The largest cryptocurrency by market cap, Bitcoin, dipped over 3% and traded below $66,000 on Tuesday after pumping to $70,000 on Monday. This plunge triggered a massive wave of liquidations in the cryptocurrency market, with data from CoinGlass showing that about $206 million in trading positions were wiped out.

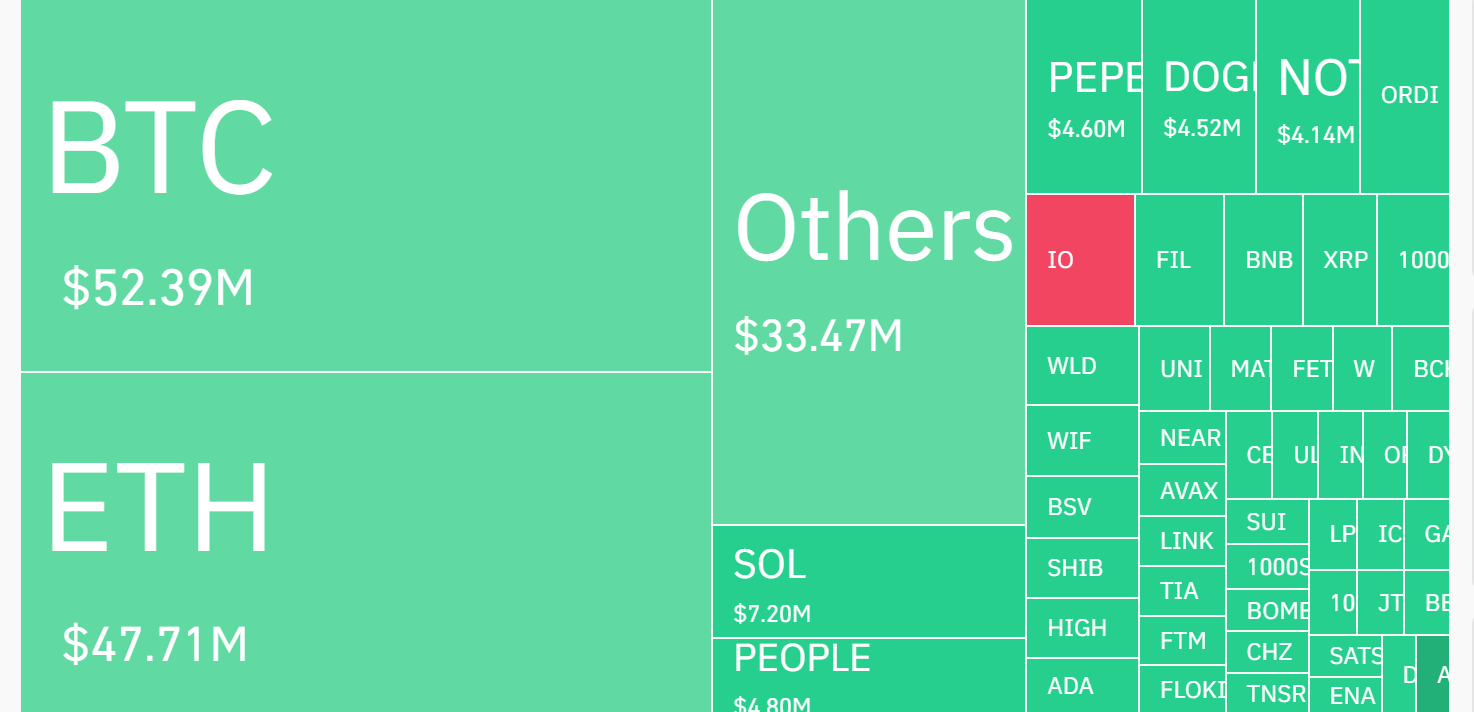

Cryptocurrency investors suffered a significant blow, with long positions taking the biggest hit. About $165 million of bull positions were chalked off in the past 24 hours as Bitcoin dipped sharply to $66,000. Bears had minimal impacts, as just $41.7 million in short trading positions were affected.

Crypto Bulls Wrecked

In the past 24 hours, about $38.16 million worth of Bitcoin long positions have been liquidated, with bears also suffering a $14 million loss. The Ethereum market also experienced a significant shakeout, with approximately $38 million worth of long positions being liquidated, accounting for the majority of the total $47.7 million in ETH-related positions liquidated. This massive sell-off led to a 6.8% decline in ETH’s value, which went as low as $3,438.

Solana (SOL) traders also saw significant liquidation, with about $5.94 million and $1.25 million bullish and bearish positions chalked off the market. The coin’s price took the hardest hit among the top five crypto assets, with a staggering 8.5% decline in value.

PEPE, DOGE, and NOT (the token behind the popular Telegram game Notcoin) also saw significant liquidations, with each token experiencing around $4 million in long-position liquidations over the same period.

Bitcoin Tumbles to $66,000

Bitcoin took a dive just hours after the Federal Reserve System (Fed) meeting scheduled for Wednesday, marking its sharpest downward slide in over a month. Analysts tipped Bitcoin to reach its all-time high of $73,737 over the weekend, but the asset has defied that projection and instead has continued to go sideways.

At the time of writing, Bitcoin’s price stood at $67,495, a significant drop from its 48-hour high of over $70,000. The sudden decline has left many investors reeling, with crypto longs taking the hardest hit.