XRP saw a slight retracement as the new President’s effects wore off. The third-largest cryptocurrency saw a notable shift in sentiment following the inauguration.

The crypto market faces notable retracements as Donald Trump’s inauguration hype and anticipation wears off. XRP’s current price movement reflects the broader trend across several cryptocurrencies.

Memecoins in honor of the US president and the first lady took a plunge. The Official Trump dipped from over $60 a few hours ago and trades at $39 at the time of writing. The Official Melania Meme was the reason for the reduced attention on $TRUMP. However, it is on the downtrend.

The global cryptocurrency market cap retraced from $3.70 trillion early Monday to $3.58 trillion. The over 2% decline in value reflects investors’ sentiment. Fear and Greed Index remain neutral 58 amidst the latest administration change.

Other major assets, such as Ethereum and Binance Coin, are down by 2%. A closer look at the top 10 reveals that no asset in the top 10 has been notably red in the last 24 hours.

The week offers little in terms of fundamentals to anticipate. However, the crypto market resumes its uptrend.

Top Five Cryptocurrencies

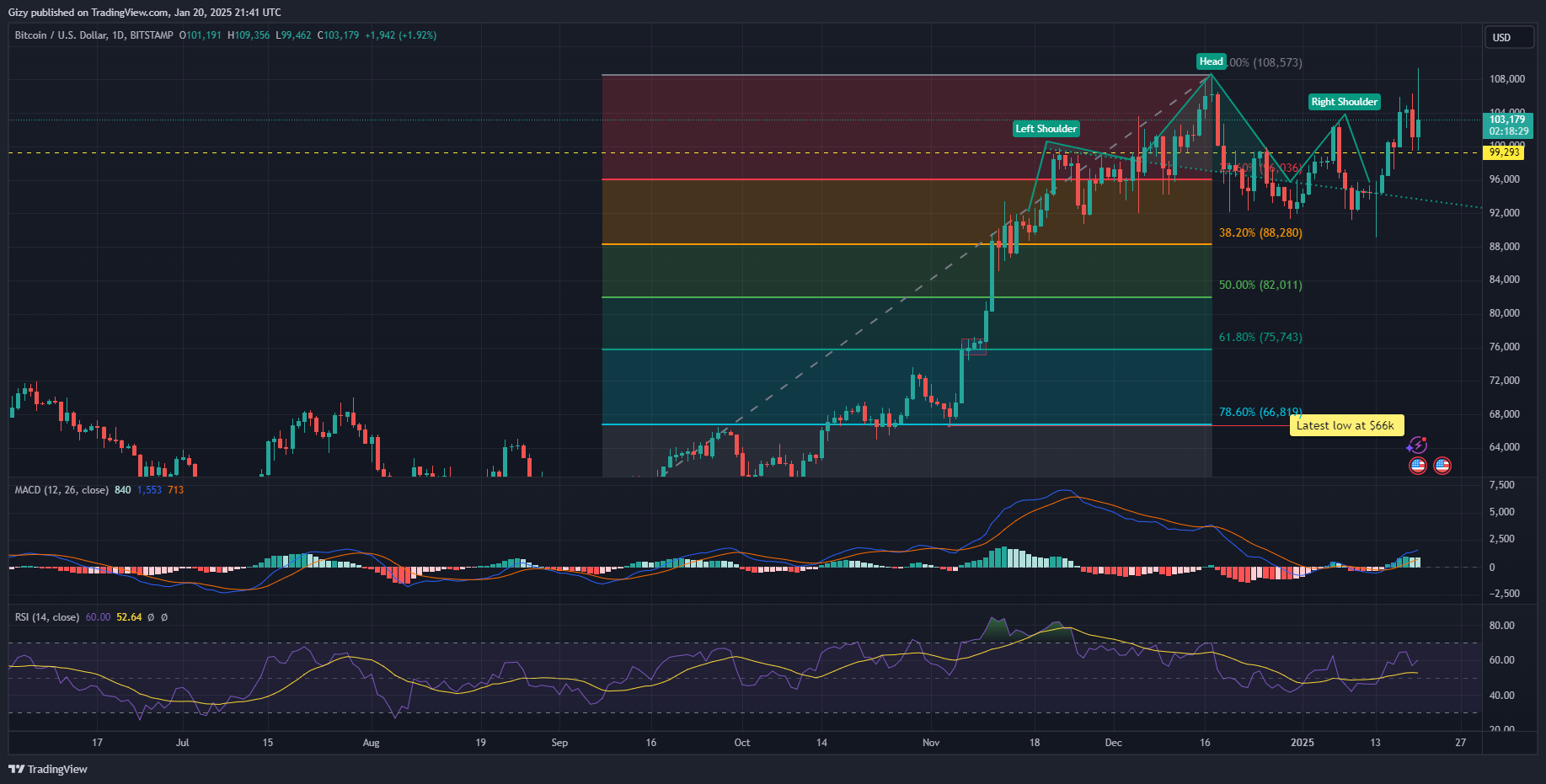

BTC/USD

Bitcoin was off to a good start earlier on Monday, as sentiment remained bullish. It attained a new all-time high, hitting $109,356. Its latest climb brings it closer to the $110k mark. However, price actions indicate notable selling congestion around the highlighted barrier.

BTC’s latest milestone comes barely a day after it declined by over 3%. It surged to $106k and slipped below $100k. Nonetheless, the apex is up by 2% since the day started.

Onchian data remain positive despite the ongoing selloffs. Investors are stacking up the asset, as indicated by the declining exchange reserves. These trading platforms are also seeing notable outflows. The NetFlow is negative 170% as holders move holdings off exchanges.

However, investors from the US showed relatively weaker buying sentiment on Monday than the previous day. The Coinbase premium is negative, which may indicate less whale activity. The Korea premium sees the same sentiment as traders become bearish.

The one-day chart hints at recovery and the uptrend resuming. RSI is rising as the bulls struggle to sustain the uptrend. Previous price action suggests that BTC may break above $110k this week. A flip may trigger a run to $112k.

However, the moving average convergence divergence prints bearish signals at the time of writing. The 12-day EMA halted its uptrend, trending parallel. A further decline may result in negative interception, heralding more downtrends.

