Sui Blockchain is a next-generation layer-1 blockchain designed to offer high-speed transactions, low fees, and a scalable environment for Web3 applications. Unlike traditional blockchains, Sui processes transactions in parallel, making it significantly faster and more efficient.

In this guide, we’ll break down everything you need to know about Sui, including its key features, how it works, the role of the SUI coin, and its impact on gaming and DeFi—all in simple terms.

Let’s answer the big question: What is Sui Blockchain?

Sui Blockchain Explained

The Sui blockchain is a layer-1 blockchain designed to offer developers and users high-speed transactions, low fees, and scalable smart contract deployment. It aims to solve the blockchain trilemma—balancing scalability, security, and decentralization—through its innovative architecture. Transactions on Sui are fast, scalable, and processed without third-party intervention.

The name Sui (pronounced swē) is derived from a Japanese word representing the element water, which also influenced its logo—a water droplet shape.

Unlike many traditional blockchains, Sui does not rely on a single sequential transaction process. Instead, it utilizes a unique Proof-of-Stake (PoS) model with Narwhal & Tusk, a Byzantine Fault Tolerant (BFT) consensus mechanism that enhances speed and efficiency.

The blockchain is powered by Move, a smart contract-focused programming language inspired by Rust. Move plays a key role in Sui’s parallel transaction execution, allowing the network to process transactions faster than many traditional blockchains.

Move Programming Language: Brief Background

Move is an open-source programming language for building smart contracts and blockchain applications. But how did it come into existence? Let’s dive into the story.

It all started in 2019 when Meta (formerly Facebook) introduced a stablecoin project called Libra. The goal of Libra was to act as a bridge between traditional currencies and cryptocurrencies, making payments easier on platforms like Facebook and WhatsApp. To power this system, Meta developed Move as Libra’s native programming language.

At this point, you might think everything went according to plan—but it didn’t.

By 2020, regulatory concerns arose, forcing Meta to rebrand Libra as Diem to gain approval. Despite this, the project continued to face strong opposition from regulators. In 2022, Meta officially shut down the Diem project and sold its intellectual property to Silvergate Capital Corporation for $182 million.

However, while Diem was abandoned, the Move programming language survived. Since Move was explicitly designed for smart contracts and blockchain applications, it was adopted by other blockchain networks—including Sui, which has become one of its most notable users.

Brief History of the Sui Blockchain

The Sui blockchain was developed by Mysten Labs, a team of five engineers who were formerly senior executives at Meta’s Novi division—the group responsible for the Diem stablecoin project. When Diem shut down, these engineers came together to create Mysten Labs and develop Sui, a next-generation blockchain focused on scalability and low-latency transactions.

The founding team of Mysten Labs includes:

- Evan Cheng

- Adeniyi Abiodun

- Sam Blackshear

- George Danezis

- Kostas Chalkias

Mysten Labs quickly attracted investment from major venture capital firms, including Circle, Binance Labs, a16z (Andreessen Horowitz), and others. These partnerships played a key role in Sui’s adoption.

In August 2022, Mysten Labs launched Sui’s incentivized testnet, marking the beginning of real-world testing. The following month (September 2022), the company secured $300 million in Series B funding to accelerate development.

After months of testing, Sui’s mainnet officially launched on May 3, 2023. At launch, Sui partnered with several centralized exchanges (CEXs), including Bybit, to enable users to buy and stake SUI tokens.

Sui’s Major Investors and its Roadmap

Sui has participated in multiple funding rounds, attracting significant investment from leading venture capital firms and strategic partners.

In December 2021, Sui completed its first funding round, raising $36 million. This round was led by a16z (Andreessen Horowitz). Other notable participants included Electric Capital, Redpoint Ventures, Standard Crypto, Lightspeed, NFX, Coinbase Ventures, Samsung NEXT, Elad Gil, and additional investors.

In September 2022, Sui raised $300 million in its Series B round. This round was led by FTX Ventures (associated with Sam Bankman-Fried’s cryptocurrency exchange). Participants in this round included Coinbase Ventures, Binance Labs, Circle Ventures, Jump Crypto, Lightspeed Venture Partners, Apollo, Green Oaks Capital, and Franklin Templeton, among others.

