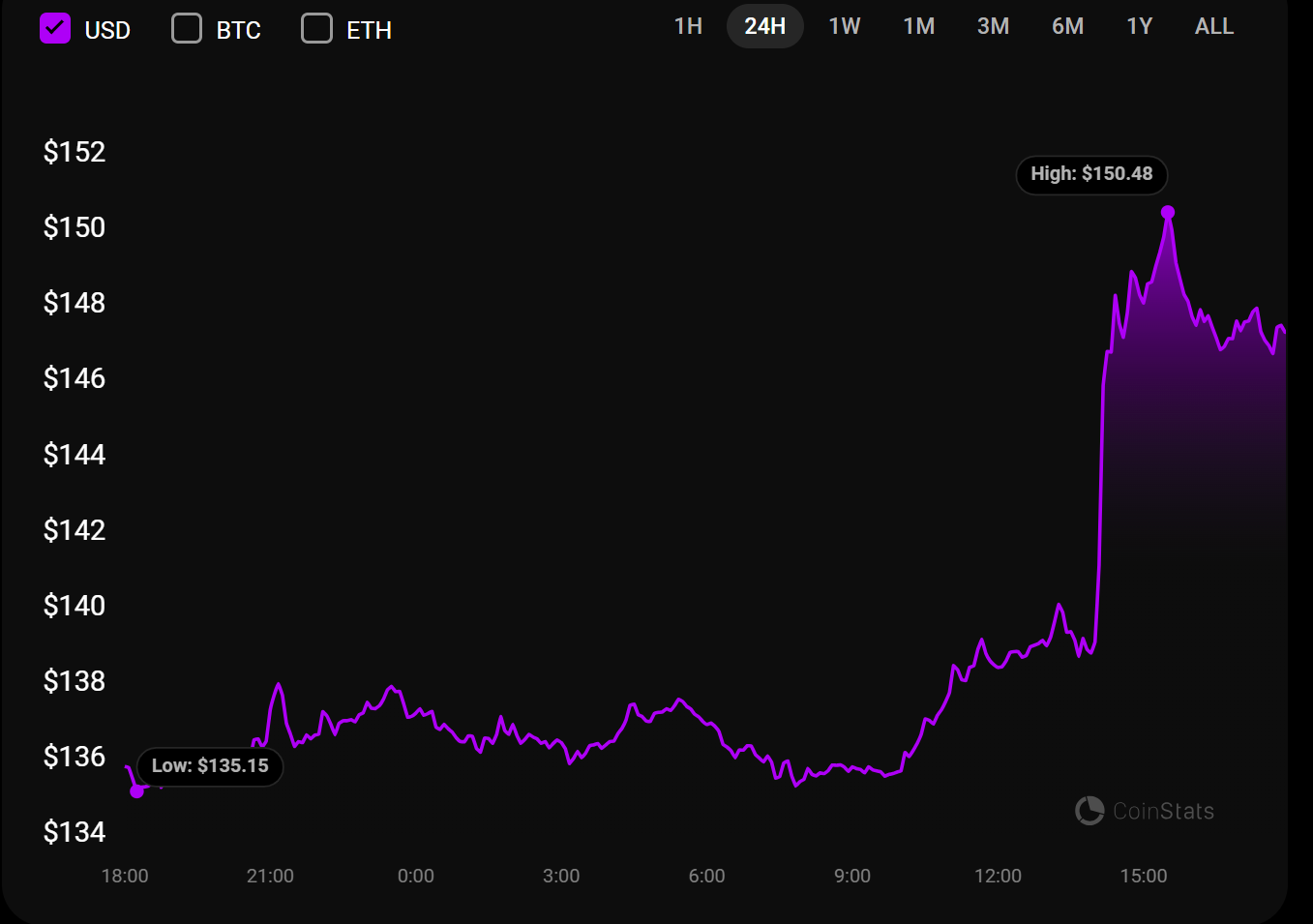

Solana’s native token, SOL, moved over 6% following the announcement. The coin moved from $139.6 to as high as $150.48, trading at $148 at press time. SOL has grown over 8% in the past 24 hours, outperforming major cryptocurrencies like Bitcoin, Ethereum, and BNB.

Solana Is a Comodity: VanEck

VanEck’s head of digital assets research, Matthew Sigel, shared his thoughts on the filing, saying that SOL was a commodity like Bitcoin and Ethereum.

“We believe the native token, SOL, functions similarly to other digital commodities such as bitcoin and ETH. It is utilized to pay for transaction fees and computational services on the blockchain. Like ether on the Ethereum network, SOL can be traded on digital asset platforms or used in peer-to-peer transactions,” Sigel tweeted.

Sigel also noted that the Solana ETF would compete with Ethereum, seeing that the Solana blockchain’s unique combination of scalability, speed, and low cost may offer a better user experience for many use cases.

No Chance Till 2025: Seyffart

Reacting to the filing, Bloomberg’s top analyst, James Seyffart, noted that he doesn’t see the spot Solana ETF launching this year.

“First SOLETF filing in the US. Will be interesting to see if other issuers immediately follow suit. Early thoughts are that this only has a shot to launch sometime in 2025 if we have a new admin in the White House and SEC. Even then, not guaranteed,” Seyffart said in a tweet on Thursday.

Several analysts have speculated that presidential candidate Donald Trump’s election would be bullish for crypto. Standard Chartered predicted that Bitcoin would hit $150,000 if Trump wins the November election. Analyst Seyffart’s comment alleges that the Solana ETF would not be approved if Joe Biden and Gary Gensler stayed as president and SEC chair, respectively.