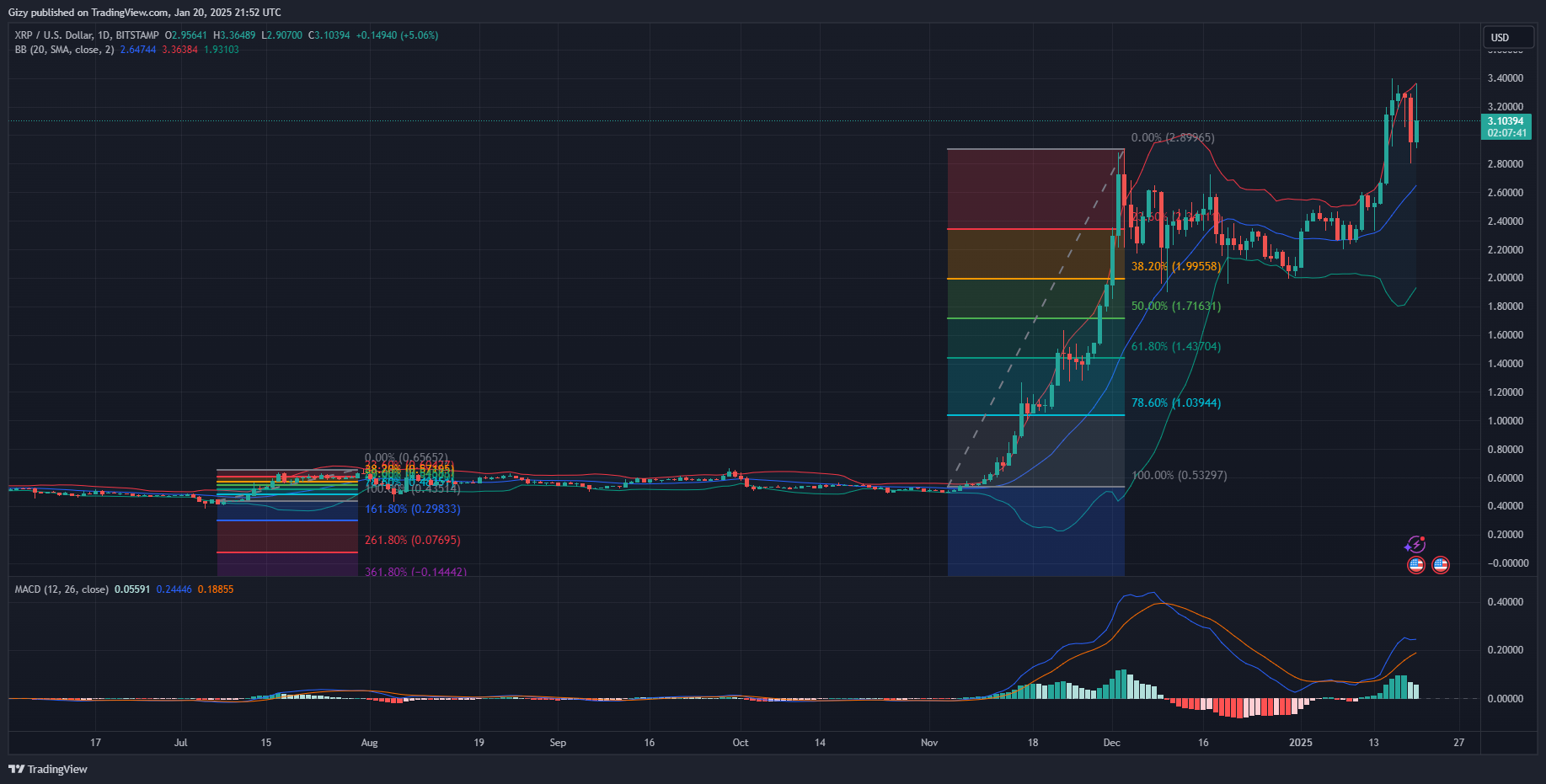

XRP/USD

XRP recovers from Sunday’s descent, hinting at a change in investors sentiment. The asset was one of the worst hit by the bearish sentiment that ravaged the market during the previous intraday session. It lost the $3 support during this period, hitting a low of $2.80 from $3.26. Closing with a loss of almost 10%, the asset’s latest increase failed to erase it.

The altcoin was off to a good start on Monday, surging from $2.95 to a high of $3.36. However, it lost momentum and was trading at $3.10 at the time of writing. Indicators show mixed readings about the next price action.

MACD prints negative signals as the 12-day EMA halted its uptrend. The metric trends in a straight line as traders anticipate the next big move. Previous price movements suggest that further declines may send XRP as low as $2.60. On the other hand, XRP may edge closer to $4 this week.

SUI/USD

If prices remain the same, SUI may mark its second consecutive day of losses. A few hours ago, the asset surged to a high of $4.50 but now trades at $4.38, over 2% lower than its opening price. It has recovered from a low of $4.29.

The cryptocurrency struggled to erase the previous day’s loss as the bulls failed to sustain the momentum. It opened Sunday at $5 but retraced, losing the $4.50 support and hitting a low of $4.39. It lost almost 10% during the session, bringing its two-day loss to over 12%.

Indicators are primarily bearish amidst the price trend. The relative strength index is at 44, dipping from 57 a few days ago. The metric suggests room for more descent. MACD bears the same as it continues downward following its negative interception a few days ago.