Sui’s Roadmap

As Sui continues to evolve, its roadmap is focused on:

- Improving DeFi Functionality: Enhancing the ecosystem to support more robust and efficient decentralized finance applications.

- Increasing Liquidity: Attracting more participants and capital ensures the network remains competitive.

- Expanding the User Base: Growing the number of developers and end-users who interact with the platform.

- Enhancing Use Cases: Broadening the range of applications and services available on the network to drive broader adoption.

Understanding How Sui Works

The Sui blockchain operates differently from traditional blockchains due to its unique consensus mechanism and transaction processing model.

Transaction Processing: Sui vs. Traditional Blockchains

Most traditional blockchains use a vertical scaling method, meaning they process and add transactions to the blockchain sequentially, one block at a time. This process can slow down the network, especially when high transaction volumes lead to congestion and higher fees.

Sui, however, adopts a horizontal scaling approach, enabling parallel transaction execution. Instead of requiring every transaction to pass through all network nodes, Sui allows multiple transactions to be processed simultaneously.

This method maximizes the use of network resources by enabling validators to dynamically adjust scaling power—increasing or reducing processing capacity as needed. This results in:

- No idle processing power

- Lower latency

- Higher transaction throughput

Thanks to this parallel execution model, Sui can process over 100,000 transactions per second (TPS)—far surpassing many traditional blockchain networks.

Delegated Proof-of-Stake (DPOS)

The Sui blockchain employs a Delegated Proof-of-Stake (DPoS) consensus mechanism to secure and maintain its network. In this system, SUI token holders delegate their tokens to validators responsible for processing transactions and upholding the blockchain’s integrity. The more stake a validator accumulates through delegation, the greater their voting power and influence within the network. In return for their services, validators earn rewards from gas fees, which are then shared with their delegators.

Staking

Staking Process

- Delegation: SUI token holders can delegate their tokens to a chosen validator by sending a staking transaction. This action creates a self-custodial stake object containing details such as the validator’s staking pool ID and the activation epoch.

- Activation: Staked tokens become active at the start of the next epoch—a fixed period during which the network’s validator set and parameters remain unchanged.

- Earnings: Delegators accrue rewards based on the validator’s performance and the amount of gas fees collected during the epoch.

Unstaking Process

- Initiation: To withdraw staked tokens, delegators send an unstaking transaction, which releases both the principal amount and any accumulated rewards.

- Completion: Unstaked tokens and rewards are available after the current epoch concludes.

Choosing a Validator

When selecting a validator to delegate your SUI tokens, consider the following factors:

- Commission Rate: Validators may charge a commission—a percentage of the rewards earned—which is deducted before distributing profits to delegators.

- Performance: Validators with consistent uptime and reliable operations are less likely to be penalized, ensuring steady rewards for their delegators.

