The quest for a Solana spot exchange-traded fund (ETF) has heated up after Ark Invest’s 21 Shares filed for the product with the Securities and Exchange Commission (SEC) on Friday.

The filing was the second Solana ETF application on the SEC’s desk after asset manager VanEck filed for the product on Thursday. 21 Shares and VanEck have notoriously been early applicants of ETF products after taking the lead in both Bitcoin and Ethereum spot ETFs.

Similar to VanEck, Ark Invest’s 21 Shares Core Solana ETF would trade on the Chicago Board Options Exchange (CBOE) BZX exchange and allow investors “to gain investment exposure to SOL without making a direct investment in SOL.”

Growing Demand for Solana ETF

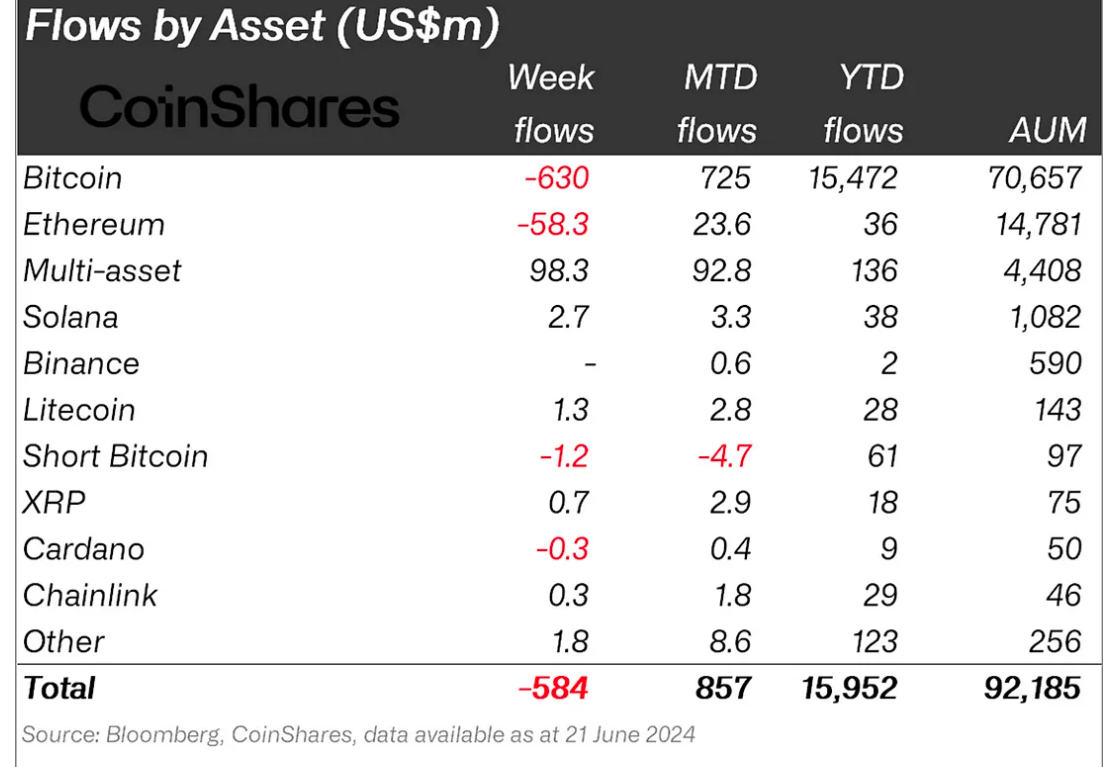

Ark Invest’s Solana ETF application highlights the increased demand for SOL investment products. Investors threw $2.7 million into Solana investment products last week, $3.3 million month-to-date, and $38 million year-to-date.

Solana Investment Products has an asset under management (AUM) of $1.08 billion, with only Bitcoin and Ethereum having better investor interest. Hence, Solana meets market maker GSR’s demand eligibility criteria for the next spot ETF.

Analysts have predicted that Solana will have more demand than any other crypto asset besides Bitcoin and Ethereum. Regulated by the Commodity Futures Trading Commission (CTFC), the SOL futures contract is already trading in the market.

Whether other asset managers will join the bandwagon remains uncertain; however, Bitwise’s CEO, Hunter Horsley, noted that the crypto community will see Solana spot ETF ads “all in due time.” Rumors swelled earlier in the month that BlackRock was applying for a Solana ETF soon.