The Fibonacci retracement level hints at a possible decline to the 38% mark at $4. Nonetheless, previous price movements suggest notable demand concentration at this mark. While it risks further declines to $3.50, a change in sentiment may send it above $5.

WIF/USD

The Fibonacci retracement level points to further declines for Dogwifhat, as prices dropped below the 100% Fib mark a few days ago. The altcoin risks further descent, as almost every indicator is bearish at the time of writing.

It is approaching its third consecutive day of notable downtrends. The downhill movement, which started on Saturday with a 5% dip, has no end in sight, as the asset may register another 10% loss after its 13% drop on Sunday.

Indicators like the moving average convergence divergence reveal that WIF may see further declines as the 12-day EMA edges toward the completion of the bearish convergence. The memecoin may hit a low of $1 before recovery.

Nonetheless, the Bollinger band reveals an impending trend reversal. The altcoin trades close to its lower band, hinting at the end of its downtrend.

GALA/USD

Gala edged closer to the 78% fib level a few hours ago as it slipped to a low of $0.030. The bulls defended the mark, resulting in a pushback to $0.32. It prints a green candle in response to the latest buyback attempt.

Like XRP, the asset had a notable increase earlier on Monday. It peaked at $0.037 but lost momentum, resulting in its current price. The small green candle brings relief after its over 10% decline on Sunday and 8% drop on Saturday.

However, MACD reveals that the uptick may be temporary. The metric shows a bearish divergence, which may indicate further declines. The relative strength index is on the decline as selling more substantial selling pressure amidst the most recent increase.

GALA risk declining below the 78% fib level at $0.028. Nonetheless, its latest change suggests a possible return to $0.035