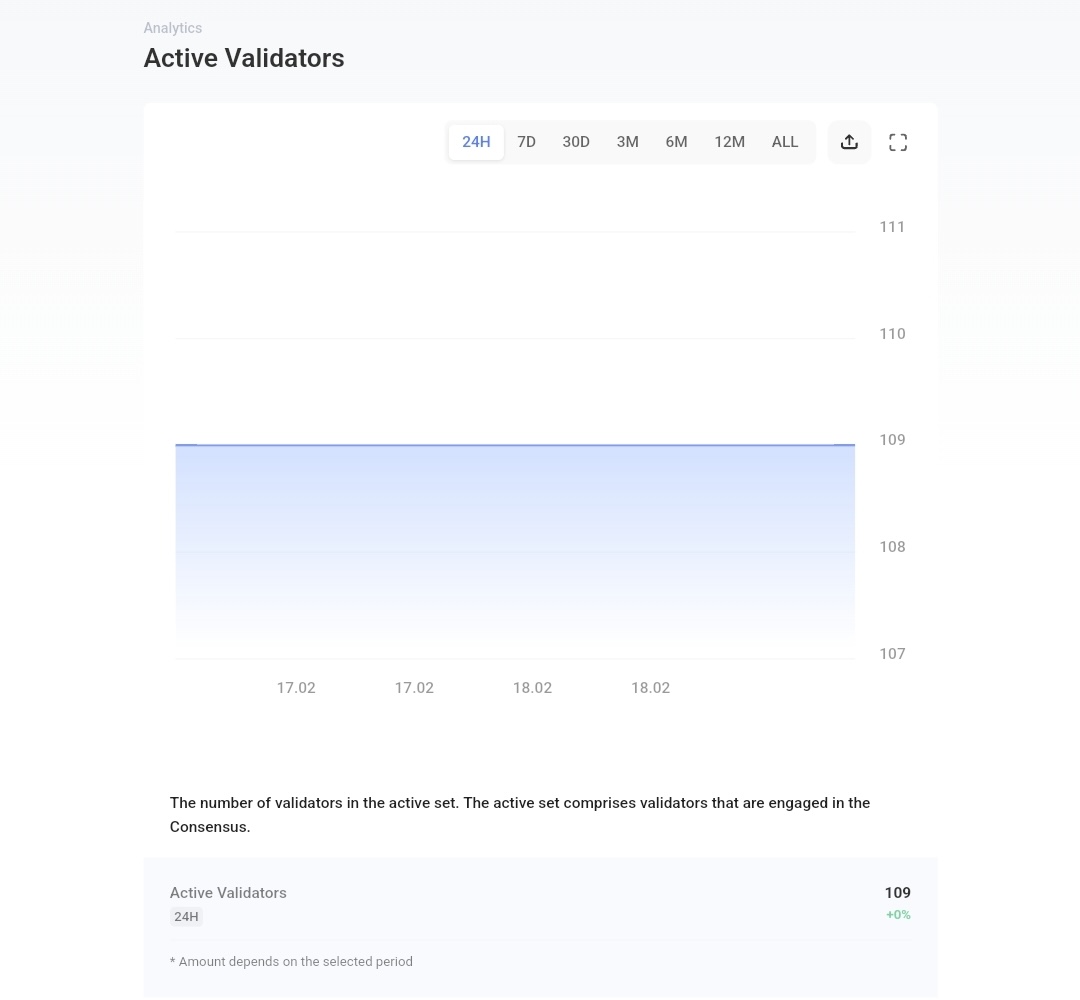

Information about validator performance and commission rates is typically available through Sui-compatible wallets and blockchain explorers. Data from Suiscan reveals that there are 109 active validators on the Sui network.

Sui Blockchain’s Use Cases

The Sui blockchain offers a diverse range of applications across various sectors:

Gaming: Sui revolutionizes the gaming industry by enabling decentralized gaming services, granting players true ownership of in-game assets.

Fast and Secure Financial Services: Sui provides a platform for rapid and secure transactions, ensuring users can execute financial operations with minimal latency.

Decentralized Social Interactions: By offering decentralized social platforms, Sui allows users to engage in on-chain conversations without the oversight of a central authority.

NFT Projects: Developers and users can create and trade non-fungible tokens (NFTs) on Sui, fostering a vibrant digital asset ecosystem.

Features of Sui Blockchain

Sui’s architecture incorporates several key features:

- Scalability: Utilizing horizontal scaling and parallel transaction processing, Sui achieves high throughput and low latency, accommodating a growing number of users without compromising performance.

- Minimal Gas Fees: Sui offers low transaction fees, with an average gas fee of approximately 0.0019 SUI. This is achieved by calculating a reference gas price that validators adhere to, ensuring affordability for users.

- Security: As a decentralized network, Sui enables direct asset trading without intermediaries, preserving user privacy and enhancing security.

- User-Friendly Interface: Designed with simplicity in mind, Sui’s intuitive interface allows investors to perform transactions effortlessly.

Bridges on Sui

Bridging refers to transferring tokens between different blockchains. On Sui, bridges facilitate seamless asset movement to and from other networks, enhancing interoperability.

