Against popular opinion, chart veteran Peter Brandt has alleged that Bitcoin may have topped $73,000. In a blog post on Friday, he noted that the current bull run might have ended and expects the crypto asset to decline to mid-$30,000 or even lower.

Peter based his latest view on the concept of ‘exponential decay,’ a statistical principle often used to describe the gradual decrease of an asset’s quantity over time.

“The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years. You may like the story of this data or not – but you will have to deal with it (or at least account for it, adjust for it or just plain ignore it). In fact, I don’t like the Exponential Decay occurring in Bitcoin – Bitcoin is one of my personal largest investment positions,” Brandt stated on his blog.

Will Exponential Decay Kick-In?

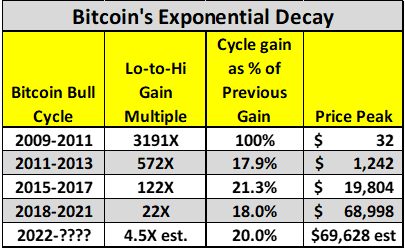

According to Brandt, historical data shows that each of the last bull runs experienced approximately an 80% exponential decay, meaning that the next was just 20% of the gain multiplier of the previous.

His data showed that from the first bull run between 2009 and 2011, Bitcoin rose 3191x from $0.01 to $31.91. The next cycle between 2011 and 2013 saw an 82% decay in multiplier gains as the asset moved 572x from a $2.1 low to $1,242.

The exponential decay continued in the same manner in the 2015–2017 and 2018–2022 bull runs, showing a consistent pattern of price multiplier decrement of 78.6% and 81.9%, respectively.

If this pattern continues, Bitcoin has already grown more than 20% of the previous multiplier gain (22), moving over 4.5x from the 2018-2022 bull run low of $15,473. Thus, the $73,471 Bitcoin reached on March 14 may have spelled the cycle top for the crypto asset.

A 25% Bet Though

Brandt placed a 25% bet on the Bitcoin top analysis. He, however, noted that if it turned out to be accurate, Bitcoin would dip to as low as $30,000, a price last seen in October 2023.

Despite his current stance, Brandt maintains a positive outlook on Bitcoin, suggesting that ”such a decline is the most bullish thing that could happen from a long-term view.” He also points to the recent halving event as a potential catalyst to alter the trajectory of Bitcoin’s ‘exponential decay’ historical data.

Note that I assigned a 25% probability to my analysis. I give more credence to a report I issued in February. Here is a chart from that analysis — projecting a bull market until Sep/Oct 2025 https://t.co/hiSogUtEkt pic.twitter.com/Y5I8g5JWwa

— Peter Brandt (@PeterLBrandt) April 29, 2024

The latest analysis from Brandt contradicts his earlier bullish stance on Bitcoin. In February, the veteran charter stated that the crypto asset would reach $200,000 by September 2025.