Teddy, a professional crypto gambler, shared a technical indicator, suggesting that bitcoin (BTC) is moving closer to a bottom in its current corrections. He stated that a price bounce back will follow once the digital asset hits this bottom.

The Analysis

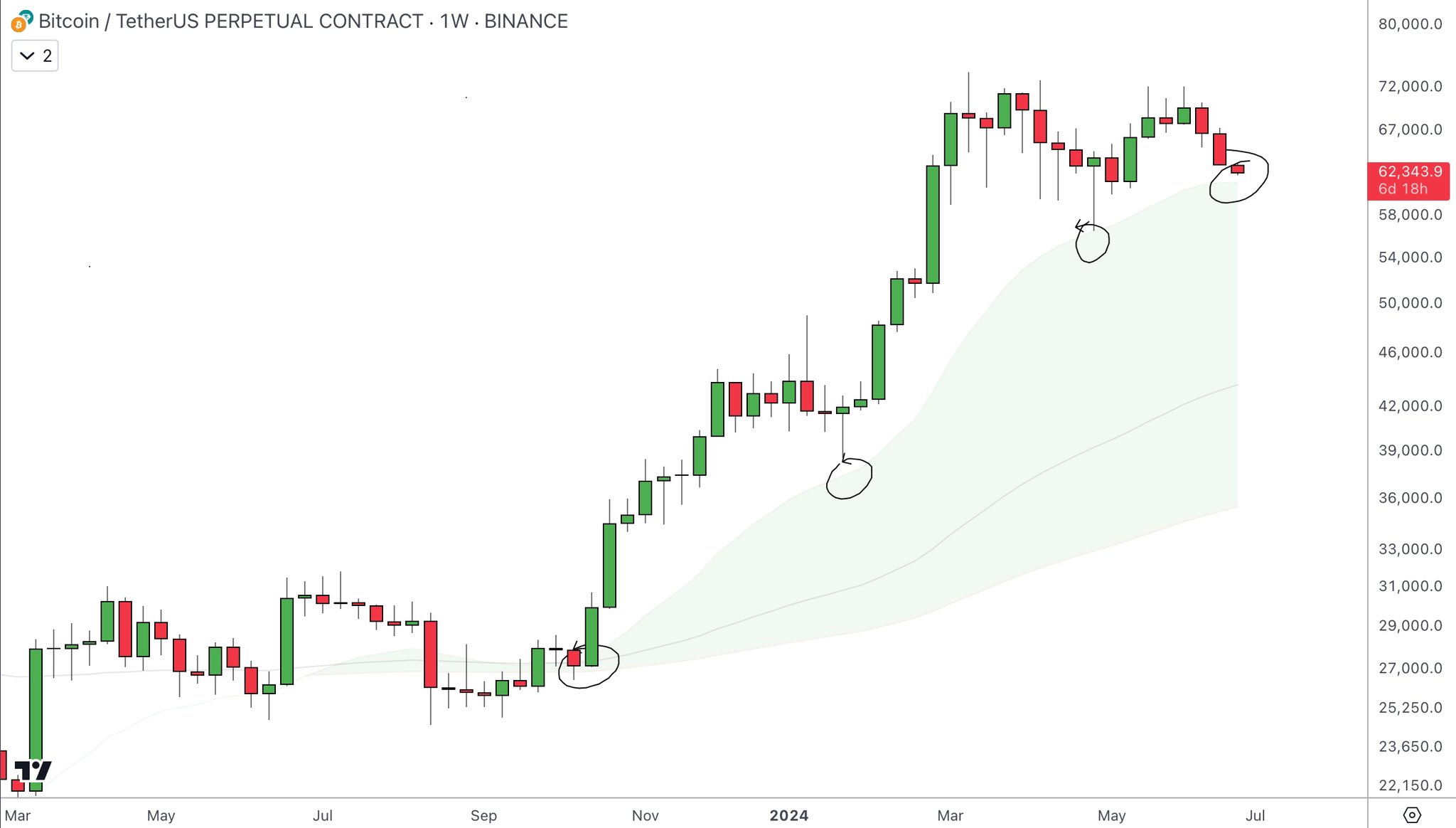

According to Teddy, the 21-week exponential moving average (EMA) has historically been a support level for bitcoin during bull runs.

Exponential moving average is a type of moving average (MA) that focuses on recent price data. It helps investors to identify trends and potential support/resistance levels in the price of an asset like BTC and ETH.

Teddy pointed out that since the bull run started, every correction BTC has faced landed on the 21-week EMA before bouncing off it.

He mentioned that the current price of BTC is approaching the 21-week EMA again, which is currently around $61,000. At the time of writing this line, the world’s largest cryptocurrency trades at $61,141.

As per Teddy’s analysis, if history is to be repeated, the price of BTC might experience a bounce once it hits the $61,000 bottom. With BTC almost hitting this zone, market participants anticipate a price surge for the asset soon.

However, investors should note that this is just a technical indicator and does not guarantee a price rally for the pioneering cryptocurrency. Well, only time will tell if BTC will again find support at the 21-week EMA.

BTC Struggle Continues

The price of BTC has been facing drawdowns since hitting an all-time high (ATH) of more than $73,700 in March 2024. With BTC trading around $61,141 at press time, it is currently 17% down from its peak.

This performance has been attributed to poor macroeconomic data and aggressive spot Bitcoin exchange-traded funds (ETFs) sell-off. Last week, these BTC products experienced five-day net outflows, during which more than $1 billion flowed out of it.