For instance, if you hold SOL and wish to participate in Sui’s DeFi yield farming, you can use a bridge to transfer your assets directly, eliminating the need for multiple exchanges and reducing associated fees.

Leading Bridges on Sui

- Sui Bridge: The native bridge of the Sui networ, “Sui Bridge,” enables secure and efficient transfers of assets like ETH, WETH, WBTC, and USDT between Ethereum and Sui. Governed by network validators, it ensures decentralized control and leverages Sui’s inherent security features.

- Wormhole Connect: Built on the open-source Wormhole protocol, Wormhole Connect allows users to bridge tokens from any supported blockchain into Sui. Developers can embed this tool directly into their applications, providing a seamless user experience.

- Wormhole Portal Bridge: Supporting a wide range of assets, including stablecoins and wrapped tokens, the Wormhole Portal Bridge offers unlimited transfers across chains for tokens and NFTs wrapped by Wormhole.

By leveraging these bridges, Sui enhances its interoperability, allowing users to seamlessly integrate assets across various blockchain networks.

Note: Always use official and trusted platforms to maintain security and avoid potential risks when bridging assets.

What is SUI Coin?

SUI is the native cryptocurrency powering the Sui blockchain. To distinguish between the coin and the blockchain:

- SUI: Refers to the cryptocurrency.

- Sui: Denotes the blockchain network.

The smallest unit of SUI is called a MIST, with one SUI equating to 1,000,000,000 MIST.

Total Supply of SUI

The SUI token has a fixed supply cap of 10 billion coins, ensuring scarcity and value over time. At the time of writing, approximately 3.1 billion SUI are in circulation.

Tokenomics

The allocation of SUI tokens is designed to support the network’s growth and sustainability:

- 20%: Early contributors and developers.

- 14%: Investors who provided initial funding.

- 10%: Treasury managed by Mysten Labs, including core team members.

- 6%: Community Access Program and application testers.

- 50%: Community Reserve to support ecosystem growth.

Transaction Fees

SUI serves as the medium for transaction fees, commonly known as gas fees, on the Sui network. Users pay these fees when performing on-chain activities or interacting with smart contracts. The network’s design ensures low and predictable fees, enhancing user experience.

Staking Opportunities

Holders can stake SUI tokens to support network validators, contributing to the blockchain’s security and integrity. In return, stakers earn rewards, incentivizing active participation in network maintenance.

Governance

SUI token holders possess governance rights, enabling them to participate in on-chain voting regarding protocol upgrades and other critical network decisions. This decentralized governance model ensures that the community has a voice in the network’s evolution.

Investment Asset

Beyond its utility within the network, SUI can be viewed as an investment asset. As of February 27, 2025, SUI is trading at approximately $2.93. Potential investors should conduct thorough research and consider market volatility before investing.

Note: Cryptocurrency investments carry inherent risks due to market volatility. It’s essential to perform due diligence and consult financial advisors when necessary.

How High Can SUI’s Price Go in 2025?

The Sui blockchain has experienced significant growth, currently boasting a market capitalization exceeding $9 billion. Historically, the SUI coin reached an all-time low of $0.3648 in October 2023 and an all-time high of $5.35 in January 2025.

Market analysts suggest that influenced by favorable market conditions and increased adoption, SUI’s price could climb to approximately $6.77 by the end of 2025. However, this projection is speculative and depends on various market factors.

How to Purchase SUI

Acquiring SUI coins is straightforward and can be done through several cryptocurrency exchanges, with Binance being a prominent example. Here’s a concise guide to purchasing SUI on Binance:

- Account Creation and Verification: Visit the Binance website or download the Binance app to create an account. Complete the identity verification process as prompted. If you already have a Binance account, proceed to the next step.

- Navigate to ‘Buy Crypto’: Once logged in, go to the “Buy Crypto” section to explore available options for purchasing SUI.

- Select Payment Method: Choose your preferred payment method and enter the amount of SUI you wish to purchase.

- Review Details: Carefully check the payment details and any associated transaction fees.

- Confirm Purchase: Confirm your order to complete the transaction. Congratulations, you’ve successfully acquired SUI coins!

