Solana is trading at $146, following a decline from $155. The latest drop comes barely a day after the asset gained over 7%.

However, the charts do not follow any notable pattern, which suggests growing price uncertainty as the tussle between the bulls and bears rages on. Since the week started, it edged close to testing $160 but fell short at $159. It also retraced to a low of $140 but rebounded.

SOL is printing a doji in response to the current price trend, as it has yet to register any significant price improvement. In addition to the current bearish trend in the crypto market, the altcoin is experiencing little effect from other fundamentals.

FTX Bailout Threatens Price

FTX recently announced that it has enough to pay all its creditors/customers and still has over 18% of the total funds after the payout. The firm stated that once it sells all its assets, it will have $16.3 billion to settle its $11 billion debt.

Following its announcement on May 7, SOL retraced by over 3%. The price decline is due to the company’s plans to sell off its holdings to settle its debts. According to previous announcements, more than 34% of the American cryptocurrency exchange’s total reserve comprises Solana.

The firm sold two-thirds of its bag in April to Galaxy Trading, Pantera Capital, and Neptune Digital Assets at a 63% discount. Following this sale, the cryptocurrency closed the month with losses exceeding 37%.

The latest announcement brought back ‘PTSD.’ Traders are anticipating another decline when FTX decides to sell its remaining bag. It is worth noting that it failed to say when it would sell the remaining bag. This means the asset is gearing up for another significant decline.

Aside from the exchange woes, Michael Saylor recently announced that the SEC will go after several coins and tokens. He identified Solana as one such asset. A few days after Saylor’s comments, Gary Gensler went on CNBC and announced the regulators would be going after some cryptocurrency.

With the prospect of more worries for the cryptocurrency, it is in for a more significant decline and enormous volatility.

Solana’s Current Price Trend

Solana is currently trading at a 4% decline. Amidst the price drop, it maintained its bullish posture. The moving average convergence divergence is still on the uptrend. The 12-day EMA continues its ascent following its interception of the 26-day EMA a few days back.

The broader exponential moving average also tells the same story. The asset is trading above the 100-day EMA, demonstrating its bullish trend. This also means it is trading above the 200-day EMA. However, it is currently below its 50-day EMA, which raises concerns about further price declines and shows the bears edging.

In response to April’s decline, the moving averages display mixed signals. For example, the 50-day MA is going downhill. Nonetheless, the altcoin is trending below it. Amidst the downtrend, SOL continues above the 200-day MA. If the 50-day MA continues its decline, the asset may experience a death cross.