- Secure Your Assets: Decide whether to transfer your SUI coins to a personal crypto wallet for enhanced security or keep them in your Binance account. You can choose to hold, stake, or trade your SUI as desired.

- While the process may vary slightly on other platforms, the general steps remain similar.

Sui Wallets

Proper storage of your SUI coins is essential for security and accessibility. Sui wallets allow users to store SUI coins, NFTs, and other digital assets on the Sui blockchain, facilitating seamless interaction with the network, including sending, receiving, swapping, and staking assets.

There are two primary types of wallets for storing SUI:

- Hot (Software) Wallets: These are applications or browser extensions that require an internet connection. They offer convenience, allowing access from mobile devices or desktops, but may be more susceptible to security risks compared to cold wallets.

- Cold (Hardware) Wallets: Physical devices that store private keys offline, providing enhanced security. While they don’t require an internet connection, they might be less convenient for frequent transactions.

The Sui Wallet and How to Use It

The Sui Wallet, developed by Mysten Labs, is the official wallet for the Sui blockchain. It’s available as a mobile application on the App Store and Google Play and as a browser extension compatible with Chrome, Edge, Opera, and Brave. The Sui Wallet enables users to send, receive, stake, and swap assets seamlessly.

To get started with the Sui Wallet:

- Create an Account: Download the Sui Wallet app or browser extension and follow the setup instructions. Ensure you create a strong password and securely store your recovery phrase offline.

- Fund Your Wallet: Add SUI coins by transferring them from a cryptocurrency exchange or receiving them from another user.

- Sending SUI: Within the wallet, use the “Send” function, enter the recipient’s address and the amount, then confirm the transaction.

- Receiving SUI: Share your Sui wallet address with the sender to receive funds.

- Interact with dApps: Connect your Sui Wallet to decentralized applications (dApps) on the Sui network to utilize features like token swaps or participation in decentralized finance (DeFi) protocols.

For a visual walkthrough on purchasing SUI on Binance, you may find the following video helpful: How to BUY or CONVERT SUI on Binance (Easy Step-by-Step Guide) – 2024

Crypto Wallets That Support Sui Network

In addition to the official Sui Wallet, several other wallets are compatible with the Sui blockchain:

- Suiet: A non-custodial browser extension wallet offering a user-friendly interface. Suiet enables users to buy, send, receive, and swap SUI tokens. It also allows users to view their NFTs and mint exclusive Suiet NFTs when available.

- Surf Wallet: Developed by the Surf DAO team, Surf Wallet is available on the Apple App Store, Google Play, and as a browser extension for Chrome. It features an embedded browser, allowing users to access DeFi functionalities within the Sui ecosystem seamlessly.

- Ledger Nano X: A widely-used hardware wallet that provides offline storage for enhanced security. While Ledger doesn’t natively support the Sui blockchain, users can manage their SUI tokens by connecting Ledger to a compatible third-party wallet, such as the Sui Wallet.

- Phantom Wallet: Sui recently debuted on the popular Solana wallet.

Choosing the Best Sui Wallet

Selecting the ideal Sui wallet depends on individual preferences and requirements. Consider the following factors:

- Security: Hardware wallets like Ledger offer enhanced security by storing private keys offline.

- Convenience: Hot wallets, such as Suiet and Surf Wallet, provide easy access and are suitable for daily transactions.

- Features: Evaluate wallets based on additional functionalities like NFT support, staking options, and integration with decentralized applications (dApps).

As the crypto landscape evolves, it’s essential to regularly assess whether your chosen wallet continues to meet your needs. If not, consider transferring your assets to a more suitable option. Always conduct thorough research before making a switch.

Everything You Need to Know About SUI Airdrop

The Sui Foundation has explicitly stated that it will not conduct any SUI airdrops. This decision aims to protect users from potential scams, as airdrop announcements can attract malicious actors impersonating official channels to deceive investors.

Instead of airdrops, the Sui Foundation offers alternative avenues for community members to acquire SUI tokens:

SUI Token Community Access Program: This initiative enables early supporters, testers, and contributors to obtain SUI tokens during the network’s initial phases. The program emphasizes broad geographic participation where permissible and aims to empower robust and fair involvement. Notably, U.S. citizens and residents are ineligible to participate in this program.

For the most accurate and up-to-date information, always refer to official Sui channels and be cautious of unofficial airdrop claims to avoid potential scams.

What are Sui Games?

Sui games are innovative video games developed on the Sui blockchain, offering a seamless and cost-effective platform for both developers and players. The Sui network’s high-speed and scalable infrastructure ensures an immersive gaming experience without concerns of lag or network congestion.

One of the standout features of Sui games is the empowerment of creators and players to truly own and control their in-game assets. These assets, often in the form of non-fungible tokens (NFTs), can be traded or utilized across different games, fostering a dynamic and interconnected gaming ecosystem. Additionally, the decentralized nature of the Sui network enables players to interact with each other directly, eliminating the need for intermediaries and ensuring a transparent gaming environment.

Top Sui Games to Explore

For enthusiasts eager to delve into blockchain gaming, here are some notable titles built on the Sui blockchain:

- Bushi: A Web3 combat game where players select from a roster of unique characters, each possessing special abilities. As you engage in battles and participate in tournaments, you can earn NFT rewards, including weapons and character skins, which are tradable within the game’s marketplace.

- Stella Fantasy: This free-to-play, multi-network blockchain game offers players the chance to earn tokens and NFT rewards through gameplay. The NFTs acquired can be traded or used to enhance in-game experiences, providing both entertainment and potential financial incentives.

- Cosmocadia: A social farming game that emphasizes community collaboration. Players can engage in activities like farming, fishing, and decorating their virtual spaces, all while building relationships with fellow gamers in a decentralized setting.

- Run Legends: A unique game that combines physical fitness with blockchain rewards. Players are incentivized to run and stay active, earning in-game rewards for their real-world physical activities.

The Sui blockchain continues to attract a diverse range of games, each leveraging the network’s robust features to offer players unparalleled experiences in the blockchain gaming realm.

For a visual overview and deeper insight into some of these exciting titles, you might find the following video informative: 8 MUST SEE web3 Games on SUI

Frequently Asked Questions

How many SUI coins are there?

The SUI token has a total capped supply of 10 billion tokens. As of now, approximately 3.1 billion SUI tokens are in circulation.

Should I use the Sui Wallet?

The Sui Wallet, developed by Mysten Labs, is the native wallet for the Sui blockchain. It offers an intuitive interface and robust security features, making it a reliable choice for storing and managing your SUI tokens. However, it’s essential to conduct thorough research before selecting a cryptocurrency wallet. Consider factors such as security protocols, ease of use, and device compatibility. Assess your investment goals and choose a wallet that best suits your unique needs.

Is SUI a good crypto investment?

SUI operates on a blockchain network known for its speed, scalability, and cost-effectiveness, which may appeal to long-term investors. However, it’s crucial to recognize that all cryptocurrencies, including SUI, are subject to high volatility. Factors such as market demand, regulatory changes, and technological advancements can lead to significant price fluctuations. Before investing, conduct comprehensive research and avoid making decisions based on market hype or the fear of missing out (FOMO). Never invest more than you are willing to lose.

What is the future of the Sui ecosystem?

Since its launch, the Sui ecosystem has demonstrated significant growth, indicating potential for further expansion. The network’s emphasis on scalability and security positions it well for future developments. However, predicting the exact trajectory of the Sui ecosystem is challenging, as it depends on various factors, including technological advancements, market trends, and regulatory environments. Staying informed through official Sui channels and reputable news sources will provide the most accurate and up-to-date information regarding the ecosystem’s progress.

Summary

Sui is a Layer-1 blockchain network that enables users to perform fast and secure on-chain transactions, interact with smart contracts, and develop decentralized applications (dApps). It utilizes the Move programming language and operates on a Delegated Proof-of-Stake (DPoS) consensus mechanism.

SUI tokens are available for purchase on various cryptocurrency exchanges. While the Sui blockchain presents promising features, investing in SUI should be a personal decision based on thorough research and consideration of individual financial goals.