Solana Price Prediction 2024

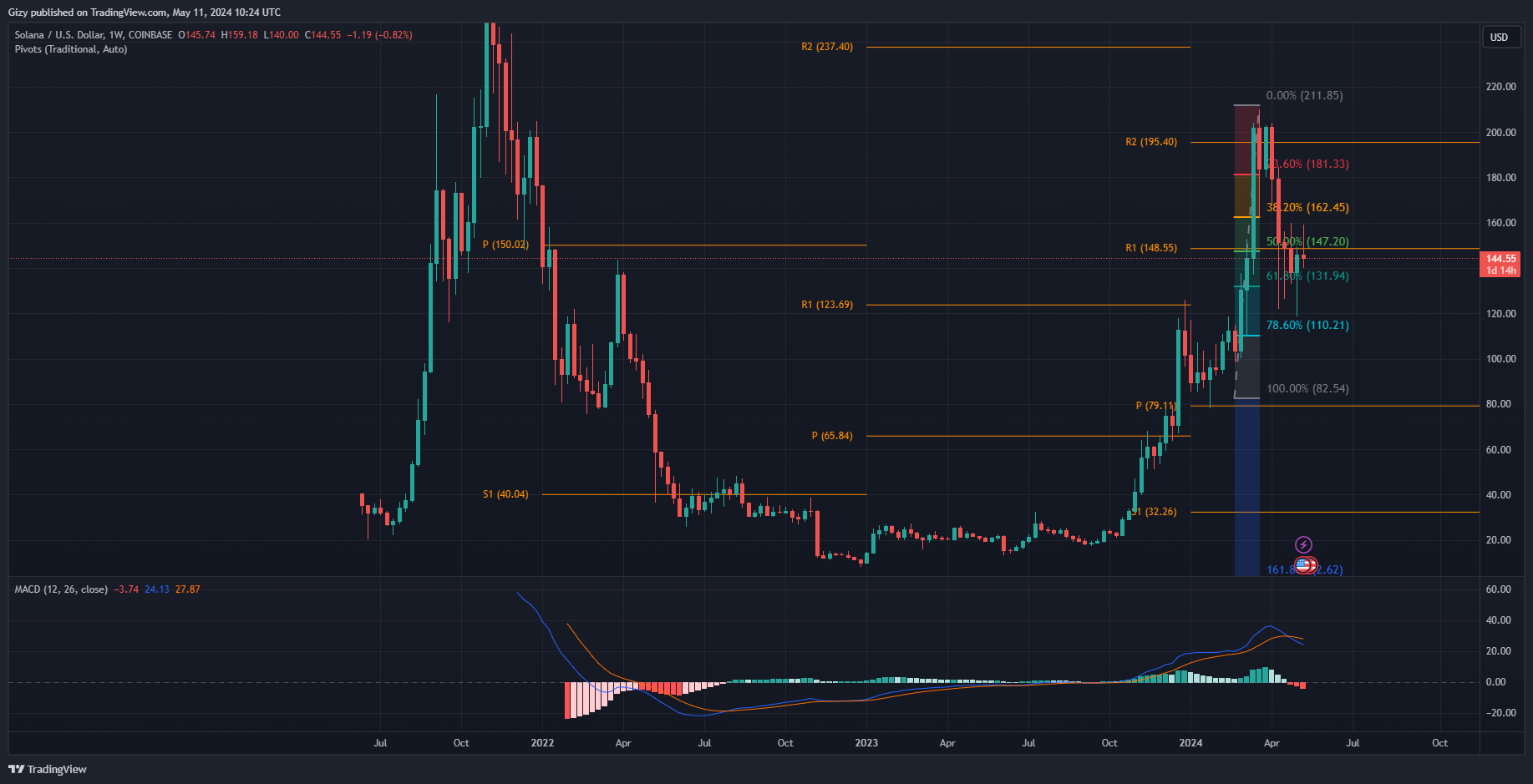

With more price declines looming for SOL, the bulls will attempt to halt the downtrend at several critical levels. Nonetheless, the altcoin will try flipping its pivot point at $150 in the coming days. It failed to break it decisively recently, so price trends below it continued. The relative strength index hints at the current price decline; it points to reduced selling pressure.

After losing the PP, the next pivot level is at $97. Nonetheless, the Fibonacci retracement highlights other critical levels with notable demand concentration. At SOL’s current price, it has lost its 50% Fib level. The next critical level is the 61% Fib level at $131. Previous price movement indicates significant demand concentration at this mark.

With a prospect of further decline, traders will gear up for a drop to $110. The 78% Fib may break, and the altcoin return to its February low, guaranteeing a retest of the first pivot support at $97.

Following the decline, the cryptocurrency will look to reclaim lost levels. It will attempt the first pivot resistance at $180. Previous price movements suggest that the coin will hover around this level for an extended period before further attempts. After gaining stability above the said mark, it will look to surge as high as $200.

As the crypto market picks up, Solana will attain a new ATH before the end of the year. It may also test $300 for the first time.

Price Prediction 2025

Following a bullish close to 2024, many will look to continue the trend. In a previous prediction, an analyst affirmed that several assets will register a notable increase in 2025. SOL will join in with such sentiment with the crypto market, seeing such a prospect.

Currently, on the weekly chart, the coin is trying to recover from a bearish divergence. MACD is on a downtrend in this timeframe. However, this will change once the bull run starts. This will mean a bullish divergence will take place.

The last time SOL had such interception in the 1-week timeframe, it gained over 1000%. While such a margin looks unrealistic in 2025, the asset will enjoy between 200% and 500% surges. Adding to the authenticity of this trend, it is worth noting that such played out in 2021.

A year after Bitcoin’s previous halving, the asset surged by over 500% before a correction. With a 200% increase in view for the year under review, the coin will look to climb as high as $800, following its close around $300 in 2024.

Nonetheless, the pivot point standard suggests a possible support at $264. This may be the launchpad for the 2025 campaign.

Price Prediction 2026

The close to 2025 will most likely be bearish. While this is not certain, 2026 will be bearish for SOL.

Based on previous price movements, the second year following a halving is the most negative. Ethereum’s performance during such periods proves this. For example, in 2018, ETH dipped by over 82%, and in 2022, it lost over 67%. In a similar fashion, Solana lost over 90% in 2022.

With a possible close between $500 and $700 in 2025, the altcoin may retrace as low as $200 when the bear market starts. Nonetheless, the coin may maintain a rebound of around $250. This comes as the PPS highlighted $264 as a critical level.

Price Predictions 2027

Historically, the following year, after a bear market, is mildly bullish. Several cryptocurrencies will recover and attempt to reclaim the lost levels during this period.

The apex altcoin is an example of this trend. In 2019, the asset surged from $130 to $363. In 2023, it surged from $1,192 to $2,447. Similarly, SOL gained a whopping 900% in 2023.

If the same trend continues, the asset may end 2027 between $300 and $500.